The widespread shift to online channels during COVID-19 has seen scams and fraudulent activities surge. A new study by Onfido, a provider of identity verification solutions, highlights an increase of 44% in identity fraud since 2019 as a result of the global pandemic, a trend which the firm predicts will continue this year onward.

The Identity Fraud Report 2022, which shares insights gained from an analysis of Onfido customers’ data collected from October 1, 2020 to October 1, 2021, shows that during this period, the average identity fraud rate stood at 5.9%, compared to an average rate of 4.1% in 2019.

This figure shows that despite governments and businesses lifting some physical restrictions, fraud still hasn’t dropped back to pre-COVID-19 levels. Onfido projects that the jump in fraudulent activities will likely pursue as consumers become more comfortable transacting online and fraudsters stay online with them.

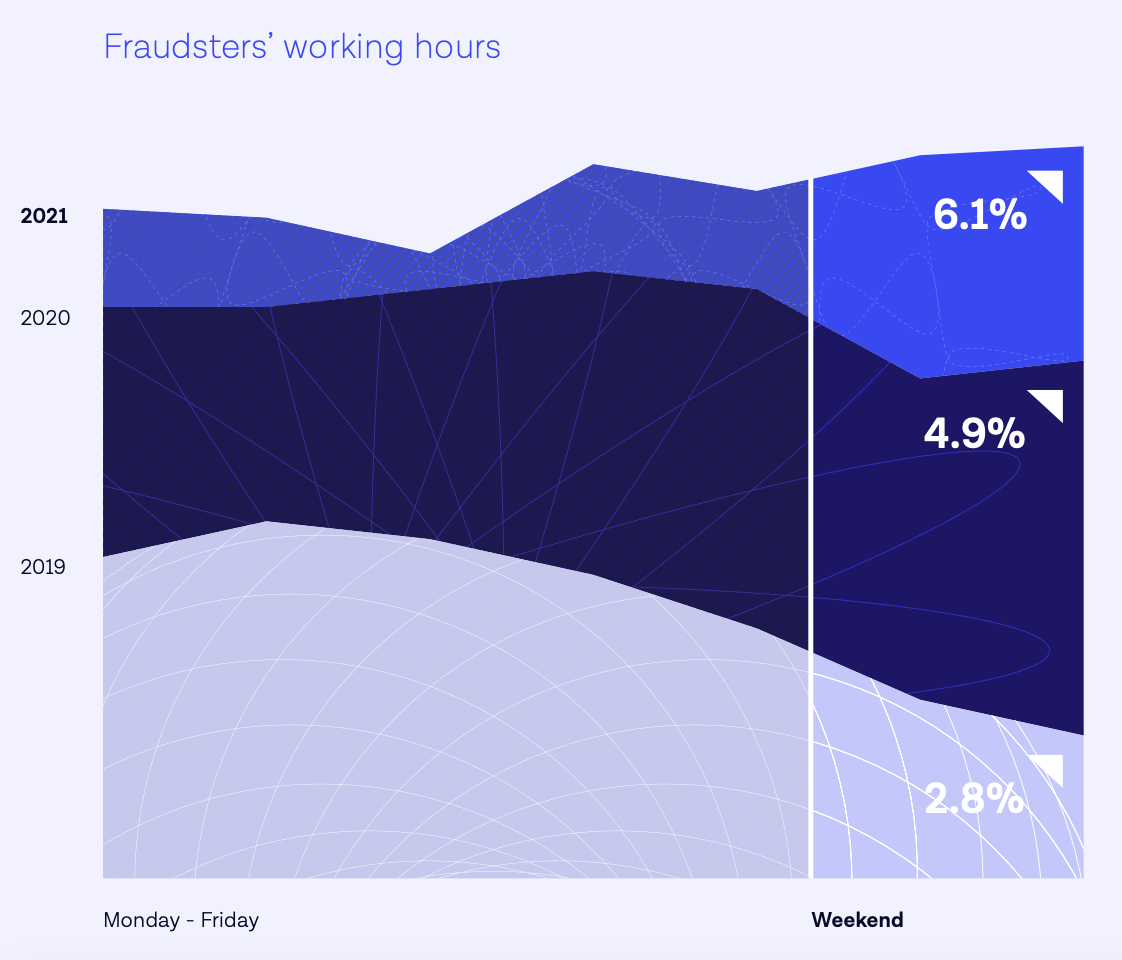

Furthermore, the report notes that the long-term impact of COVID-19 on fraudsters’ behavior is also evidenced by the frequency of fraudulent activities. While pre-COVID-19, fraud attempts followed the general working week, now, they are up every day of the week and peaks on weekends.

