Fintech Philippines Report 2022 Highlights the Rise of Crypto and Advent of Digibanks

by Fintech News Philippines December 1, 2021In the Philippines, the fintech sector is developing at a rapid pace, fueled by booming digitalization, a favorable regulatory landscape, and ongoing effort by the government to help boost financial inclusion, a new report jointly produced Fintech News Philippines and FinTech Alliance.ph shows.

The Philippines Fintech Report 2022, looks at the state of the fintech industry in the Philippines, highlighting the key developments that occurred over the past year and the emerging trends to look out for.

In particular, the report notes rising acceptance of cryptocurrencies and a burgeoning digital asset industry, booming usage of digital payments on the back of modernization initiatives by the government, and the advent of the country’s first branchless, virtual banks.

Crypto moves towards the mainstream

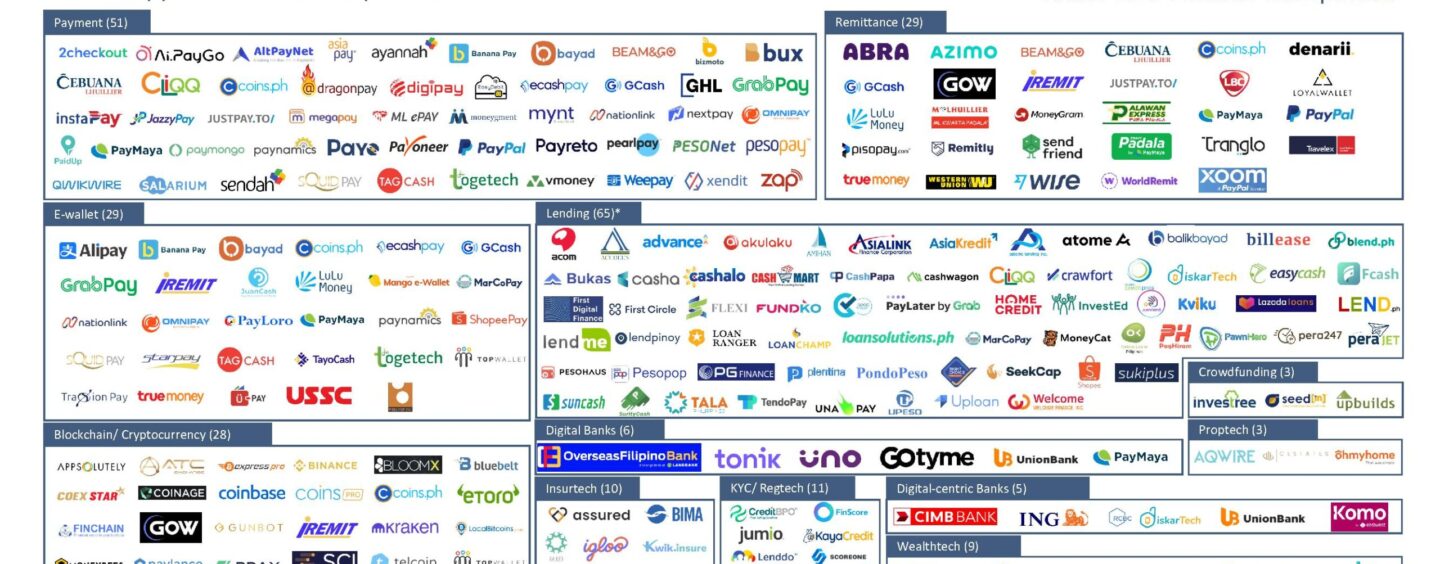

Cryptocurrency transactions are soaring in the Philippines amid increased adoption of digital currencies for use in payments and remittances.

Between 2019 and 2020, the value of cryptocurrency transactions jumped 410% to reach PHP 76 billion (US$1.5 billion), while volume rose 36% to 7.2 million.

Growth of cryptocurrency transactions in the Philippines, Source: Bangko Sentral ng Pilipinas (BSP) via Philippines Fintech Report 2022, Fintech News Philippines

Rising acceptance is further evidenced by cryptocurrency startups recording strong customer growth and raising large rounds of funding.

Philippine Digital Asset Exchange (PDAX), a regulated cryptocurrency exchange platform, has seen its customer base surge from just 20,000 in H2 2019 to now 500,000. PDAX founder and chief executive Nichel Gaba calls this “a golden age of cryptocurrency adoption” in the Philippines, noting that transaction volume on PDAX grew 70 times between 2020 and 2021.

