CIMB Philippines Offers Easy Credit Through BNPL Offering for Lalamove Drivers

by Fintech News Philippines October 28, 2021CIMB Bank Philippines and Lalamove partnered up to provide easy credit access to hundreds of thousands of partner drivers through the bank’s new Buy Now, Pay Later (BNPL) offering, REVI Credit.

This collaboration will enable Lalamove partner drivers to get easy access to credit for their day-to-day needs and emergencies with a revolving credit line of up to PHP 250,000.

Through REVI Credit, qualified Lalamove partner drivers are given more flexibility over how to access, as well as use, the credit given to them.

They can easily pay for bills and, soon, online goods upfront on credit and pay over a period of time.

REVI also lets them withdraw cash from their credit line to their CIMB Bank‘s savings account.

In addition, they can convert up to 70% of their credit limit into a term loan, which they can pay at flexible terms and low interest rates.

The application process itself is also fully digital, with the entire application process is said to take about five minutes.

As an added benefit, the partnership also entails CIMB Bank Philippines providing a personal accident insurance of up to PHP 50,000 for free to qualified Lalamove partner drivers.

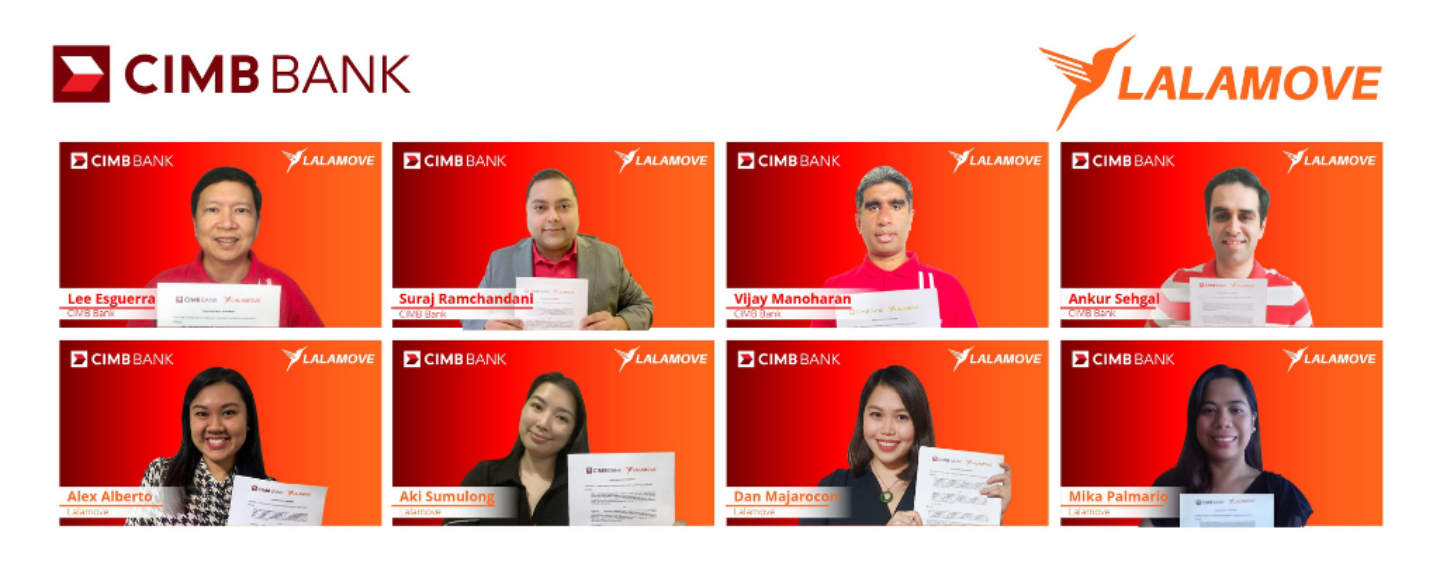

Vijay Manoharan

“We are all about consistently innovating to provide meaningful digital financial solutions that address a real need and solve pain points for Filipinos, especially those who are in the informal economy, where access to credit is just so difficult. Partnering with Lalamove is a step towards this direction.

We want to help hardworking Filipinos, like Lalamove’s partner drivers, have easier access to credit to be able to better fulfill their needs, get ahead, and earn more for themselves and their families. We are able to do so through an innovative solution in the form of REVI Credit – which is also CIMB’s Buy Now Pay Later Product.”

shared Vijay Manoharan, Chief Executive Officer of CIMB.

Dannah Majarocon

“A lot of our partner drivers often need emergency cash, usually for unforeseen health, accident, and personal emergencies.

With them having access to REVI Credit, and of course, the insurance, our partner drivers can breathe easier. They will always have something to tap in cases of unanticipated needs.”

says Dannah Majarocon, Lalamove’s Managing Director.