Philippines’ Outdated Outward Remittance Processes is Overdue for Revamp

by Fintech News Philippines August 6, 2021As Asia’s third largest recipient of remittances, the Philippines relies heavily on money sent home by around 10 million Filipinos who live and work overseas. In 2019, personal remittances accounted for 9.3% of gross domestic product, according to Bangko Sentral ng Pilipinas (BSP).

With COVID-19 accelerating digital payment adoption, fintech startups and payment providers have jumped on the Philippines’ massive remittance opportunity, inking key partnerships and launching innovative solutions to facilitate money inflows into the country.

Last year, digital payment platform InstaReM expanded its offering for the Filipino market, launching cash payout options for recipients at approved outlets. The new option complements InstaReM’ other payout options for the Philippines which already included direct transfers to bank accounts. These services apply for both real-time payments (within five minutes) or same day payments.

Earlier this year, Telcoin, a blockchain-powered fintech platform that connects telcos and mobile money platforms, launched a digital remittance corridor between Canada and the Philippines. The service, which is offered in collaboration with leading mobile wallet GCash, aims to be the most affordable and convenient option for overseas Filipinos to send money back home.

And just last week, SBI Remit, the largest money transfer provider in Japan, announced a partnership with mobile payment service Coins.ph, digital asset exchange platform SBI VC Trade, and enterprise blockchain and cryptocurrency solutions provider Ripple to offer faster and more affordable remittance options from Japan to the Philippines.

Outward remittances in need of a revamp

While much has been done to modernize remittances coming into the Philippines, little development has been made so far to improve the process of sending money out of the country, or outward remittances.

In fact, a recent analysis by the Fintech News Network shows that in the Philippines, outward remittances still mostly rely on slow and inefficient processes like international bank wires where customers are required to visit a branch to fill out forms and submit applications. This is the case for BPI, Security Bank, and Maybank Philippines. Even market leaders and incumbents like Western Union and MoneyGram require customers to visit an agent location to verify their identity and complete their transactions.

A few exemptions though exist. These include cross-border digital payment service WorldRemit, which allows users to transfer money from the Philippines to more than 130 destinations across the world. Users pay for their transfer using a debit, credit or prepaid card, and needs to verify their identity and address by uploading their documents online.

The Philippines’ digital payment transformation plan

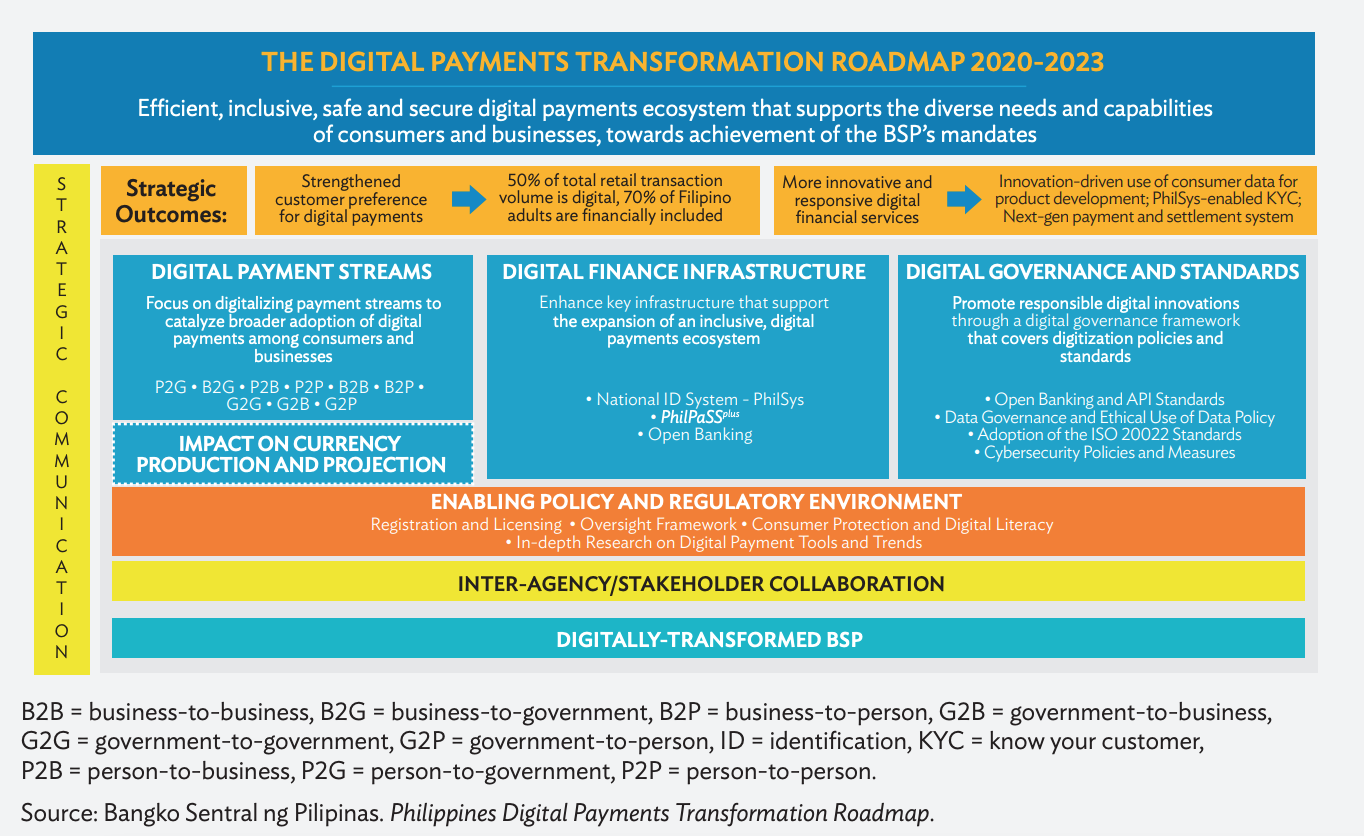

BSP, the country’s central bank, introduced its Digital Payments Transformation Roadmap for 2020-2023 last year, outlining a series of initiatives to increase digital payments to 50% of all payments and increase financial inclusion to 70% by 2023. The strategic outcomes include stronger customer preference for digital payments and more innovative and responsive digital financial services.

The roadmap’s three pillars include creating compelling and large-scale digital payments use cases, setting up digital finance infrastructure that is secure, efficient and interconnected, and introducing digital governance and standards allied with global best practices.

The introduction of the digital national identification scheme (PhilID) is expected to further support the Philippines’ payment modernization reform by facilitating real-time processing of financial transactions and supporting digital onboarding, especially for unbanked populations.

As of early July 2021, over 37.2 million Filipinos had registered to the Philippine Identification System (PhilSys) and over 343,000 registrants had received their PhilID cards, according to a report by the Manila Times.

The Digital Payments Transformation Roadmap 2020-2023, Graphic via Harnessing Digitalization for Remittances in Asia and the Pacific (APAC), Asian Development Bank, July 2021

Featured image: Photo by Mari Gimenez on Unsplash