This could mean that more amateurs have moved into the space as part-time fraudsters, but also that fraudsters are trying to take advantage of businesses’ downtime, the report says.

Fraudsters’ working hours, Source: Identity Fraud Report 2022, Onfido

Passports become most frequently attacked identification document

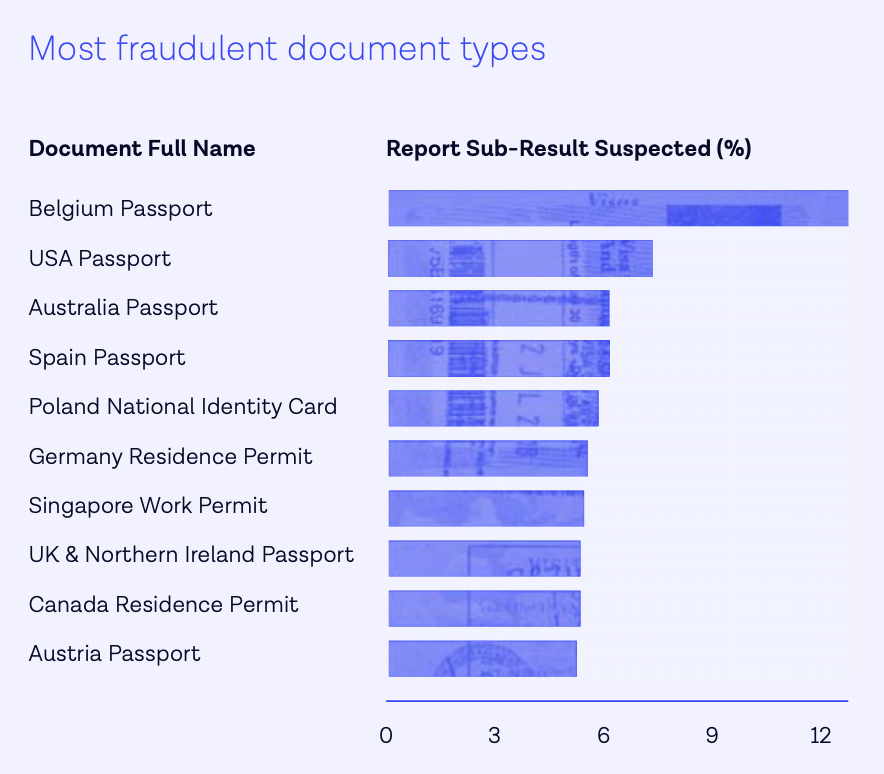

Looking at data collected from its customers, Onfido was able to draw key insights into fraudulent trends and techniques that have emerged over the past few years.

In particular, the firm notes that while in 2020, national identity cards were the most frequently attacked document type, in 2021, passports dominated the list. This might be because a document verification check involving a passport only requires one photo since it is a one-sided document, unlike a national identity card, implying that making a fake passport requires less effort for a fraudster since they only have to edit or recreate one part of a document.