PDAX recently raised US$12.5 million in funding to fuel the company’s short- and long-term growth plans. PDAX is among the 17 companies dealing with cryptocurrencies that are licensed by the central bank.

Increased cryptocurrency adoption can also be seen through rising acceptance by the traditional finance sector. The Philippine Stock Exchange (PSE) is reportedly planning a cryptocurrency exchange. Meanwhile, the Union Bank of the Philippines (UnionBank), one of the Philippines’ most prominent banks, is piloting a new digital asset custody service in partnership with digital asset specialist Hex Trust.

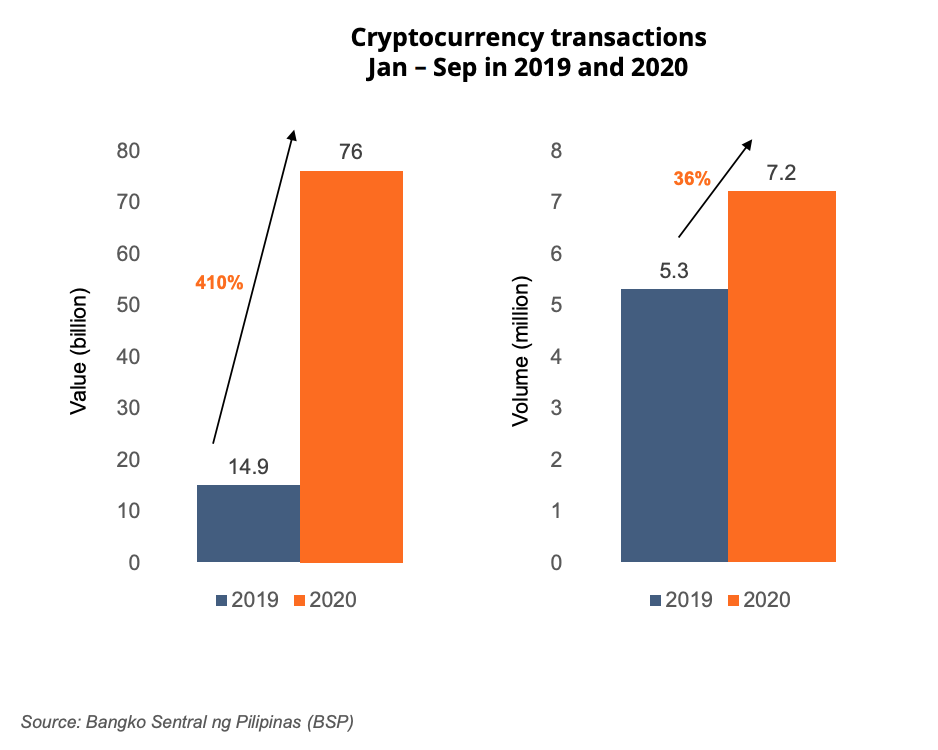

First digital banks go live in the Philippines

The past year has seen the launch of the Philippines’ first virtual-only banks. This came amid the creation of a new regulatory framework for digital banks, a move motivated by the ambition to improve financial inclusion and raise the number of Filipino adults with bank accounts to 70% by 2023.

Overseas Filipino Bank (OFBank), a wholly-owned subsidiary of the Land Bank of the Philippines, was the first branchless digital bank to go live back in June 2020. In H1 2021, more than 25,000 new OFBank deposit accounts were created, bringing the total number of deposit accounts to over 45,000. As a comparison, OFBank had less than 20,000 deposit accounts in December 2020.

The launch of OFBank was followed in March 2021 by the launch of Tonik’s digital banking offering. Fintech startup Tonik, which has raised a total of US$44 million in funding, has won over 100,000 customers since its launch, showcasing strong customer traction. In its first month, the company pulled in more than PHP 1 billion (US$20 million) in retail deposits, which to date total over PHP 4.4 billion (US$87 million).

UNObank, a brand operated by Singapore-headquartered fintech DigibankASIA, has yet to go live but recently secured US$7.5 million in fresh funding, Dealstreetasia reported last week. UNObank plans to launch by the end of the year.

The last three digital banking licensees, GoTyme, a partnership between Filipino conglomerate Gokongwei Group and Singapore-headquartered digital banking group Tyme, Union Digital Bank, a wholly-owned subsidiary of UnionBank, and Maya Bank, the digital bank of Voyager Innovation, are all expected to launch by mid-2022.

Key players in the Filipino digital banking landscape, Source: Philippines Fintech Report 2022, Fintech News Philippines

Advancing digital payment adoption

Initiatives to modernize the domestic payment landscape continue to unfold. 2019 saw the launch of QR Ph, the National QR Code Standard for peer-to-peer (P2P) use, which was followed in 2020 by the launch of the PhilSys national identification (ID) system.

