How Is the Philippines Gearing Up to Be a Digital-Heavy and Cash-Light Society?

by Fintech News Philippines October 4, 2021The Governor of Bangko Sentral ng Pilipinas (BSP), Benjamin E. Diokno has a vision of transforming the Philippines into a digital-heavy and cash-light society to help achieve inclusive growth.

The vision, which he shared during an online forum of the Asian Development Bank Institute (ADBI), also includes a target of ensuring 50% or half of the transactions should be digital by 2023 and 70% of Filipino adults should have formal bank accounts by 2023.

Ultimately, Diokno aims to transition the economy to a cash-light environment by 2025 and eventually to a coin-less and cash-less society.

Undoubtedly, some challenges are standing in the way within the cash-reliant archipelago before this vision can be achieved.

However, the Philippines are undeterred and have been taking the necessary steps to overcome these barriers.

Initiatives To Overcome Challenges of Poor Internet Coverage and Digital Infrastructure

The fundamental factor in realising the vision of a digital-heavy and cash-light society in the Philippines lies in the strength and stability of internet connectivity.

Although the internet speed in the Philippines has improved and recorded a 216.94 percent increase in the country’s average download speed for fixed broadband and a 127.82 percent increase for mobile broadband from July 2016 to July 2020, there are still gaps that need to be addressed beyond just the speed of the Internet.

Poor coverage still exists throughout the country due to a lack of information and communications technology (ICT) infrastructure, causing many to experience weak or no signal at all.

The Philippines Digital Economy Report 2020 by the World Bank reports that the digital divide in the Philippines is substantial, with almost 60 percent of households not having access to the internet.

Cognizant of this fact, PHP 1.9 billion has been allocated for the 2021 National Broadband Plan in the Philippines to accelerate telecom builds in the country, an increase from the earlier proposed PHP 903.194 million.

The National Broadband Plan (NBP) is the government’s broadband infrastructure blueprint to install fibre optic and wireless technologies to improve internet accessibility, broadband speed, and affordability.

Overall, at least PHP 18 billion is required for the complete implementation of the NBP.

Apart from this funding support, the government has also been urged to act on the pending Open Access in Data Transmission bill, that would allow more service providers to come in and build infrastructure in rural areas.

The act seeks to lower barriers to market entry, fast-track and lower the cost of deploying broadband facilities and promote infrastructure sharing.

It also mandates interconnection among data transmission participants to prevent monopoly by a single player or a group of data providers and promote fair and open competition.

Digital Payments Transformation Roadmap 2020 to 2023

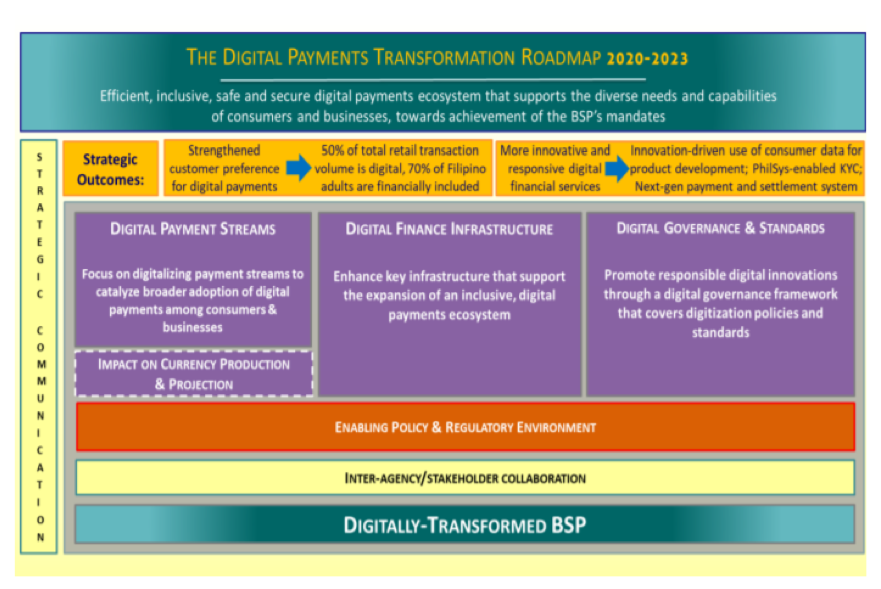

The BSP has also launched the Digital Payments Transformation Roadmap (DPTR) from 2020 to 2023, and among the key strategic outcomes from this initiative is to strengthen customer preference for digital payments by converting 50 percent of retail payments into digital form.

It also aims to expand the financially included to 70% of Filipino adults.

