Philippines Project to be Among Fastest Growing Neobanking Adoption in Next 5 Years

by Fintech News Philippines October 12, 2022Between 2022 and 2027, the Philippines and Mexico are expected to see the fastest rise in neobanking adoption, owing to the current relatively low usage, supportive regulatory landscape and favorable demographics, according to a new analysis by Hungarian fraud prevention company Seon.

In the Philippines, around 13% of the population currently use neobanks, but by 2027, that figure is set to soar 154% to 33% of the population, the analysis found, representing the biggest increase out of all countries studied.

The Filipino central bank approved a digital banking framework in November 2020 with hopes to help improve financial inclusion and digitalize payment transactions. Six entities have so far been granted a digital banking license, with three now fully operational. All three players, namely the Overseas Filipino Bank (OFBank), Tonik, and Maya Bank, have said they’ve witnessed strong growth since being active.

Tonik, which launched in March 2021, says it has set “new bank growth records” in the Philippines, amassing US$20 million and US$100 million in consumer deposits within the first and eight months of operation, respectively.

Maya Bank, an affiliate of Filipino financial services and digital payments company PayMaya, says it had reached PHP 5 billion (US$84 million) in deposits just three months after its public launch, and over 650,000 customers.

And OFBank, which targets overseas Filipinos and remittances, claims to have received PHP 7.22 billion (US$122 million) in online banking transactions over the past two years from managing more than 80,000 accounts.

After the Philippines, Mexico was found by the Seon analysis as the location with the second highest forecast in neobanking adoption growth between 2022 and 2027. Currently, only 17% of Mexican residents hold a digital-only bank account, a proportion that’s expected to rise to 41% by 2027.

Since 2016, Mexico has seen the arrival of hundreds of fintech companies offering digital bank accounts, including homegrown Klar, Kueski Pay, Stori, and Albo, as well as international fintech firms like Nubank from Brazil, Uala from Argentina and Revolut from the UK.

All of these companies are eyeing Mexico’s large population of unbanked, which stood at about 50% of the population in 2021, and its cash-intensive economy. According to official statistics released earlier this year, cash still drives 90% of transactions under MXN 500 (US$25), as well as 78.7% of payments or bills over MXN 500, leaving plenty of opportunities for fintech companies to tap into.

Challenger banks in Mexico has so far witnessed notable traction. Klar, which was founded in 2018, claims that between mid-2020 and mid-2021, it added 1.4 million customers and originated over US$100 million worth of loans. Brazilian digital bank Nubank says 3.2 million of its customers are located in Mexico, and Argentina’s Uala, which began operating in Mexico in 2020, managed to onboard more than 100,000 customers in the country in the span of six months.

Uala CEO Pierpaolo Barbieri told Reuters in an interview earlier this month that US$150 million will be invested over the next 18 months on boosting its digital banking business, mainly in Mexico and Colombia.

After the Philippines and Mexico, Portugal, the United Arab Emirates (UAE) and Malaysia were identified as the countries where neobanking will be adopted the fastest in the next five years.

In Portugal, neobanking penetration will rise 129% to 32%, the report says, while in the UAE, penetration will increase 116% from 2022 to reach 41% of the population by 2027. In Malaysia, 28% of the population will own a digital bank account within the next five years, up 28% from the current 13%.

Which countries are adopting neobanking the fastest, Source: Seon, 2022

Released on September 28, 2022, the Seon report uses findings from a 2022 digital banking survey conducted by Australian financial comparison platform Finder, as well as data from Crunchbase, TopMobileBanks, CityPopulation, and other sources, to provide an overview of the global neobanking industry.

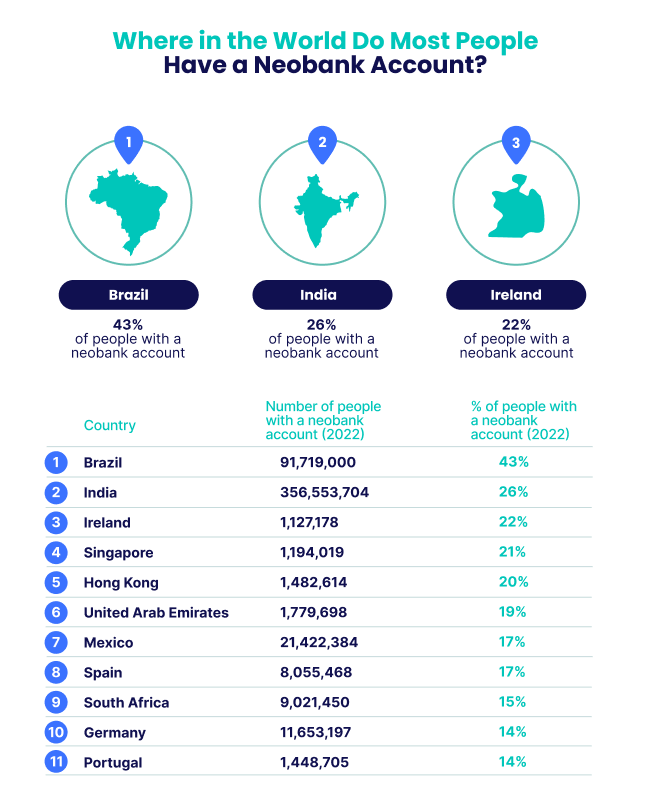

According to the report, Brazil is currently the world leader in digital banking adoption with 43% of the population owning a neobanking account. The country is home to one of the largest digital bank in the world, Nubank, which clocked 53.9 million customers, as of early 2022.

India stands second at 26%, followed by Ireland at 22%, Singapore at 21% and Hong Kong at 20%.

In India, the establishment of the digital infrastructure known as the India Stack, coupled with the launch of government-led financial inclusion program Pradhan Mantri Jan Dhan Yojana (PMJDY), has significantly widen access to financial services. Since PMJDY was introduced back in 2014, 420 million bank accounts have been opened. According to official data, financial inclusion in the country increased from 43.4% in 2017 to 56.4% in 2022.

Singapore and Hong Kong, meanwhile, granted their first digital banking licenses in 2020 and 2019, respectively. In Hong Kong, ZA Bank is the largest virtual bank, recording about 500,000 customers, as of April 2022. Mox Bank, which backed by Standard Chartered, stands second with 300,000 customers, followed by Livi, a virtual bank backed by Bank of China (Hong Kong), with 200,000 clients.

In Singapore, Grab and Singtel rolled out their digital banking app in September, becoming the second challenger bank to launch in the city state. Called GXS, the bank said it will start by offering a savings accounts, targeting younger users and the gig economy workers that underpin Grab’s car-hailing and meal delivery services.

China’s Ant Group soft-launched its digital bank Anext Bank in July. Anext Bank focuses on providing digital financial services to local and regional micro, small and medium enterprises (MSMEs), especially those engaging in cross-border operations for growth and global expansion.

Where in the world do most people have a neobank account, Source: Seon, 2022