70% of Filipino Banks Find it Difficult to Keep up With Customer Expectations

by Fintech News Philippines October 4, 2021Changing consumer expectations and a fast-evolving banking landscape are posing challenges for incumbents to keep up.

Despite the realization that digital banking is the way forward, many Filipino banks are struggling to develop and implement innovative solutions, citing outdated legacy systems and uncertainty on how to partner with fintech companies as key challenges, a new research conducted by Forrester Consulting for Backbase found.

Out of 450 top financial services executives in Asia-Pacific (APAC) surveyed in February/March 2021, 70% of Filipino respondents said keeping pace with customer expectations and remaining both profitable and relevant were critical challenges, a figure that’s above the APAC average of 63%.

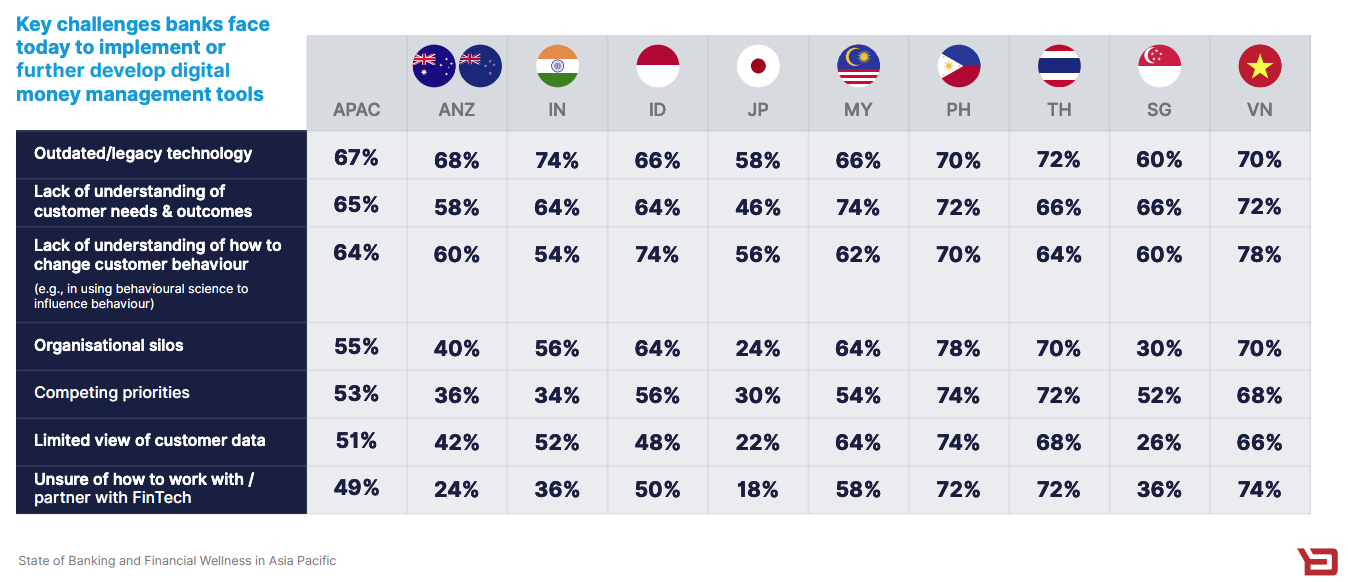

Findings from the study found that technological challenges and legacy systems are holding back a vast majority of these financial institutions in their digital banking efforts. In the Philippines, respondents cited organizational siloes (78%), competing priorities (74%) and limited customers data (74%) as the key hurdles they face when developing or implementing digital money management tools. Furthermore, 72% of decision-makers said they are unsure how to partner with fintech companies, behind only Vietnam at 74%.