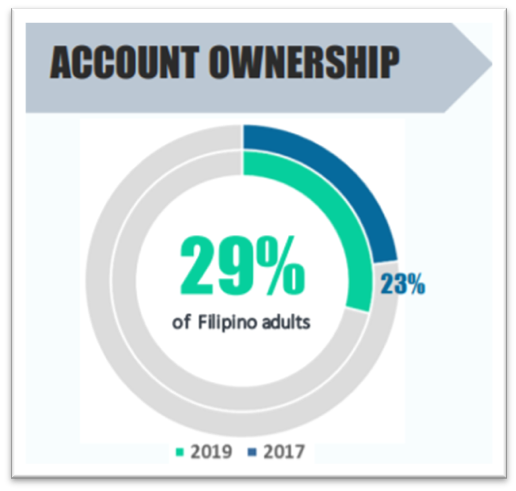

As of 2019, the number of Filipinos with accounts only stands at 29%. However, the BSP aims to improve financial inclusion among Filipinos by encouraging the adoption and usage of e-payments.

Account Ownership in the Philippines in 2017 and 2019, Source: 2020 Financial Inclusion Initiatives

As individuals and small businesses use digital payments, they can begin to build their transaction histories, and this can then be used to support access to other financial products.

Therefore, aside from achieving the vision of a digital-heavy and cash-light society, the financial inclusivity in the nation can also be improved by encouraging the use of digital payments.

Additionally, an increase in digital payment adoption can also encourage the emerging of new e-commerce businesses within the economy.

BSP has set forth three key pillars to achieve the strategic outcomes of the DPTR, and the first pillar is to develop the payment systems in the country.

The two payment schemes under BSP’s National Retail Payment Scheme (NRPS) are InstaPay and PESONet.

Recently, BSP has announced several upcoming initiatives in collaboration with the Philippines Payments Management Inc. (PPMI) to advance the digitalisation of payments in the country.

This includes the full launch of QR Ph for person-to-merchant (P2M) payments for a more efficient payment process and implementation of the PESONet Multiple Batch Settlement (MBS) to increase the frequency of PESONet settlements in a day.

The second pillar is to establish a digital infrastructure to facilitate the interoperability of payment services and the third pillar involves the implementation of a digital governance standard to build trust among the public in digital payment systems.

Additionally, another key theme of the DPTR is also a commitment to innovation and support for open finance to empower customers to use their personal data and support the development of products that can meet their needs and preferences.

The Digital Payments Transformation Roadmap 2020 to 2023, Source: 2020 Financial Inclusion Initiatives

Digital Banking Licenses

The digital finance ecosystem in the Philippines will also be enhanced by the presence of digital banks in the country.

In December 2020, the BSP released a regulatory framework on digital banks to foster a regulatory environment that promotes responsible innovation, cyber resilience, and expand the digitalisation of the financial sector.

Since then, six digital banking licenses have been awarded to OFBank, Tonik Bank, UNO Bank, UnionBank, GoTyme and Maya Bank.

These digital banks, which offer financial services and products through a digital platform or electronic channels, can further support the vision of transforming the nation into a digital-heavy and cash-light society, in addition to improving financial inclusivity in the country.

However, it is also vital for these new entrants to understand the local financial landscape and subsequently formulate ways to build trust with Filipinos to ensure their success.

The Digital Literacy Programme

However, the responsibility to build trust among Filipinos is not a responsibility for the new entrants alone.

Instead, it should be a collaborative effort with the government to ensure success.

Understanding this, the BSP has developed a Digital Literacy Programme to increase the trust and confidence of Filipinos in the digital finance ecosystem and promote the use of digital financial services.

Two key highlights of this programme are the #SafeAtHome with E-Payments Campaign to promote the adoption of e-payment solutions such as PESONet and InstaPay, and the Cybersecurity Awareness Campaign to educate consumers on ways to safeguard their accounts and online transactions that they perform.

A Society Free of Poverty

However, ultimately, World Bank Economist Kevin Chua believes that increasing the digital adoption rate in the Philippines can help the country achieve its vision of becoming a society free of poverty by 2040.

Through a society-wide digital transformation, the government can work towards speeding up e-governance projects, foster policies to narrow the digital divide gap, and create a more conducive environment for the digital economy to flourish.

Given that it is estimated that the poverty incidence rate in the Philippines has increased during the pandemic, it appears that realising the vision of a digital-heavy and cash-light society is more necessary than ever if the country wants to eliminate poverty by 2040.

Featured image credit: edited from Pixabay and https://www.pexels.com/photo/cheerful-young-woman-using-smartphone-in-studio-5700606/