Remittance

RCBC, Digital Wallet Corp. to Streamline Philippines-Japan Cross-Border Payments

In a move to streamline digital transactions between the Philippines and Japan, Rizal Commercial Banking Corporation (RCBC) has entered into a partnership with Digital Wallet Corporation (DWC), a Japanese IT and fintech company. This collaboration aims to facilitate smoother cross-border

Read MorePomelo Secures Major Series A Funding to Grow Credit-Based Remittance Services

Consumer credit-based cross border payments provider, Pomelo has recently announced a significant increase in funding, securing a Series A investment of US$35 million and expanding its warehouse facility by US$75 million. The round was led by Vy Capital, with contributions

Read MoreStables to Facilitate Remittances Between Australia and The Philippines

Stables, an Australian firm specialising in digital wallet and payment solutions, has announced the introduction of international remittance services, catering primarily to the financial exchange between Australia and the Philippines. Stables’ clientele, who are spread across more than 130 countries,

Read MoreGCash Partners with E9pay to Expand Remittances for Filipinos to South Korea

E-wallet GCash has announced its expansion into South Korea through a strategic partnership with Seoul-based broker E9pay. This collaboration aims to offer overseas Filipino workers a more efficient and cost-effective way to remit funds back home, tapping into the sizable

Read MoreBSP Reports Record Highs From Overseas Remittances in the Philippines

In December 2023, personal remittances from overseas Filipinos achieved a record high in the Philippines, reaching US$3.6 billion, an increase of 3.9% from the US$3.5 billion reported in December 2022. This growth, as detailed by the Bangko Sentral ng Pilipinas

Read MoreCoins.ph and Circle to Drive Awareness of USDC-Denominated Remittances

Coins.ph, a Philippines-based cryptocurrency exchange and digital wallet provider, has partnered with Circle Internet Financial (Circle), a global fintech firm and issuer of USDC. The partnership aims to drive awareness of USDC-denominated remittances as a secure, low-cost and near-instant solution

Read MoreRemittance Continues to Play Major Role in Filipino Economy as It Hits Record Highs

Remittances play a critical role in the Filipino economy and have significant social and economic impacts on the country: they help alleviate poverty, are a driving force behind the country’s economy, and help expand the financial sector and promote financial

Read MoreWise Users Can Now Send Up to PHP 9 Million to the Philippines

Online money transfer service Wise announced that its users can now send up to PHP 9 million (approximately US$161,000) to the Philippines. This is almost 18 times more than what they could send previously. Users can send PHP to any individual

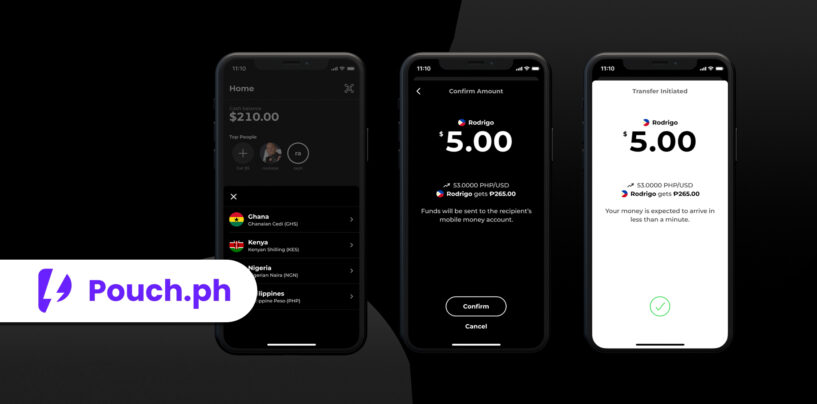

Read MorePouch Partners Strike for Remittance From the U.S. to the Philippines

Filipino startup Pouch has partnered with Strike, a digital payments platform built on Bitcoin’s Lightning Network, for fast, secure, and low-cost remittance payments from the U.S. to the Philippines. Pouch is a lightning service provider which facilitates connectivity to the

Read MoreGcash Partners Roxe to Provide Affordable Blockchain-Based Cross Border Payments

Blockchain infrastructure company Roxe announced that it has partnered with G-Xchange’s GCash to enable affordable cross-border payments. The partnership connects GCash to Roxe’s blockchain-based payment network, where users from around the world can send funds to GCash’s customers. Roxe says

Read More