Archive

Seamless Philippines to Discuss the Future of Payments, E-Commerce and Fintech

On 30 September & 1 October, Seamless Philippines’ 2020 edition will take place online, bringing together the region’s commerce and finance ecosystem to discuss the latest trends in payments, e-commerce, retail, fintech and more. On the morning of 30 September,

Read MoreAyannah and Card-MRI to Launch Digital Financial Services in the Philippines

Ayannah and CARD-MRI Group announced a partnership to launch digital payments, lending, banking and insurance products to serve CARD-MRI’s membership base. CARD-MRI’s lending and insurance operations will be digitised and integrated into Ayannah’s digital omni-channel transaction network. CARD-MRI is a

Read MorePayMongo Secures $12M in Series A Funding Round Led by Stripe

PayMongo, a Filipino-owned online payment platform, recently secured $12 million in a Series A financing round led by Stripe. The funding round comprised of other existing investors — Y Combinator, Global Founders Capital and a new investor, Bedrock Capital. The

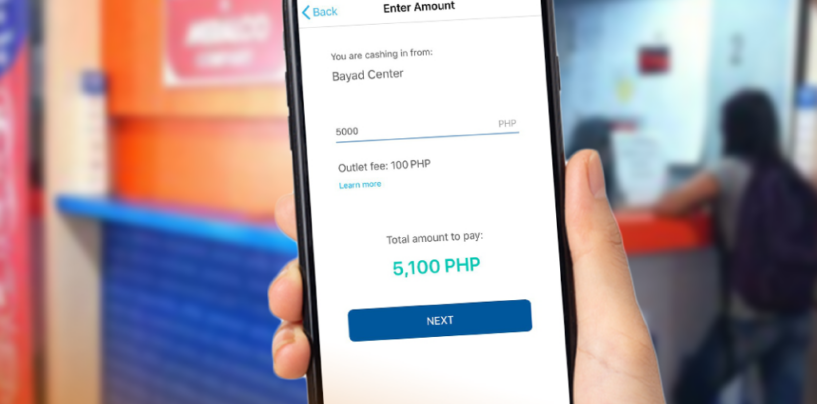

Read MorePayment Platform Bayad Center Records Huge Spike in Digital Transactions

CIS Bayad Center, a multi-channel payment platform in the Philippines, reported a significant growth in digital transactions within its biller and partner network since the month of May 2020. As of August 2020, online payments recorded a year on year

Read MoreFintech Startups Make Moves in the Philippines as Remittance Inflows Recover

With lockdowns easing up, Filipinos based abroad are back at sending money home. According to data from ING, overseas Filipinos are defining expectations, sending a total of US$2.78 billion worth of remittances back to the Philippines in July, representing a

Read MoreHome Credit Ties up With RCBC’s DiskarTech App to Disburse Cash Loans

Rizal Commercial Banking Corporation’s (RCBC) DiskarTech has tied up with taps Home Credit to allow its users to have their cash loans disbursed straight into the former’s digital savings accounts. This interest-bearing basic deposit account earns a competitive 3.25% profit

Read MoreING Banks: COVID-19 Is Causing Fillipinos to Save More

Dutch financial giant and all-digital bank in the Philippines, ING Bank, said that the rise of the “savings mentality” during the quarantine period can be sustained even after the COVID-19 pandemic in the Philippines. In a report by ING’s research

Read MoreTransUnion Aims to Tackle Online Credit Application Dropouts and Rising Fraud

Global risk and information solutions provider TransUnion is extending its data and technology expertise to help financial institutions accelerate digital transformation and be able to provide consumers with an easy digital application and onboarding experience. With the demand for digital access increasing

Read MoreDiskarTech Deepens Financial Inclusion Strategy With Agri-Fishery Credit Programme

The Department of Agriculture – Agricultural Credit Policy Council (DA-ACPC) has partnered with the Rizal Commercial Banking Corporation’s (RCBC) DiskarTech to make agri-fishery credit programmes more convenient and accessible for small farmers and fisherfolk (SFF) in the new normal. The

Read MorePhilippines Airline Cebu Pacific Opts for Cellpoint Digital’s Payment Platform

Cebu Pacific Airlines airline has selected CellPoint Digit to implement a Payment Platform across all its digital channels. The platform called Velocity, will enable Cebu Pacific to ease the payment experience of its repeat customers by deploying stored cards in

Read More