Tag "TONIK"

Philippines Digital Banks Attracted US$700 Million So Far as Investors Interest Peaks

In a promising development for the standalone digital banks in the Philippines, more than US$700 million has been invested by both local and global investors, indicating robust growth in this emerging industry. As of the end of 2023, the number

Read MoreBreaking Down Digital Banking Products in the Philippines

Digital banking has swiftly expanded across Asia, notably achieving reasonable success in nations such as South Korea, China, and Japan. Within Southeast Asia’s digital banking sector, the Philippines joined Singapore as early adopters of digital bank products and services amid

Read MoreTonik Financial Confirms Multiple Layoffs in Bid for Profitability

Tonik Financial, headquartered in Singapore and operating the Tonik Digital Bank in the Philippines, has recently revealed a reduction in its workforce, which the company says is a strategic move towards enhancing revenue streams and attaining profitability. The decision, as disclosed

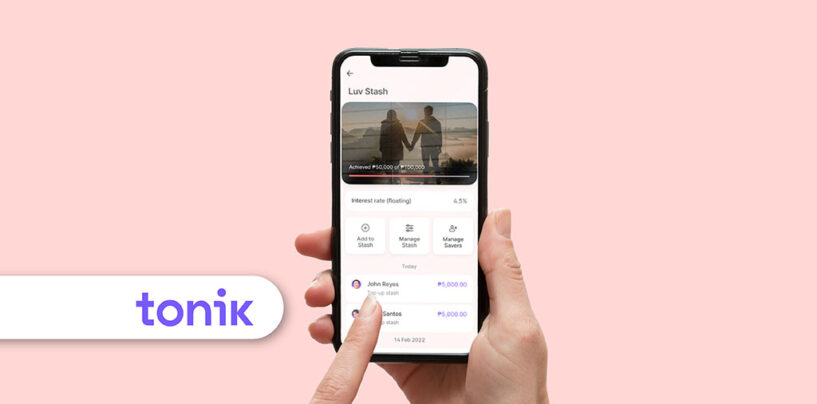

Read MoreTonik Introduces ‘Luv Stash’, a Savings Product for Couples to Earn 4.5% Interest

Following Valentine’s Day last week, Tonik Digital Bank has recently unveiled ‘Luv Stash,’ a novel savings product. This facility stands out in the market by allowing two individuals to jointly save whilst earning an interest rate of 4.5%. The idea

Read MoreTonik and Xendit Collaboration to Grow Digital Banking Payment Options

Tonik Digital Bank and the Southeast Asian payment gateway Xendit have announced a new strategic partnership, set to enhance the range of financial services available to Tonik consumers by introducing secure and convenient options for managing financial transactions. Starting from

Read MoreMaria Pineda Takes Helm as New Chair of Tonik Digital Bank’s Board

Tonik Digital Bank, Inc. has recently appointed Maria Lourdes “Long” Pineda as the non-executive Chair of its Board of Directors. Maria, with a background in financial inclusion and banking, was previously the President of Tonik since 2019. Her career, spanning

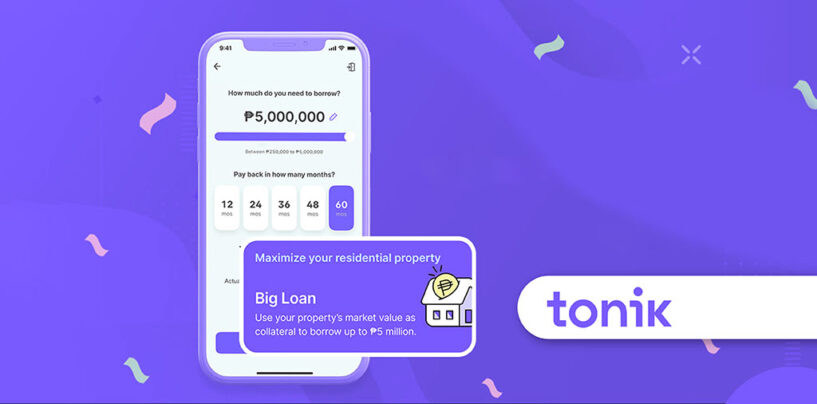

Read MoreTonik Upgrades Loan Offering to Cater to SMEs

Tonik Digital Bank recently updated its Big Loan product, aiming to address a broader range of financial requirements for small businesses in the Philippines. This enhancement is part of Tonik’s efforts to support the growing needs of small and medium

Read MoreFintech in the Philippines: 2023 in Review

The fintech space in the Philippines has been growing rapidly in 2023, with several developments that have shaped the industry and the country’s financial inclusion. The fintech sector in the Philippines witnessed significant growth in 2023 which reflects the country’s

Read MoreTonik Rolls Out Insurance Product for Loan Borrowers

Philippines’ digital bank Tonik has tied up with life insurance company Sun Life Grepa Financial to launch Payhinga, an inclusive insurance product for loan borrowers. Payhinga will complement Tonik’s existing loan offerings and will be readily available to customers applying

Read MoreTonik Strengthens Finastra Partnership as It Surpasses 1 Million Users

Philippines’ digital bank Tonik announced that it has renewed its partnership with financial services software and cloud solutions provider Finastra. Through this partnership, Finastra’s Essence core banking platform will continue to power Tonik’s end-to-end banking operations. Essence is cloud-enabled and

Read More