PayMongo and Vesta Join Forces to Secure Digital Payments

by Fintech News Philippines November 3, 2020PayMongo, a Manila-based online payment processing platform, announced its partnership with Vesta, a fintech focused on fraud detection for e-commerce payment solutions, to further enhance the company’s advanced fraud detection capabilities.

The partnership adds fraud assessment to protect customers’ accounts and enable real-time reporting for PayMongo’s merchants comprising mostly of small and medium Filipino enterprises.

PayMongo also offers merchants waived sign-up and monthly fees, providing a quick and automated onboarding process and seamless API integration for those with website or apps, as well as letting them accept digital payments such as credit and debit cards and e-wallets through its PayMongo links product and e-commerce plug-ins.

PayMongo’s collaboration with Vesta comes at the heels of its Stripe-led US$12 million Series A funding.

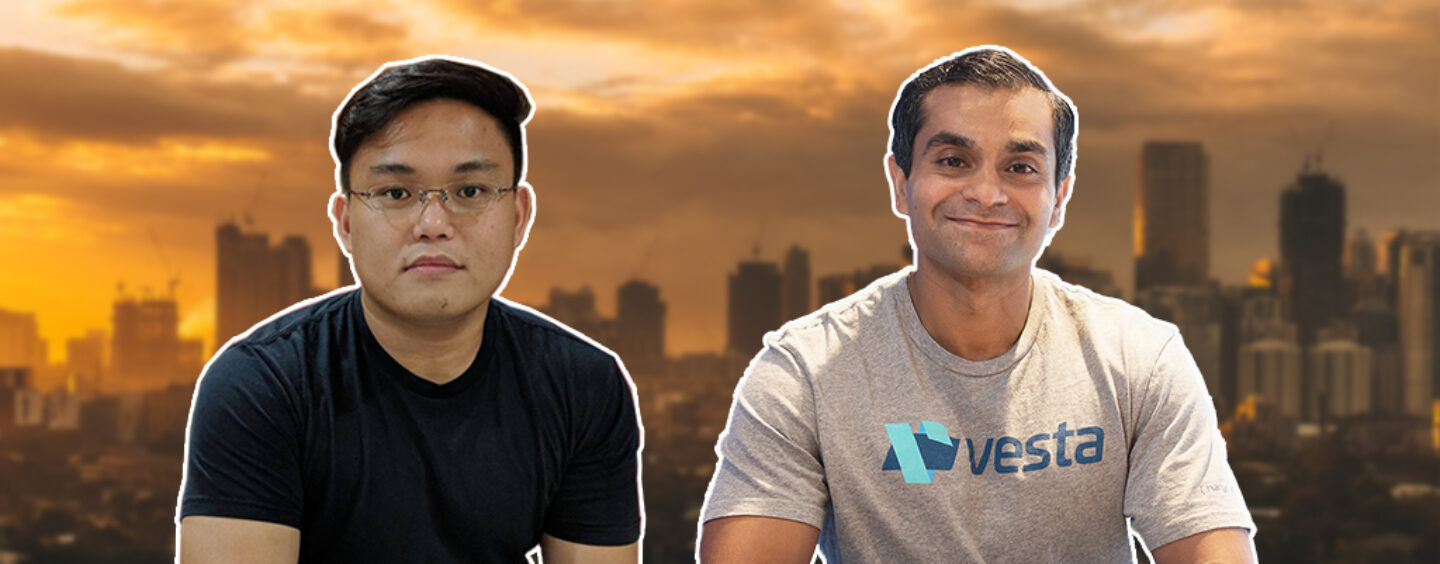

Francis Plaza

“One of PayMongo’s strong points is our robust fraud detection system. Still, we continue to improve and innovate. With its track record, Vesta is a natural choice for PayMongo to help us amplify the protection we give our merchants,”

said Francis Plaza, PayMongo co-founder and Chief Executive Officer.

Shabab Muhaddes

“We are excited to partner with PayMongo, and saw a great match in PayMongo’s commitment to always cater to their merchants’ needs that made this partnership come to fruition especially during a time where businesses require the support they need to continue growing digitally.”

said Shabab Muhaddes, Vesta General Manager in the Asia Pacific.

Vesta had recently acquired funding from Singapore-based EDBI, a global Asian-based investor and Goldfinch Partners.

Both firms will tap into each other’s strengths and capabilities to address the need for fraud protection in the Philippines.

Featured image: Francis Plaza, PayMongo co-founder and Chief Executive Officer and Shabab Muhaddes, Vesta General Manager in the Asia Pacific