Most fraudulent document types, Source: Identity Fraud Report 2022, Onfido

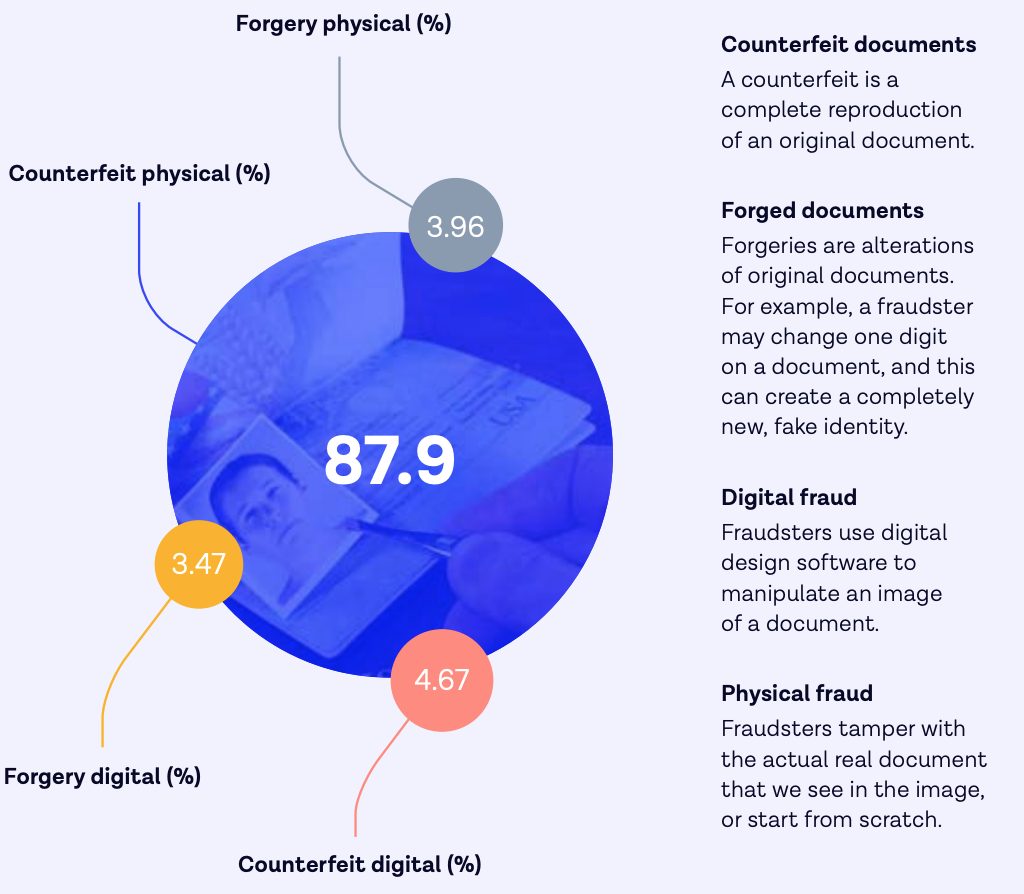

Rise of counterfeit documents

Another noteworthy trend observed by Onfido is the rise in usage of counterfeit documents where fraudsters are choosing to create their own reproductions from scratch.

The high number of counterfeits could be driven by the vast number of template files available online that fraudsters can easily edit, the report says.

Plus, many of the modern identification documents contain a lot of integrated security features, making any modifications, like what we would see on a forgery, easily detectable even to the untrained eye.

The report also notes that most of these counterfeit documents are physical reproductions and rarely digital fraud. This might be because Onfido’s products are designed to prevent them, by, for instance, requiring end-users to capture a photo of their document live, preventing fraudsters from creating or altering images of documents in advance and then uploading them.