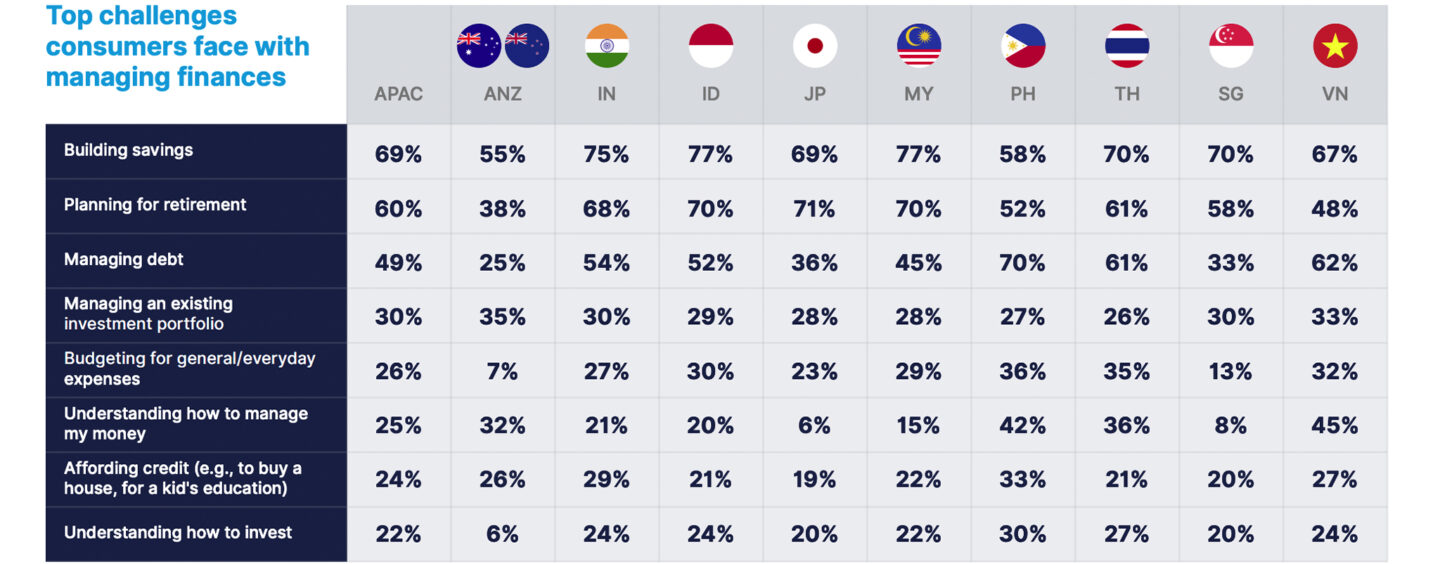

Key challenges banks face today to implement or further develop digital money management tools, Source: State of Banking and Financial Wellness, Forrester Consulting for Backbase, 2021

These findings come at a time when new regulation is being introduced in the Philippines to boost financial inclusion. So far, six entities have been granted digital banking licenses with hopes that these new entrants will be able to serve the country’s large population of unbanked with affordable financial services, and that increased competition in the banking sector will spur a wave of innovation.

Disparate digital banking adoption and readiness across APAC

Findings from the Backbase research vary from one country to another, showcasing how disparate APAC countries are.

Across the region, Singaporeans were found to be the most digitally serviced when it comes to banking, indicating that customer demand has been so far driving the changes in the sector. Of the 900 APAC retail-banking consumers who took part in the study, 74% of Singaporean respondents said they have used their institution’s existing mobile app, compared to a regional APAC average of just 50%, and a massive 88% said they value excellent mobile app experience from their financial service providers.

Mobile banking adoption is also high, with 86% of retail banking customers indicating using their smartphone to conduct their day-to-day banking, higher than the regional average, as well as other developed markets including Japan or Australia, the research found.

In Malaysia, similarly to the Philippines, banks are struggling to keep up with evolving customer expectations with 72% citing keeping pace with changing customer demand and remaining both profitable and relevant, as critical challenges.

Furthermore, 62% indicated organizational silos as a key challenge in implementing or developing digital money management tools to improve customers’ financial wellness.

In Indonesia, banks are showing commitment in improving financial literacy with 80% of banking executives indicating plans to implement relevant tools or expanding/upgrading their current implementing in the next 12 months.

These efforts are paying off with 58% of consumers feeling “informed” about their current financial situation.

At the end of the spectrum, Vietnamese consumers were found to be the least “informed,” with 51% sharing interest in their main bank providing them with financial literacy tools.

Despite their customers’ struggles, Vietnamese banks are showing the least willingness in improving their customers’ financial wellness, with just 42% of banking executives indicating plans to increase spending on financial wellness initiatives, and only 20% planning to invest more on digital personal financial management tools over the next 12 months.

Across Southeast Asia, regulators are introducing new rules to enable and facilitate the entrance of innovating challenger banks in a bid to improve financial inclusion. Singapore awarded four digital banking licenses in December 2020. Malaysia plans to hand out digital banking licenses next year. And Indonesia introduced new regulations in August to facilitate the establishment of digital banks, allowing near-full foreign ownership of local lenders and reducing red tape for new services.

According to a 2020 Fitch Ratings report, about half of the region’s population is unbanked with no access to financial products, and a further 18% are underbanked, meaning that they lack access to anything other than a bank account.

Vietnam, the Philippines and Indonesia currently stand in the top ten most unbanked countries in the world with 69%, 66% and 51% of their respective populations having no access to traditional banking services or similar financial organization, according to data provided by British research platform Merchant Machine.