Archive

How Can Financial Institutions Put a Stop to Account Takeover Attacks

Financial Institutions (FI’s) can detect and prevent account takeover attacks using continuous monitoring and adaptive multi-factor authentication. Account takeover (ATO) fraud is one of the top causes of fraud losses for banks and financial institutions. An account takeover occurs when

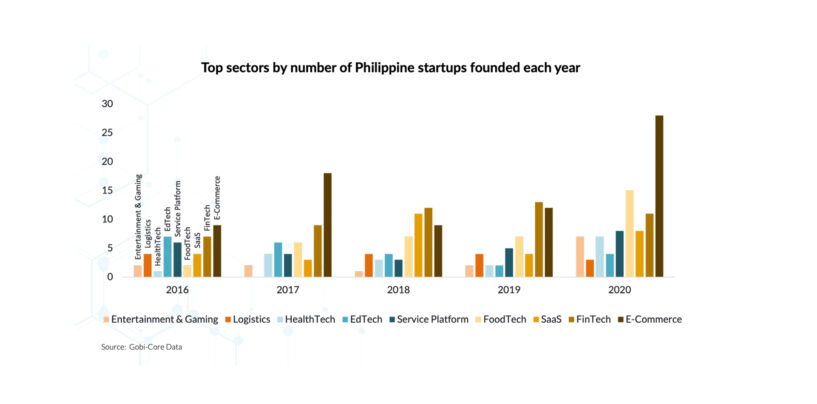

Read MorePhilippines’ New Generation of Startups Will Boost E-Commerce and Fintech

The Philippines is entering its third generation of startups, building on the groundwork laid by early tech pioneers and innovators during the past two decades. This new generation of startups are now thriving on the back of government support and

Read MorePhilippines’ SEC Issues Guidelines to Stamp Out Predatory Lending Practices

The Securities and Exchange Commission (SEC) has issued draft guidelines for the registration and operation of online lending platforms (OLPs) to stamp out abusive and predatory practices. The proposed guidelines will apply to both existing and newly registered financing and

Read MoreBSP Encourages Public to Use Digital Wallets for Holiday Gift Giving

The Bangko Sentral ng Pilipinas (BSP) is encouraging the public to use digital wallets when sending cash gifts this holiday season. The central bank said that using digital money as an alternative means of giving cash gifts is highly recommended

Read MoreHow to Protect Your Ecommerce Business From Fraud This Black Friday and Cyber Monday

As we head into the holiday season, we’re projecting a significant increase in fraud attacks targeting eCommerce businesses. In this article, learn how to protect your business from the threat of fraud. In 2020, consumers spent $861.12 billion online with U.S. merchants

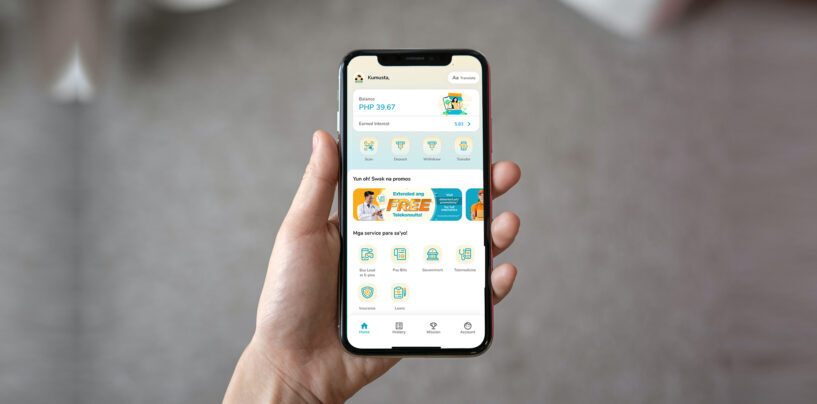

Read MoreRCBC’s DiskarTech App Recorded Phenomenal Growth Rate Since Last Year

Rizal Commercial Banking Corporation (RCBC), with its flagship financial inclusion app DiskarTech, has reached a five-digit organic growth in partner deposits by end of October versus same period last year. DiskarTech’s partner deposits recorded a 69,526 % and 12,765 %

Read MorePLDT and Smart Secure Online Transactions With Vesta’s Anti-Fraud Tools

Philippines’ telecommunications company PLDT and its wireless unit Smart Communications announced that they are utilising Vesta’s anti-fraud solutions to enhance the protection of their online transactions. Vesta is an end-to-end transaction guarantee platforms for online purchases, and its anti-fraud solution

Read MoreBNPL Startup Plentina Raises US$2.2 Million to Accelerate Regional Expansion

Plentina, a Buy Now Pay Later (BNPL) startup for emerging markets, announced that it has raised US$2.2 million in a latest funding round led by New York-based venture capital firm TMV, bringing its total funds raised to US$5.7 million. Joining

Read MoreFintech Alliance.PH Inks Agreement With the Anti Money Laundering Council

The Fintech Alliance.PH announced that it has signed the Information Sharing Protocol (ISP) with the Anti-Money Laundering Council (AMLC) to bolster the fight against money laundering and terrorism financing in the country. The AMLC is the Philippines’ Financial Intelligence Unit

Read MoreFormer Grab Execs Secure Funding for MSME Bookkeeping App Lista

Lista, a bookkeeping app for MSMEs based in the Philippines, has raised an undisclosed sum from oversubscribed round from 1982 Ventures, East Ventures, Saison Capital, Alternate Ventures, and other angel investors. The angel investors include former Grab Philippines’ President and

Read More