In 2021, a revamped version of the country’s real-time gross settlement system for interbank transactions and government collections, dubbed PhilPASS Plus, went live, supporting better interoperability and integration among domestic and global payment systems than the previous version. Capabilities of QR Ph were also expanded to support person-to-merchant (P2M).

In tandem with these developments, the use of digital payments is increasing. In H1 2021, the Philippine Electronic fund transfer System and Operations Network (PESONet), an automated clearing house, recorded a 164% growth in the volume of transactions. Similarly, the volume of transactions on InstaPay, an interbank funds transfer service, posted a 223% growth for the same period, according to a report by Philstar.

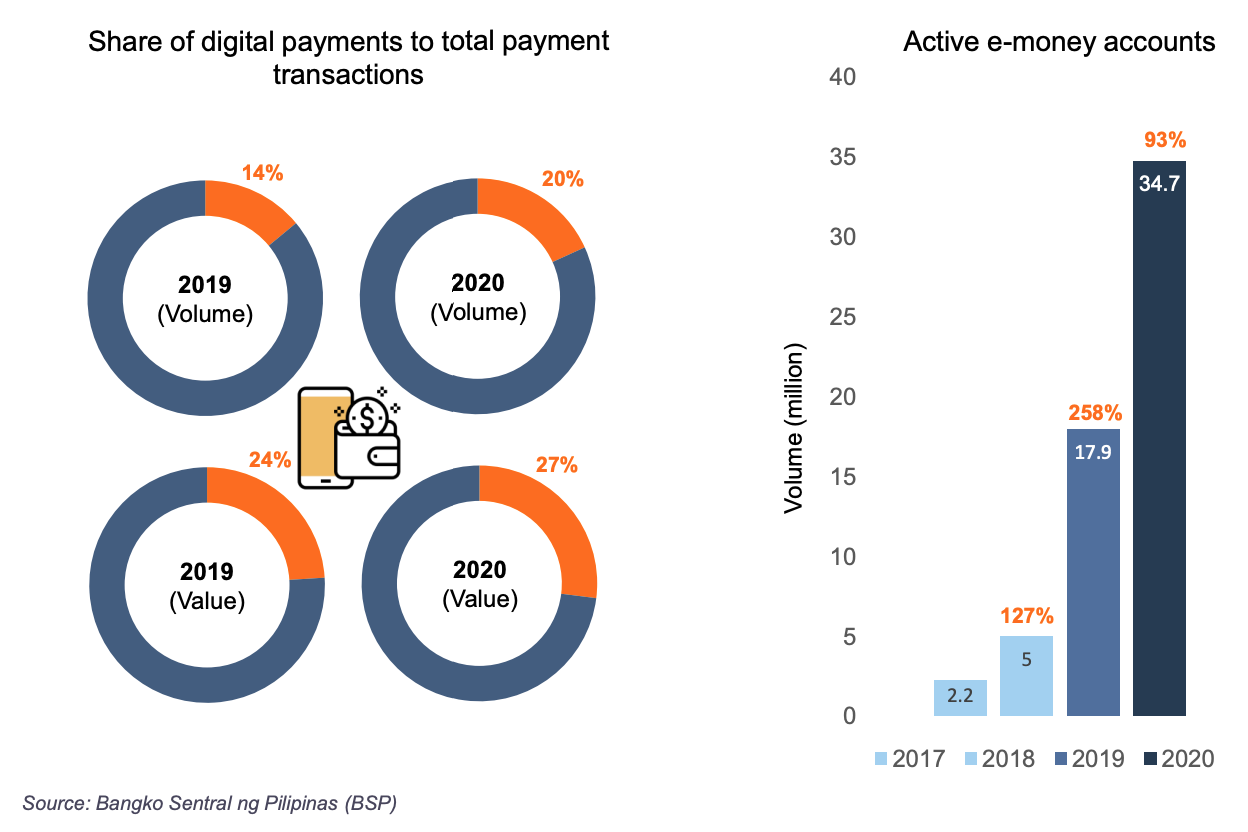

Between 2019 and 2020, the share of digital payments increased 6% points to make up 20% of all payment transactions. Meanwhile, the number of active e-money accounts soared to 34.7 million in 2020, nearly doubling from 2019’s level at 17.9 million.