Identity fraud types, Source: Identity Fraud Report 2022, Onfido

Rise in organized fraudulent activity

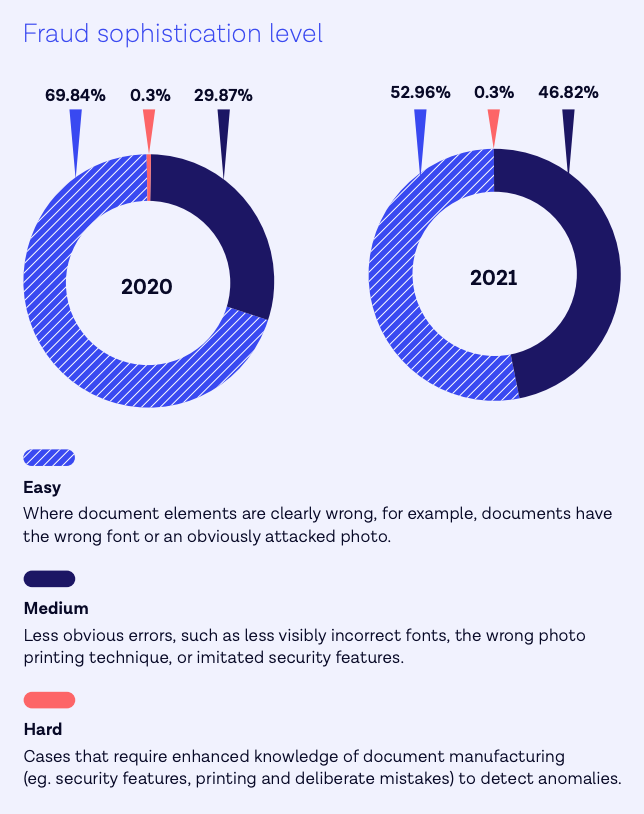

Compared to 2020, Onfido said that, in 2021, it noticed an increase in so-called “medium” fraud where errors were a bit harder to spot. Last year, 46.82% of all document fraud the firm recorded was classed as “medium”, representing a 57% from 2020’s figure.

One reason for this, Onfido said, is that in 2021, the firm saw an increase in organized fraudulent activity where groups of criminal attempted to create “verified” accounts with fake documents, before using them in other fraud attacks.

Fraud sophistication level, Source: Identity Fraud Report 2022, Onfido

Biometrics emerge as critical fraud deterrent

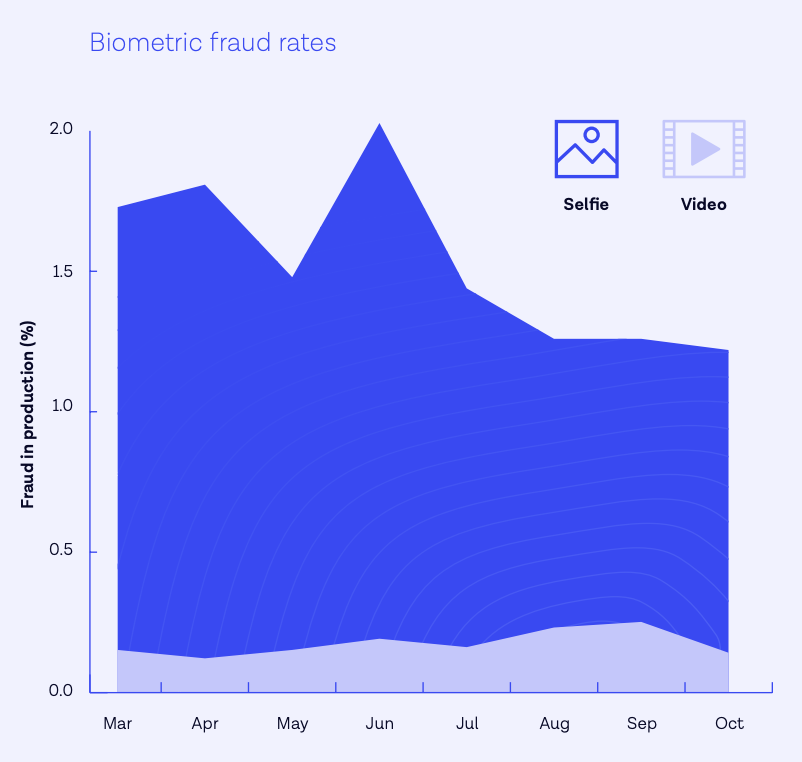

Onfido also noticed that in 2021, far fewer fraudsters tried to attack a biometric check (both selfie and video) compared to a document check. In 2021, the average document fraud rate was 5.9%, compared to 1.53% for selfies and 0.17% for videos.

