Financial Services Revolution: Salmon’s Drive to Promote Inclusion

by Fintech News Philippines May 17, 2023The economy in the Philippines is expanding at record speed, and its dynamic population – young, growing, and savvy at using mobile technologies – is set to become the key benefactor of the economic opportunities it creates, with a little help from financial institutions.

Yet recent data from the Bangko Sentral ng Pilipinas (BSP) reveals that only 56 percent of adults in the Philippines have bank accounts. This means that more than 30 million Filipinos cannot access essential financial products, such as loans, savings accounts, and insurance. However, modern fintechs like Salmon are beginning to change this.

There are many factors that contribute to low levels of financial inclusion in the Philippines, including the high cost of financial services, limited awareness and education about financial products, as well as inadequate infrastructure in some parts of the country.

At the same time, GDP growth is forecast to average 6-7 percent per year over the medium term with per capita GDP growing about 55 percent within the next eight years. And the population is set to spike by 30 percent to 85 million by 2030 from 65 million in 2022, according to a research report by McKinsey & Company.

This combination of structural and historic challenges on the supply side and the growing need for financial products on the demand side have created a perfect storm, resulting in many Filipinos being unable to access critical financial services that could have the power to greatly enhance their economic well-being.

Removing Barriers to Financial Inclusion

The good news is that in recent years, fintech has emerged as a disruptive force in the financial services industry, leveraging technology and financial know-how to deliver user-friendly solutions to customers around the globe. Fintech also has the potential to make financial services more accessible in the Philippines, reaching the part of the population that traditional banking has so far struggled to reach.

Salmon is a newly established fintech, which is on a mission to make financial products and services simple, intuitive, and available to more Filipinos. It is led by an experienced international team, with a proven track record of working for highly regulated global financial institutions as well as building successful fintech startups in other emerging markets to expand financial services.

The Philippines has an estimated 15 million informal entrepreneurs and self-employed workers—a massive pool of would-be borrowers with little access to traditional finance. Meanwhile, retail lending is heavily concentrated in a narrow band of wealthy households, according to McKinsey.

“This unbalanced distribution of existing loans—combined with a rapidly growing adult population, continuous broad-based gains in household income, ongoing regulatory efforts to promote financial inclusion, and the introduction of new digital technologies—makes retail lending especially prone to disruption and accelerated growth,’’

McKinsey said in the report dated 3rd May.

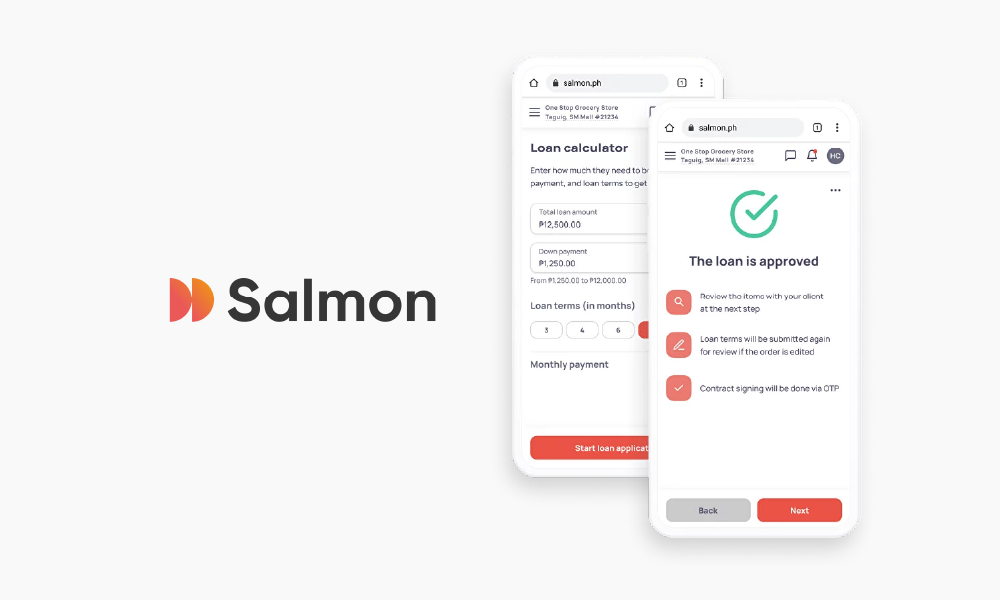

Retail lending, or more precisely point-of-sale (POS) loans are exactly the products, which Salmon began offering in the Philippines last year. Borrowers get access to funds based on their purchase value and don’t have to present a traditional credit history to be approved for a loan. However, these loans, offered through a network of partner merchants, are just the first step in Salmon’s strategy to make financial tools available to a greater number of people.

