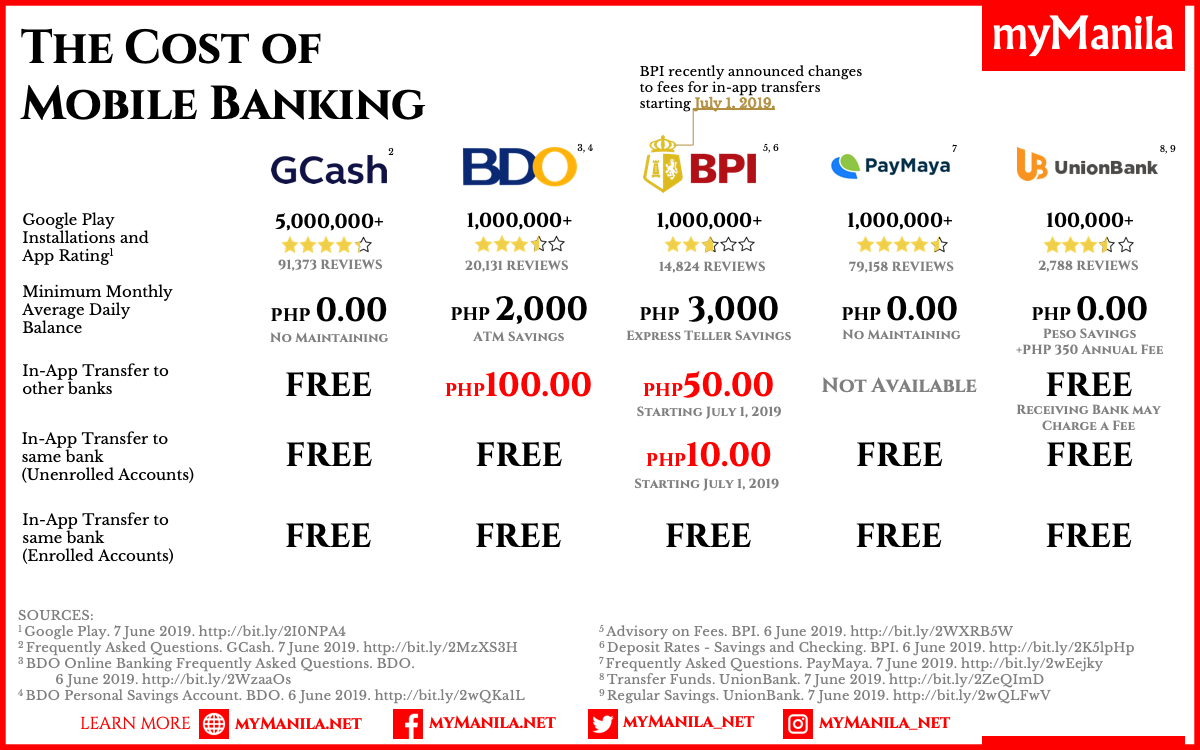

With more than 5 million downloads from Google Play, GCash is not only one of the Philippines most popular mobile banking apps, it is also one of the cheapest banking services providers, requiring no minimum maintaining balance compared to other leading banks and providers, according to an analysis by MyManila.net.

GCash is a mobile money service regulated by the Bangko Sentral ng Pilipinas (BSP), the central bank of the Philippines, that lets users buy, load, purchase items, send and receive money, pay bill, and more, on any network in the country (not just Globe’s). GCash also offers the option to access the digital wallet with a physical card through GCash Mastercard or Amex.

The service allows users to make money transfers, whether to the same bank or to another bank, for free, and doesn’t require customers to hold a minimum balance. The same goes for UnionBank, though the provider records much less users than GCash at 100,000+.

PayMaya is another popular mobile wallet in the Philippines with more than 1 million downloads and a similar price structure. Meanwhile, mobile banking services of big banks BDO and BPI, though in the top five mobile wallets in terms of app downloads from Google Play, require at least PHP 2,000 in ATM savings and PHP 3,000 in express teller savings as a minimum monthly average daily balance, respectively.

Mobile wallet app GCash is undeniably one of the pioneers and leaders in the Filipino market, counting some 20 million users. The service is provided by Globe Telecom, a major provider of telecommunications services in the Philippines.

Users register for an account either by downloading the app, dialing *143# from their mobile phone or through Facebook Messenger. They can add funds to the digital wallet by visiting one of the several partners of the service, which include banks, remittance centers, pawnshops, department stores and convenience stores. Withdrawing funds can be done the same way or via a GCash Mastercard.

Since launching in 2004, the platform has significantly expanded and continues to do so, adding for instance, the ability to shop at US stores with the GCash American Express, a virtual credit card, or make payments with QR codes with GCash QR. Paying with GCash will even reward users a 10% cashback for every transaction.

PayMaya is another strong contender that offers nearly the same product and services, and which is also network-agnostic like GCash.

The digital payments arm of PLDT’s Voyager Innovations Inc., the leading technology company in the Philippines, PayMaya offers mobile commerce services including a prepaid online payment app that enables the unbanked and the uncarded to pay online without a credit card. The company also offers PayMaya Business, its system solution that allows businesses to receive payments from all cards anytime, anywhere, Smart Money, an e-wallet linked to a mobile phone, and Smart Padala, a domestic remittance brand in the Philippines with touch points at Smart Padala Centers across the country.

PayMaya recently established a mobile-based cashless ecosystem in Boracay, a small island in the Philippines located in the south of Manila, as part of efforts to helping boost the tourism industry, making PayMaya QR available to visitors and allowing them to pay using only their mobile phones in hundreds of merchants ranging from food establishments, hotel sand accommodations, merchandise, micro-sellers, and transportation.

Besides the domestic players, several foreign companies have entered the Filipino market to tap into the country’s booming digital economy.

GrabPay is one of them. Part of the Grab ecosystem, which started with ride-hailing and rapidly branched out into more services, including courier, food delivery and financial services, GrabPay is a mobile wallet payment solution that lets users pay for Grab services and in numerous stores.

This article first appeared on fintechnews.sg