This is because biometric verification such as a video check provides more protection against fraud than document verification or a selfie check alone.

The video user experience in itself acts as a natural deterrent against fraud, because it’s a highly randomized active experience and because it’s nearly impossible to defraud the system.

Further evidenced of this is the low proportion of video spoofs observed by Onfido. In H2 2021, video spoofs accounted for a mere 0.17% of all our video checks, attesting that it is a highly effective security measure.

Biometric fraud rates, Source: Identity Fraud Report 2022, Onfido

Financial services and professional services remain two of the highest hit sectors

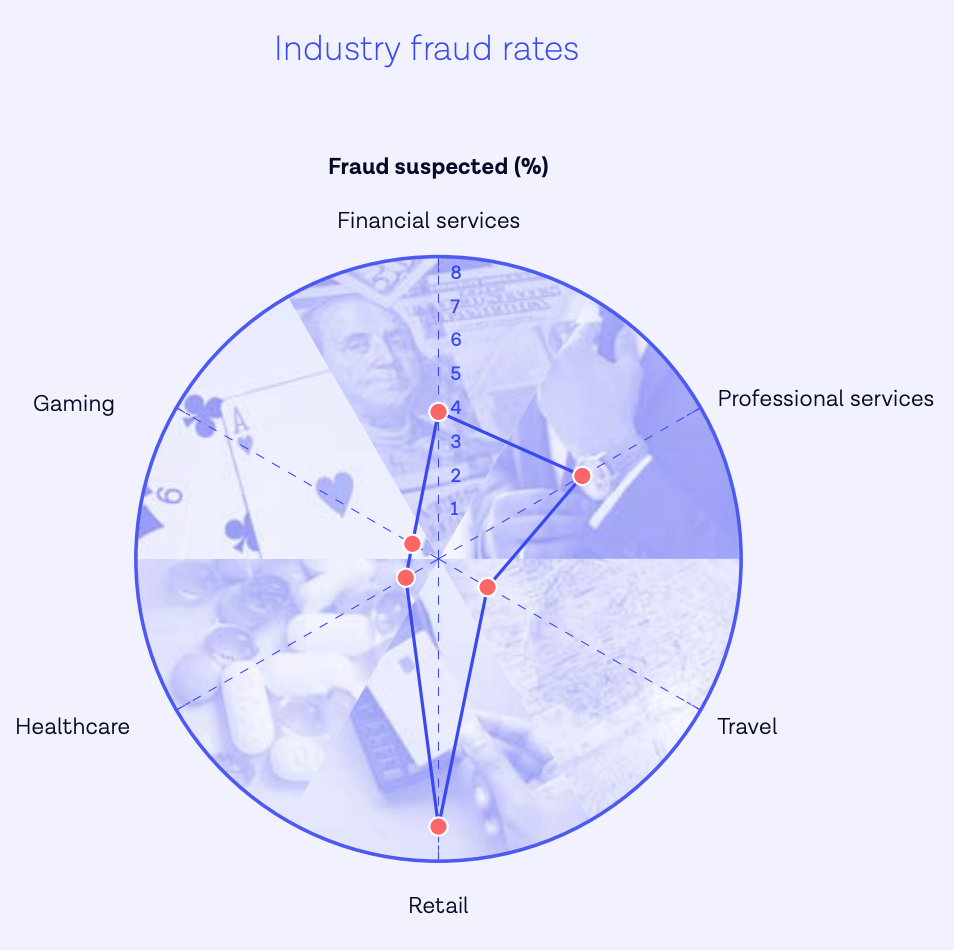

In 2021, financial services and professional services remained amongst the highest hit sectors by identity fraud. However, the year also saw a big spike in retail fraud, suggesting that fraudsters have turned their attention to opportunities in other industries.

