Tonik Ventures Into the Consumer Lending Market With ‘Quick Loan’ Offering

by Fintech News Philippines September 15, 2021Philippines’ neobank Tonik announced that it has launched a Quick Loan product on its platform marking its venture into the consumer lending market in the country.

Tonik said that its all-digital Quick Loan is designed to serve the unbanked and underbanked Filipino middle class with a quick and affordable bank credit proposition.

Applicants are not required to have prior credit history or a pre-existing bank account at any bank as the offering relies on alternative credit scoring technologies.

The application process reportedly takes 15 minutes where applicants will need to upload one form of ID and their latest pay slip.

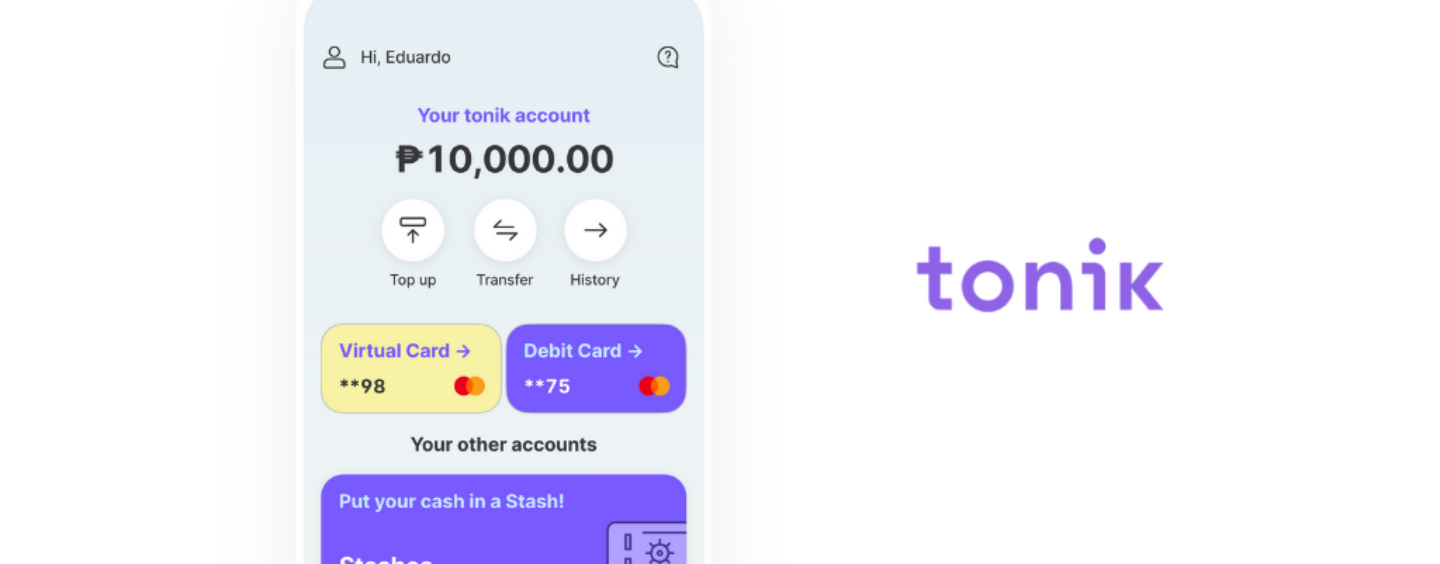

Once approved, the funds are instantly credited to the client’s Tonik account.

The funds can then be withdrawn through OTC partners Cebuana and MLhuillier, moved to client’s other bank or e-wallet account, or paid out through an ATM or merchant payment using the Tonik Debit Card.

The clients can also set their own preferred monthly repayment dates up to 24 months, as well as reduce time and interest rate by linking their salary payroll’s ATM card.

Tonik was granted a digital bank license from the Bangko Sentral ng Pilipinas (BSP), it was operating under a rural banking license since 2019 prior to that.

Greg Krasnov

Greg Krasnov, CEO and Founder of Tonik said,

“We have already attracted close to USD 80 million of consumer deposits since our launch six months ago. This has validated our ability to rapidly scale our resources for lending, and therefore enables us to grow our loan book fast and without any reliance on third party wholesale funding.

So, the Quick Loan is only the first in a range of all-digital consumer lending products that we will introduce over the coming months. Our plan is to use advanced digital technology to help solve financial inclusion in the country.”