Raffy Montemayor

“We plan to expand our offering in the future, bringing additional financial services to more Filipinos.

We are like salmon that perseveres in a journey upstream, which is filled with obstacles – we work hard, understand the landscape, and push on as we continue building what we hope will become a top credit-led neo bank in the region.’’

Salmon’s Co-founder and Philippines Business Head, Raffy Montemayor said in an interview.

By utilising an offline channel through community partners, Salmon brings its services directly to the people, including those without uninterrupted access to the internet. Salmon is also taking advantage of the latest technological advancements by using facial recognition to strengthen fraud prevention and employing a modern tech stack and advanced analytics for credit scoring. Recently, Salmon has also launched its mobile app to enable customers with mobile phones to have a seamless digital experience for managing their finances including loan repayment.

“Making financial tools easy-to-use and available to more people who really need them to thrive is at the heart of what we do,’’ Montemayor said of Salmon, whose tech know-how, coupled with a highly experienced team sets this fintech apart from competitors.

Supporting Financial Literacy and Local Talent

While Salmon is on a mission to revolutionise financial services in the Philippines, it is clear that change of that scale does not happen in isolation. Industry regulators and government bodies are key to fostering a supportive policy environment for fintech innovation, including simplified KYC processes. Furthermore, government efforts are important for identifying the gaps in financial literacy and promoting educational programmes in this space.

BSP’s Financial Inclusion Survey 2021 highlighted that only two percent of polled Filipinos could answer all six basic financial literacy questions correctly. This finding underscores the importance of promoting financial literacy in the Philippines, as a way towards enhancing financial inclusion. After all, without a basic understanding of financial tools and how they can be used to achieve and grow one’s financial well-being, financial inclusion cannot become truly universal.

Several years ago, the Financial Inclusion Steering Committee (FISC) was established, and it created a new National Strategy for Financial Inclusion (NSFI) to act as a road map for achieving the goal of advancing financial inclusion to fuel widespread economic growth and financial resilience.

“Being financially included means having access to a wide range of fit-for-purpose financial services in line with one’s capabilities and needs,’’ the NSFI said. “With appropriate use of these tools bolstered by financial literacy, consumers and businesses can become more financially resilient.’’

Financial literacy helps consumers make informed choices, thus contributing to the disruption of the poverty cycle. By learning to budget, save, and invest and having access to the right tools to do so, people can create a more secure financial future for themselves and their families. As such, financial literacy is a significant contributor to promoting financial inclusion.

Salmon is dedicated to eliminating barriers restricting the proliferation of financial services, even as it acknowledges that some of the issues are structural. Much of the fintech’s work is focused on providing user-friendly service and helping customers overcome misconceptions about financial tools.

At the same time, Salmon is also investing in the local population in other ways.

“We have a particular focus on developing local Filipino tech talent. As a sign of our commitment to developing the local tech ecosystem, we plan to invest PHP 10 million towards developing, onboarding, and nurturing Filipino tech talent in partnership with our leading universities,”

Montemayor said.

Salmon’s Future Plans

Individuals using Salmon’s services today are enhancing their future financial options. By building their credit histories with the company, Salmon’s customers can improve their prospects for accessing a more extensive range of financial products in the future.

“With less than 10 percent of retail stores offering in-store financing options and only 5 percent of the Philippine population owning a credit card, expanding Salmon’s footprint will help us reach more of the underbanked Filipinos who need financial services,”

Montemayor added.

Salmon is also engaging with regulators as it hopes to add more financial services to its offering in the future, as the fintech continues to grow.

“We have big plans to help more Filipinos gain access to quality financial services,’’ Montemayor said. “It is a really exciting time in the Philippines, and we are moving quickly.’’