Is Philippines Falling Short of Its PhilSys Digital Identity Ambitions?

by Johanan Devanesan April 12, 2023This month, the Bangko Sentral ng Pilipinas (BSP) issued the latest rules outlining the minimum digital identification and verification requirements for financial institutions, otherwise known as electronic ‘know-your-customer’ procedures, or e-KYC. Seeking to promote seamless identity verification and customer due diligence, the central bank designated the national Philippine Identification System (PhilSys) as an acceptable e-KYC system, meeting all of its regulatory requirements.

The Philippines and its progressive central bank are making great strides to prepare the country’s digital future, particularly in terms of efficient digitised services at both governmental and private sectors — along with promoting financial inclusivity for all adult Filipinos. In 2019, only 29% of the population had access to a financial account, according to the BSP’s 2021 Financial Inclusion Survey report.

The PhilSys programme was launched in 2018, and the first public registration began in April 2019 – fast tracked by the COVID-19 pandemic to encourage more secure, cashless transactions and to inculcate financial education and inclusion amongst the mostly unbanked population. Another aim to address longstanding issues of identity theft and fraud in the country, which has been a significant obstacle in the delivery of services to the public.

How did the national digital ID come about?

The Philippines is an archipelago with over 7,600 islands and a population of around 113 million people. The lack of a unified identification system has made it difficult for the government to provide efficient financial services and public programmes.

In the absence of a national ID, citizens are required to present multiple documents to access government services like healthcare, education, and social security benefits.

The implementation of PhilSys aims to address these challenges and improve access to services for all Filipinos, designed to be a one-stop-shop digital ID system that will reduce bureaucratic red tape while cutting off rampant fraud and corruption in the archipelago.

PhilSys implementation progress

Despite the top-level support from the government and the BSP, the implementation of PhilSys is a massive undertaking that requires significant investment in resources and infrastructure. The government was fortunately able to leverage the existing infrastructure of other agencies like the Philippine Statistics Authority (PSA) to expedite the registration process.

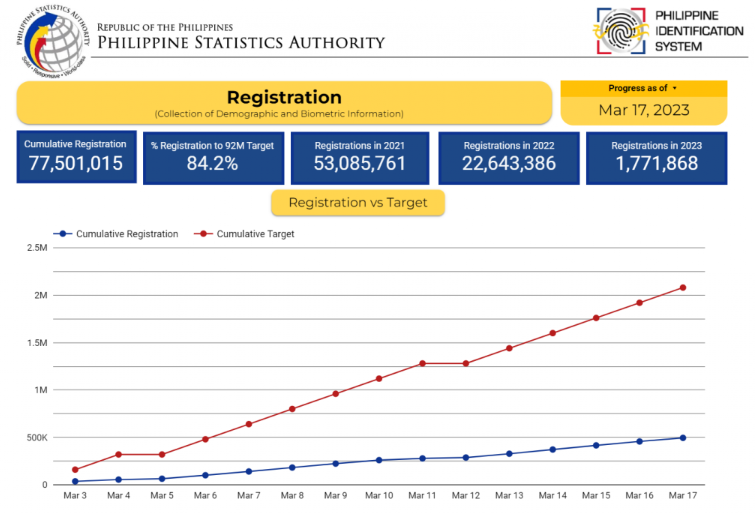

Source: Philippine Statistics Authority

The initial target was to register around 6 million Filipinos in 2019, but the programme exceeded expectations and registered over 7.5 million individuals by the end of that year. The government then established over 1,000 registration centres across the country to make the registration process even more accessible to Filipinos.

The programme has since reached significant milestones, with over 77 million individuals registered as of March 2023. This represents more than half of the target population which is in excess of 113 million people.

PhilSys key abilities and achievements

One of the most significant milestones achieved by PhilSys is the introduction of the PhilSys Number (PSN), a unique identification number assigned to every Filipino registered in the system. The PSN is intended to become the primary means of identification for all government and financial transactions, including the opening of banking accounts, availing of social welfare benefits, applying for passports, and even registering for voting.

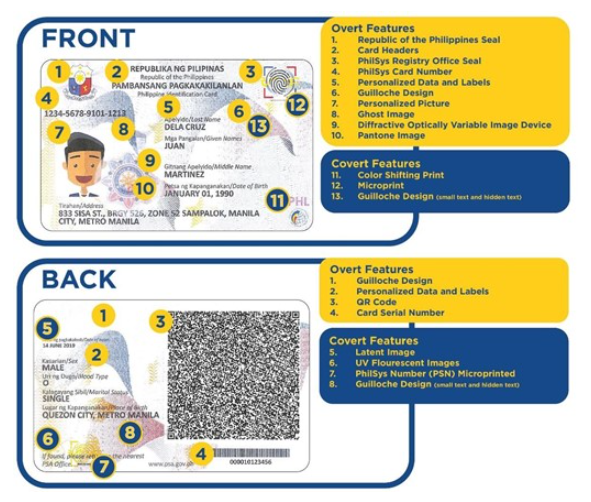

Another significant milestone achieved by PhilSys is the launch of the Philippine Identification Card, available to registered users as the physical PhilID card or as the ePhilID electronic identification, with both having the same validity and functionality as proof of identity, supporting financial services and social protection initiatives. The PhilID and ePhilID contains the individual’s name, photo, PSN, and other relevant information.

