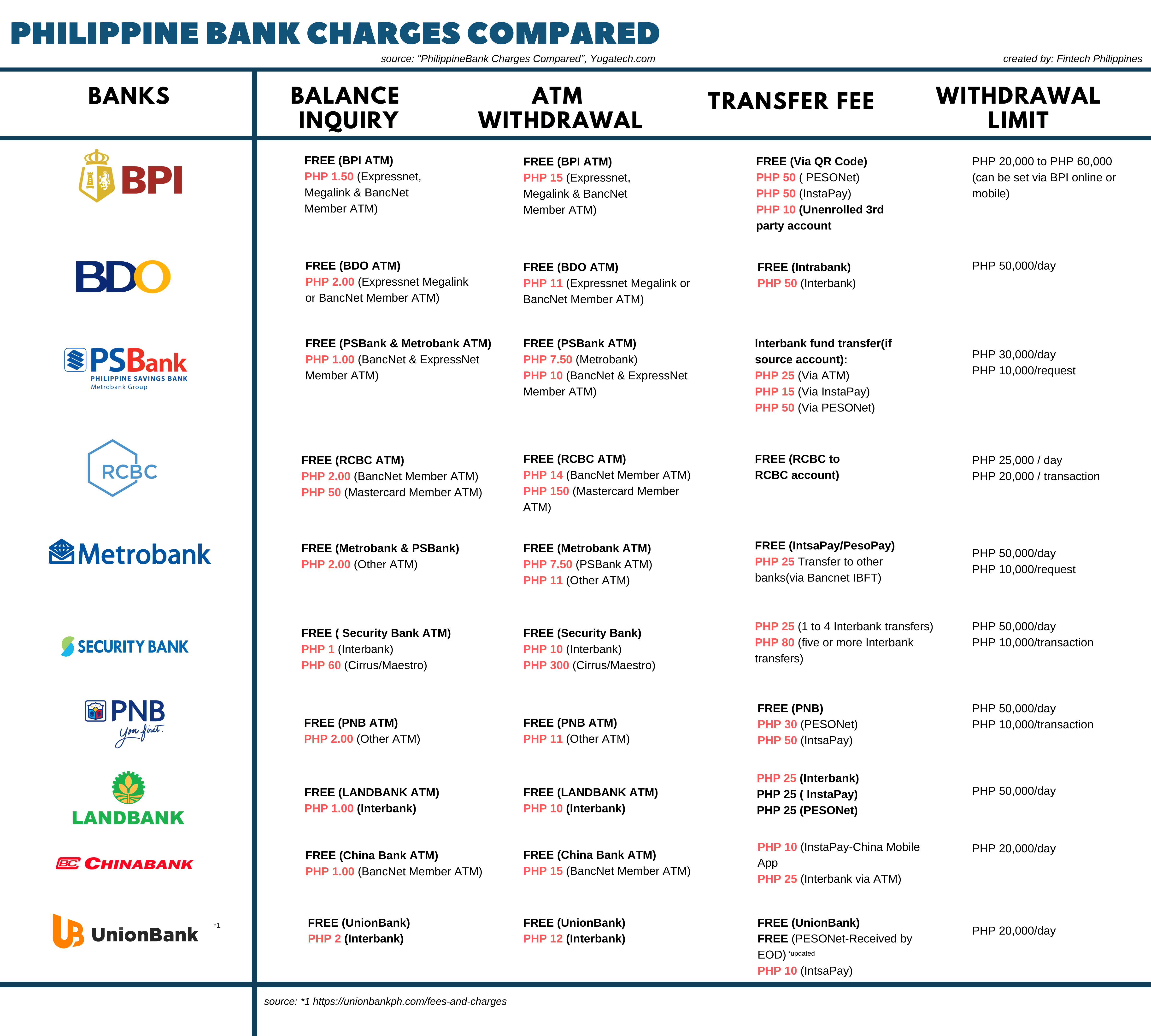

Bank of the Philippine Islands (BPI), Banco de Oro (BDO), Rizal Commercial Banking Corporation (RCBC), Metrobank and the Philippine National Bank (PNB) and UnionBank of the Philippines are the six banks in the Philippines charging the lowest ATM fees, while Security Bank and ChinaBank are the two charging the most ATM fees, according to a research by Yugatech.

The research, which analyzes Filipino banks’ ATM fees that apply to basic, savings and debit accounts, found that BPI, BDO, RCBC, Metrobank and PNB all provide free balance inquiries and free ATM withdrawals at their respective ATMs.

They also all offer free money transfers, and this applies for QR code transfers with BPI, transfers using a PNB ATM for PNB customers, intrabank transfers for BDO, Metrobank and UnionBank, as well as money transfers between RCBC accounts, and for PNB customers, transfers made from ATMs are free when they are made towards other PNB accounts.

Meanwhile Philippines Savings Bank (PSBank) offers free balance inquiries and ATM withdrawals at its respective ATMs but charges fees for any type of money transfers.

On the other hand, Security Bank and Land Bank both charge ATM fees for balance inquiries, ATM withdrawals, and transfers.

Philippine Bank Charges Compared

What to choose

For customers looking simply to store and withdraw money at ATMs, PSBank, Security Bank and Land Bank might be the best options, according to the report, as they charge only PHP 10 when using other banks’ ATMs. They are followed by BDO and PNB at PHP 11 per transaction, UnionBank at Php 12, RCBC at PHP 14, and BPI and China Bank at PHP 15.

For customers making a lot of money transfers, UnionBank offers the lowest rate at Php 10 per transaction when using Instapay. Unionbank is followed by PSBank, who charges PHP 15 for InstaPay transfer, and Metrobank, Security Bank,PNB, LandBank, and China Bank, who all charge PHP 25 per transaction. Both BPI and BDO are the most expensive, charging PHP 50 for interbank transfers, the report says.

Finally, for customers who often withdraw large sums of money at a time, BPI is the best option with a maximum daily limit of PHP 60,000. BPI is followed by BDO, Security Bank, PNB, and Land Bank at PHP 50,000 per day. Meanwhile, PSBank and Metrobank allow for PHP 30,000 to be withdrawn per day, and China Bank and UnionBank only allows for PHP 20,000 per day.

ATM fees in the Philippines

ATM transaction fees have been a hot topic over the past couple of years in the Philippines. In September 2013, amid consumers complains on their high cost, the Bangko Sentral ng Pilipinas (BSP) suspended ATM fee increases.

While the intend was to provide the population with more affordable banking services, the cap on ATM fees has led to a dwindling number of cash machines in the country, and most particularly in rural areas, a trend that runs counter to the BSP’s goals for financial inclusion. According to the association of the Philippines’ largest financial institutions, the Philippines is now falling behind its ASEAN peers in terms of the number of ATMs deployed.

The central bank eventually lifted that moratorium in 2019 but enquired banks to apply for any adjustment in ATM transaction fees. In September, the regulator gave some banks the green light to raise fees on ATM services by PHP 3 per transaction.

*Graphic updated

This article first appeared on fintechnews.sg