Lending

GCash Lending Unit Fuse Reaches Landmark P118 Billion Loan Disbursements

Fuse Lending, Inc., the lending division of GCash, has just reached a sizable milestone by disbursing loans exceeding P118 billion as of the close of 2023. This is a major increase from the P50 billion disbursed in 2022, marks a

Read MoreBNPL BillEase Reports Double Revenue, Loan Disbursement Growth in 2023

BillEase, a consumer finance and buy now, pay later application operating in the Philippines, has released its preliminary unaudited financial results for 2023, indicating a period of considerable growth. The company reported that its revenue reached US$57 million and net

Read MoreHelios Pioneers Solar Mortgage Programme to Introduce Affordable Sustainable Energy

Philippines startup Helios claims to have launched the first solar mortgage programme, marking a step towards transforming the local energy landscape. This initiative aims to facilitate Filipino households’ access to solar energy through affordable financing solutions, effectively reducing electricity bills

Read MoreGCash Disbursed Record US$2.1 Billion in Loans Last Year, Doubling 2022’s Figures

Globe Fintech Innovations, Inc. (Mynt) operated GCash has disclosed its performance metrics for the year 2023, revealing a notable increase in disbursement of loans. The online banking platform reported disbursing loans totalling P118 billion (approximately US$2.11 billion), more than doubling

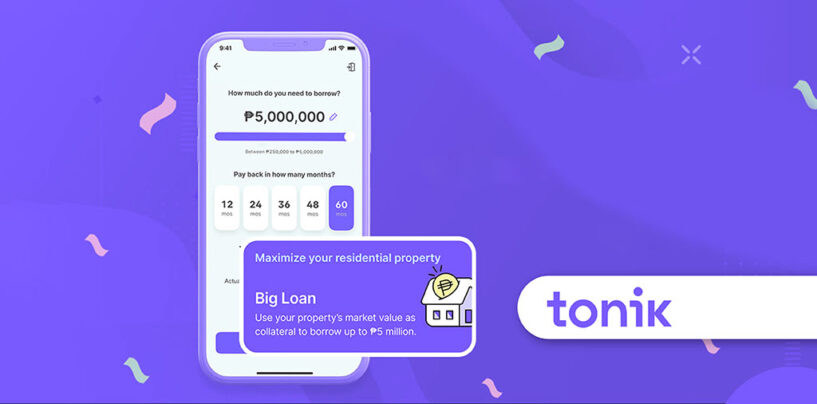

Read MoreTonik Upgrades Loan Offering to Cater to SMEs

Tonik Digital Bank recently updated its Big Loan product, aiming to address a broader range of financial requirements for small businesses in the Philippines. This enhancement is part of Tonik’s efforts to support the growing needs of small and medium

Read MoreLeapgen and FinScore Join Forces to Enhance Microloan Access for Filipinos

Local fintech firm Leapgen Lending has announced a partnership with FinScore, a Philippines-based alternative credit scoring provider. This collaboration aims to offer more accessible microloan options for individuals facing challenges in accessing traditional banking services. FinScore specialises in alternative credit

Read MoreBeyond Onboarding: Maximising Customer Value through Risk Decisioning in APAC

Discussions about risk decisioning platforms often center around onboarding and loan origination. However, investing at the start of the journey is just one aspect of the puzzle. Growth relies not only on attracting new customers but also on maximising the

Read MoreFinScore’s CrediView Elevates Credit Scoring with Extensive Loan Inquiry Data

FinScore, a Philippines-based alternative credit scoring provider, has developed a new tool named CrediView, which aims to enhance the credit assessment process beyond traditional methods. CrediView grants banks and lenders access to a borrower’s recent loan inquiries across more than

Read MoreTackling the US$2 Trillion Funding Shortfall for Asia Pacific’s SMEs

Small and medium enterprises (SMEs) are vital in driving economic growth, particularly in developing countries, as they significantly contribute to the GDP and play a key role in job creation. According to the Asian Development Bank, SMEs make up 98%

Read MoreGoTyme Bank and PayMongo Enable Easier Loan Access for Thousands of SMEs

Filipino digital bank GoTyme and payment gateway PayMongo have recently announced a partnership aimed at enhancing financial access for small and medium-sized enterprises (SMEs). This collaboration is set to allow thousands of SMEs in the PayMongo merchant network to obtain

Read More