Digital payment statistics, Source: Bangko Sentral ng Pilipinas (BSP), via Philippines Fintech Report 2022, Fintech News Philippines

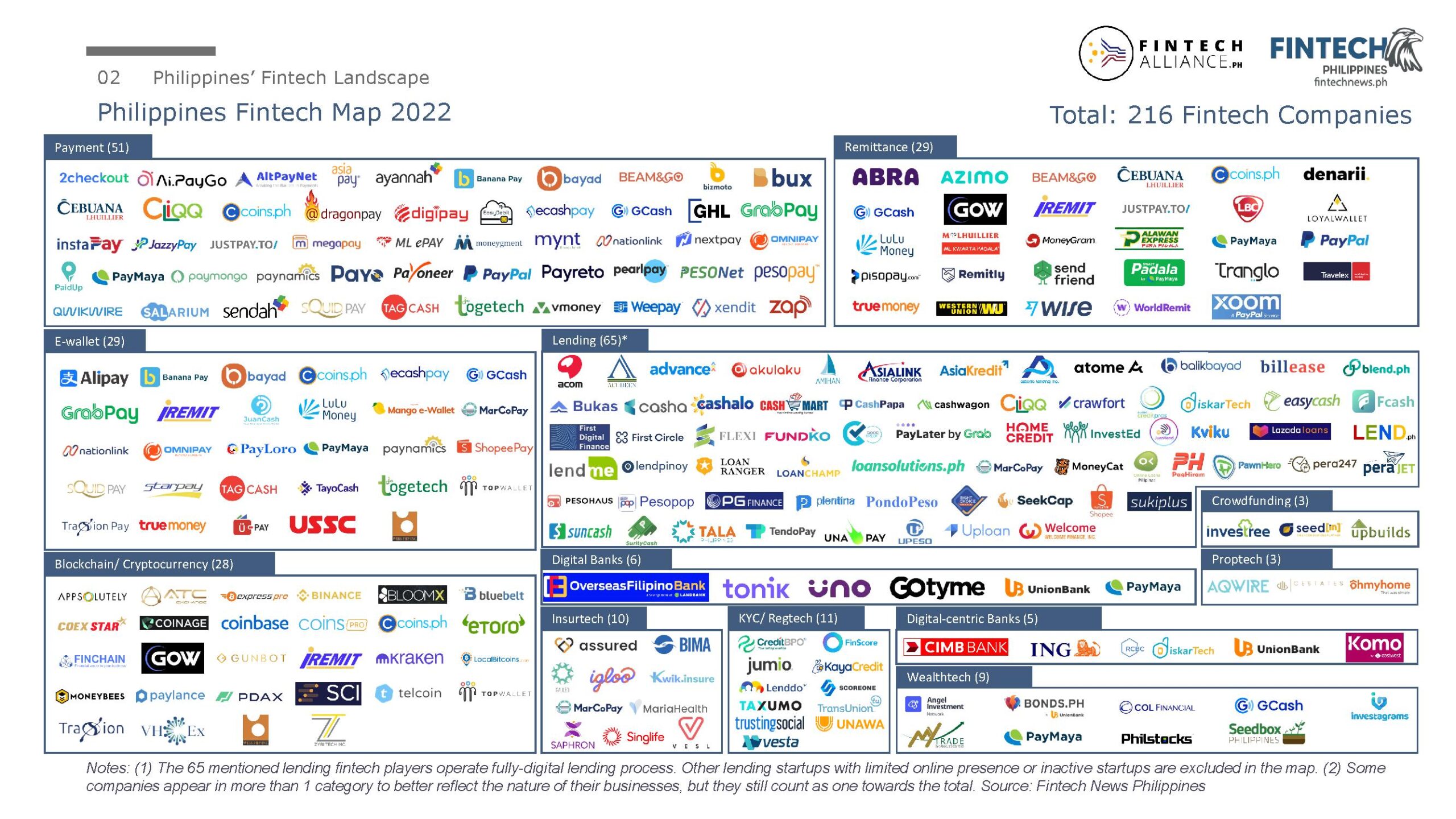

Philippines Fintech Map 2022

This year’s Philippines Fintech Map identifies more than 220 fintech companies in the country, among which 27% are in the lending segment. Payments make up 20% of all Filipino fintech companies, followed by e-wallet (13%), blockchain and cryptocurrency (12%), and remittances (12%). Other segments also represented include insurtech (4%), know-your-customer (KYC)/regtech (4%), wealthtech (4%), digital banking (2%) and crowdfunding (1%).

If you wish to learn more about the fintech ecosystem in the Philippines, the full report can be downloaded here

| Download the latest Fintech Philippines Report 2023 here |