The PhilId card carries covert features that cannot be replicated to ensure the card’s security and authenticity. Source: Philippine Statistics Authority

The PhilID card is equipped with security features such as holograms and biometric data, making it difficult to duplicate or forge. The physical card is expected to make it easier for Filipinos to access government and financial services, especially in rural areas where internet connectivity is poor.

A key feature of PhilSys is the use of biometric data, including fingerprints, iris scans, and facial recognition. Biometric data provides a much more secure and tamper-proof identification system, reducing the risk of fraud and identity theft.

The use of biometrics has also enabled the government to provide secured, targeted financial assistance to vulnerable populations, such as low-income families and senior citizens, during times of crisis like the pandemic or natural disasters.

In addition to providing a secure identification system, PhilSys also aims to promote financial inclusion. The digital ID system is linked to a national financial inclusion strategy, which aims to provide access to financial services for all Filipinos.

The government has partnered with banks and financial institutions to enable the use of PhilSys for financial transactions, such as opening bank accounts, accessing loans, and making digital payments.

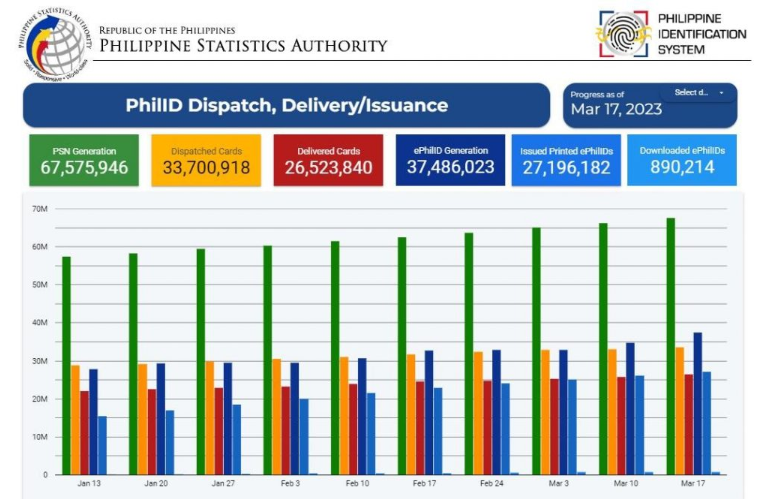

Source: Philippine Statistics Authority

As of 15 March 2023, over 60 million PhilIDs and ePhilIDs have been “successfully printed”, as per the PSA, with 33,550,575 of those being physical PhilIDs and 26,776,415 being ePhilIDs downloaded via mobile devices and printed at registration centres.

“Reaching 60 million national IDs printed brings us closer to fully realising the envisioned benefits of PhilSys of making more services accessible,” said PSA Undersecretary Dennis S. Mapa, who is also the National Statistician and Civil Registrar General.

“Verifying a registered person’s identity is as easy as scanning the QR code of the PhilID or ePhilID through our identity authentication tool, PhilSys Check,” the undersecretary added.

PhilSys impact on financial inclusion

The implementation of PhilSys is expected to have a significant impact on financial inclusion in the Philippines. According to a report by the World Bank, around 51 million Filipinos aged 15 and over do not have a bank account, with many citing the lack of identification documents as the primary reason for their exclusion from the financial system. With the introduction of PhilSys, the government aims to make it easier for Filipinos to access financial services, including opening bank accounts and availing of loans.

The PhilID card is expected to play a crucial role in promoting financial inclusion in the Philippines. The card can be used as a debit card and can be linked to a bank account, making it easier for Filipinos to transact with financial institutions.

The PhilID and ePhilID also contain information on the individual’s income and employment status, which can be used by banks to assess creditworthiness. With the introduction of the PhilSys ID system, the government hopes to make it easier for Filipinos to access credit and other financial services.

Source: Land Bank of Philippines Facebook

To achieve its targets of onboarding unbanked Filipinos, the PSA launched a co-location strategy with the Land Bank of the Philippines to open transactional accounts at PhilSys registration centres immediately upon completing their Step 2 registration.

PSA Undersecretary Dennis said that Land Bank had onboarded 8.4 million unbanked Filipinos in 2022, of whom 5.8 million were able to open transaction accounts. The BSP Financial Inclusion Survey released in August 2022 indicates that account ownership shot to 56 percent in 2021, up from 29 percent in 2019 – the biggest growth since the BSP began tracking account ownership in 2015.

Overall, the progress and milestones of PhilSys are a positive sign for the future of digital transformation in the Philippines. With its capabilities to improve access to services and promote financial inclusion, the programme has the potential to transform the lives of millions of Filipinos, and drive economic growth and development in the country.