RCBC Expands Its Payout Network to Include Those Without Mobile Phones in Rural Areas

by Fintech News Philippines May 25, 2020Rizal Commercial Banking Corporation (RCBC) said that it is closer to its target of covering all provinces of the country with handheld automated teller machines (ATM) as the bank beefs up the payout partner network through its ATM Go service.

The continuous expansion comes at the heels of an endorsement from the Department of Social Welfare and Development (DSWD) for the use of this digital facility as a payout channel for the national government’s social amelioration programs.

This includes another disbursement platform called DiskarTech Lite which has been approved by the BSP to help DSWD in quickly disbursing the government emergency fund.

Lito Villanueva

“This is the only inclusive and comprehensive disbursement platform in the country today allowing beneficiaries with or without smartphone or feature phones to receive their social grant,”

Villanueva emphasized.

This version will be limited to receiving and withdrawing funds from a user’s account. This would enable the covered beneficiary to have digital transactional accounts once they upgrade it by download the mobile app.

Almost 60 additional ATM Go terminals were deployed in April and May to new and existing payout partners. These include the New Rural Bank of San Leonardo, Cantilan Bank, Baug CARP Beneficiaries Multi-Purpose Cooperative, Kooperatiba ng Sampaloc, Bayad Center branches, and other small, and medium enterprises (SMEs).

Meanwhile, up to 90 more ATM Go terminals will be infused into the network after the onboarding of new payout partners by June. These include microfinance nonprofit organization like Kabalikat para sa Maunlad na Buhay, Inc., Mount Carmel Rural Bank, Oro Integrated Cooperative, Perpetual Help Cooperative, Cooperative Bank of Nueva Vizcaya, Ekolife OFW Marketing Cooperative, Paglaum Multi-Purpose Cooperative, CARD Bank, CARD SME Bank, and CARD MRI Rizal Bank.

“With RCBC’s extensive and massive payout partner network equipped with robust and proven disbursements platforms, the strong and growing collaboration among these partners present in 72 out of 81 provinces is a testament of our commitment in helping the government,”

said Lito Villanueva, executive vice president and chief innovation and inclusion officer of RCBC.

“This collaboration between our bank and DSWD is mutually invested towards serving the underserved and most vulnerable sectors of our society,”

Villanueva added.

RCBC has offered for free to the national government the use of its DiskarTech Lite facility as a disbursement platform. It will soon be available in DSWD’s ReliefAgad App as one of the choices for receiving emergency aid.

ATM Go’s massive payout partner network, with presence in 89 percent of provinces in the Philippines, shall also be the backbone of the Diskartech Lite disbursement platform to ensure the widest coverage of payout.

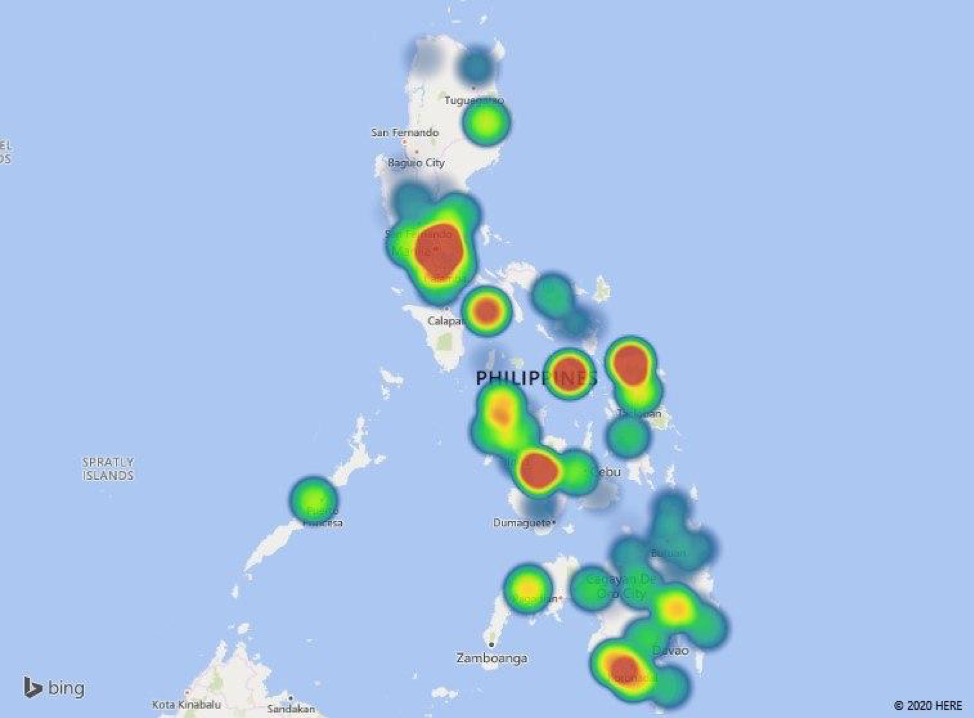

The heat map below shows localities with the highest recorded transaction amount coursed through the ATM Go service. The top five, shown with the darkest red colors, are Metro Manila, Northern Samar, Negros Occidental, Masbate, and Marinduque.

Mindanao provinces South Cotabato, Sultan Kudarat, and Davao del Norte complete the top ten, along with Aklan and Cavite.

With the go-ahead from DSWD, local government units that have received National Government funds to implement the Social Amelioration Program and the Social Pension for Indigent Senior Citizen (SocPen) Programs can now tap RCBC and its DiskarTech Lite platform to expedite payouts.

“This development which leverages digital technology is a welcome effort in the continuing efforts of both the public and the private sectors in servicing the needs of the most vulnerable sectors of society during this pandemic,”

said Villanueva.

The SocPen program seeks to support senior citizens in need during the enhanced community quarantine. The cash aid amounts to 3,000 pesos each semester per beneficiary or P500 per month.

The elderly who are qualified for the program are seniors who are frail, sickly or with disability; without any pension from other government agencies; and without a permanent source of income or source of financial assistance or compensation to support their basic needs.

As early as last month, the BSP Monetary Board, authorized RCBC to accept and disburse government funds to assist the social amelioration programs under the Bayanihan to Heal as One Act.

It is the first private universal bank permitted to aid in the efforts of DSWD.

Payout partners of RCBC’s handheld automated teller machine service, ATM Go, have also been endorsed by DSWD as off-site payment channels of its conditional cash transfer program during the enhanced community quarantine to its regional offices.

This article first appeared on fintechnews.sg