Compared to financial services and professional services, retail services have a relatively lower exposure to online fraud attacks. As a result, they might have struggled to adjust their processes, thus creating weaknesses for fraudsters to exploit, the report says.

Industry fraud rates, Source: Identity Fraud Report 2022, Onfido

Crypto-related scams and fraud

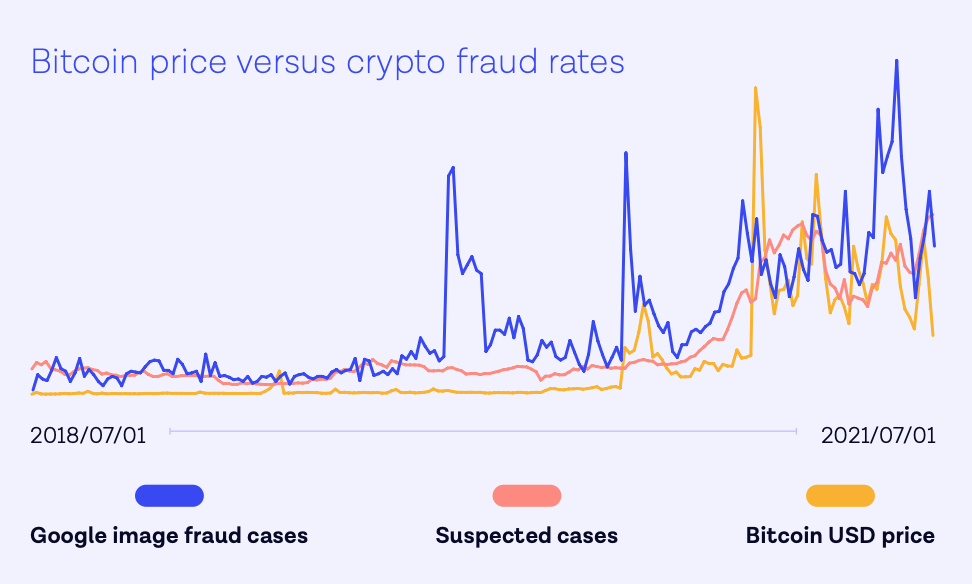

Another key trend observed in 2021 was the surge in crypto-related fraud, a trend that often correlates with the price of cryptocurrencies and rising public interest.

At Onfido, the company said it saw that as the price of cryptocurrencies goes up, so does the number of suspected fraudulent cases across its crypto customers. Additional spikes in fraud might also be related to its clients’ specific activities, for example, if they’re running campaigns offering some sort of bonus.

Bitcoin price versus crypto fraud rates, Source: Identity Fraud Report 2022, Onfido

In 2022 onward, Onfido predicts that the cryptocurrency industry will remain an attractive area for criminals, calling businesses to be vigilant of cryptojacking, an attack method where fraudsters use someone else’s computer to mine cryptocurrency by getting victims to click on a malicious link, as well as crypto investment scams.

Data breaches running rampant

2021 was a record-breaking year for data breaches during which the total number of incidents increased by a staggering 68% from 2020’s figure, an Identity Theft Resource Center (ITRC) research shows.

For Onfido, this trend is unlikely to change and will fuel a surge in social engineering attacks and coercion scams where fraudsters will use information gathered via data breaches or other methods to deceit and lure victims into taking actions that can result in financial loss or information theft.

Click here to access Onfido’s Identity Fraud Report 2022 for more details. You can also reach out to the Onfido team to find out how identity verification can help your business.

Featured image credit: Edited from Freepik