In 2021, the Philippines’ fintech industry continued to grow and mature, building on accelerated adoption of digital channels amid COVID-19, investors’ optimism on the prospect of fintech in the Southeast Asian nation, and continued effort from the government to foster financial innovation.

Consumer interest in fintech continued to grow in 2021 as mobile wallet penetration effectively surpassed that of bank accounts, according to Moody’s Investors Services. Fintech companies have gained much ground, Moody’s says, noting that Filipino banks have been slow in developing digital services, leaving room for fintech companies to threaten their position.

Usage of digital payments also picked up in 2021 amid lockdown restrictions. Domestic e-wallet leaders witnessed record growth and raised massive rounds of funding to accelerate growth, building on the momentum to expand their portfolio of products.

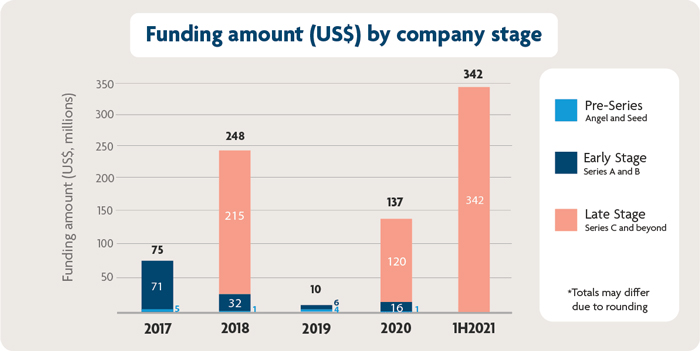

Fintech funding soars

2021 saw strong growth in investor activity in the Filipino fintech industry. Total funding for fintech firms in the country in H1 2021 reached US$342 million, more than doubling 2020’s total of US$137 million and surpassing the previous all-time high of US$248 million raised in 2018, according to data compiled by the United Overseas Bank (UOB).

Fintech funding in the Philippines, Source: UOB

Fintech funding activity in H1 2021 was driven by late stage mega-rounds of US$100 million and over closed by leaders including Mynt, the owner of the GCash e-wallet (US$175 million), and Voyager Innovations, the owner of PayMaya (US$167 million).

The trend continued in H2 2021 with another mega-round closed by Mynt (US$300 million), and funding raised by the likes of cryptocurrency exchange platform Philippine Digital Asset Exchange (PDAX) (US$12.5 million).

COVID-19 fuels digital payment takeoff

Booming fintech funding activity came on the back of accelerated digital adoption as locked-down consumers were forced to switched to mobile payment and banking apps.

Data from the Bangko Sentral ng Pilipinas (BSP), the country’s central bank, show that 20.1% of monthly payments volume was done digitally by the end of 2020, a substantial improvement from the first semester of 2020 estimates, which pegged digital payments volume at 17%.

The trend is consistent with the strong growth industry players recorded last year. GCash, one of the country’s largest e-wallet, saw the number of registered users surge to 51 million as of the end of October. Mynt reached profitability in June.

PayMaya, another top e-wallet in the Philippines, had more than 41 million registered users, as of the end of September. Throughout 2020, cashless transactions through its platform consistently registered triple-digit growth rates, the company said.

A study conducted by cybersecurity firm Kaspersky found that in Southeast Asia, the Philippines is leading in e-wallet adoption with 37% of local respondents saying they started using digital methods during the pandemic.

The Philippines welcomes first digital banks

After granting six digital banking licenses throughout 2021, the Philippines saw the launch of its first virtual-only banks: Overseas Filipino Bank (OFBank), a wholly-owned subsidiary of the Land Bank of the Philippines, and Tonik.

So far, consumer uptake has been strong. Tonik surpassed US$100 million in consumer deposits eight months after its launch. OFBank saw the number of deposit accounts opened through its digital onboarding system more than double between December 2020 and July 2021 to nearly 46,000.

UNObank, a brand operated by Singapore-headquartered fintech DigibankASIA, strives to create a full-spectrum credit-led digital bank in Southeast and South Asia, using the Philippines as a launchpad for regional expansion. UNObank has yet to go live. It raised US$7.5 million in fresh funding in November, Dealstreetasia reported.

The three other licensees, GoTyme, Union Digital Bank, and Maya Bank are expected to launch by mid-2022.

