Posts From Johanan Devanesan

Breaking Down Digital Banking Products in the Philippines

Digital banking has swiftly expanded across Asia, notably achieving reasonable success in nations such as South Korea, China, and Japan. Within Southeast Asia’s digital banking sector, the Philippines joined Singapore as early adopters of digital bank products and services amid

Read MoreList of Licensed Cryptocurrency Exchanges in the Philippines

In the Philippines, the fintech sector is developing at a rapid pace, fueled by booming digitalisation of the country’s payments, but also by the progressive stance towards cryptocurrency exchanges. As the global cryptocurrency markets have endured waves of positive and

Read MoreBSP Finalising Revised Framework for Money Service Businesses

The Bangko Sentral ng Pilipinas (BSP) is on the verge of finalising a comprehensive new framework to bolster the regulatory standards for Money Service Businesses (MSBs) within the Philippines. This initiative seeks to adapt and refine the regulatory environment, addressing

Read MoreBSP, PDIC Sign MOA to Streamline Cooperation and Supervision of Bank Deposits

The Bangko Sentral ng Pilipinas (BSP) and the Philippine Deposit Insurance Corporation (PDIC) have updated their cooperative framework through the signing of a Revised Memorandum of Agreement (MOA) on Information Exchange. The event took place at the BSP headquarters in

Read MoreBSP CBDC Project: Here’s All We Know About the Wholesale Digital Currency

In the rapidly evolving landscape of global finance, the fairly recent emergence of Central Bank Digital Currency (CBDC) represents a significant shift towards the digitalisation of national currencies. The Bangko Sentral ng Pilipinas (BSP), under the leadership of Governor Eli

Read MoreGoTyme Bank and Its Remarkable Journey Towards Profitability

GoTyme Bank stands out as a beacon of digital banking promise in the Philippines, less than two years after launch, in an era where fintech innovations are rapidly transforming the global banking landscape. The unique joint venture between Tyme Group,

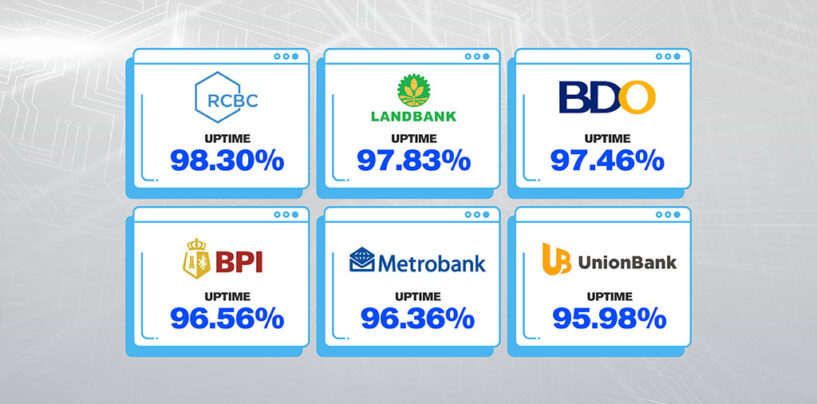

Read MoreASEAN Bank Stability Report Reveals Most (and Least) Reliable Philippines Banks

In the contemporary era where the digital economy shapes the core of financial transactions, the reliance on banking services and stability has significantly escalated, including in the Philippines. This reliance is not merely a reflection of a preference for convenience,

Read More5 Ways Digital Finance in the Philippines is Flourishing Despite Hurdles

The digital finance landscape in the Philippines is undergoing a significant transformation, offering a plethora of opportunities for growth and innovation. The Bangko Sentral ng Pilipinas (BSP) is at the forefront of this change, embracing global central banking standards and

Read MoreTop 5 Fintech Trends in the Philippines That Will Shape the Space in 2024

The financial technology landscape in the Philippines has undergone transformative changes in 2024, driven by dynamic innovations and an increasingly digital-savvy population. Today we delve into five of the top fintech trends in the Philippines shaping the nation’s financial sector,

Read MoreFintech in the Philippines: 2023 in Review

The fintech space in the Philippines has been growing rapidly in 2023, with several developments that have shaped the industry and the country’s financial inclusion. The fintech sector in the Philippines witnessed significant growth in 2023 which reflects the country’s

Read More