A burgeoning fintech sector

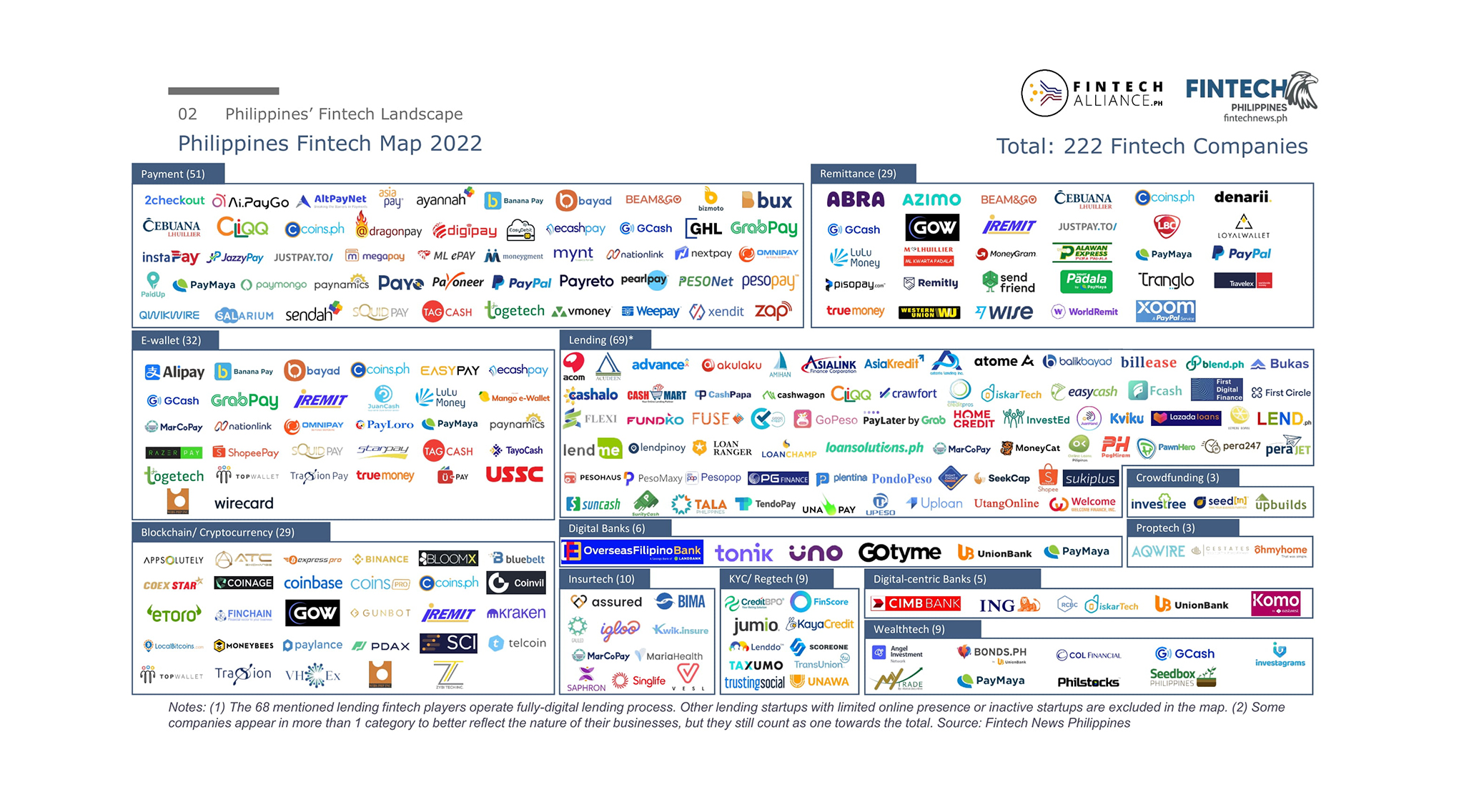

Our latest Fintech Philippines Report identifies more than 220 fintech companies in the country, among which 27% are in the lending segment. Payments make up 20% of all Filipino fintech companies, followed by e-wallet (13%), blockchain and cryptocurrency (12%), and remittances (12%). Other segments also represented include insurtech (4%), know-your-customer (KYC)/regtech (4%), wealthtech (4%), digital banking (2%) and crowdfunding (1%).

Government support

2021 saw numerous regulatory developments, notably in the fields of cryptocurrency and digital assets as well as open banking.

In January, the BSP issued guidelines for virtual asset service providers (VASP), or entities that offer financial services for virtual assets. This development came on the back of surging cryptocurrency trading activity.

This was followed in mid-2021 by the release of guidelines for the Open Finance Framework, which outlines a consent-driven data sharing scheme designed to promote collaborative partnerships among incumbent financial institutions and fintech players.

Open finance is part of the BSP’s three-year Digital Payments Transformation Roadmap, which aims to convert at least 50% of the total volume of retail payments into digital form and to onboard at least 70% of Filipino adults to the financial system.

Efforts were also made to modernize the payment landscape. During this year’s Singapore Fintech Festival in November, the BSP unveiled a new partnership agreement with the Monetary Authority of Singapore (MAS) to link their respective real-time and QR payment systems to provide instant, low-cost cross-border payments. This builds on an earlier 2017 fintech agreement to broaden the scope of fintech collaboration and partnerships between the two nations.

Featured image credit: Edited from Flower photo created by wirestock – www.freepik.com