Management consulting firm McKinsey & Co. has cautioned banks in the Philippines that they must adapt to the emerging and rapidly evolving landscape of digital finance or risk losing market share to emerging fintech providers.

In a study entitled On the Verge of a Digital Banking Revolution in the Philippines, McKinsey experts highlighted how traditional banks in the country have neglected a vast potential customer base by focusing predominantly on wholesale and corporate services.

The authors revealed that Philippine banks have significantly underinvested in digital offerings, allocating less than 10% of their revenues to information technology.

This figure falls short of the regional average of around 15% in the Asia Pacific region. Furthermore, the digital channels of Philippine banks contribute a mere five to 15% of their revenues, according to data from Finalta by McKinsey — well below the 25% average observed in other Asian emerging markets.

In the face of innovative competitors, incumbent banks must swiftly adapt or face permanent market share loss. The authors pointed out that the traditional banking sector has already shown vulnerability to digital innovation.

Fintechs, digital banks coming on strong

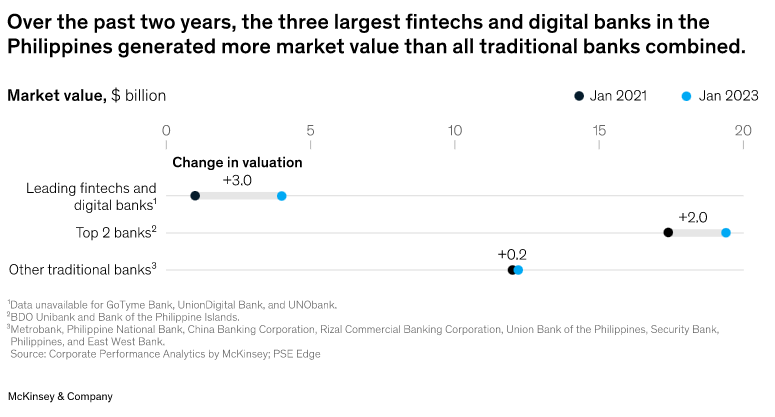

Despite their limited scope, digital finance service providers in the Philippines excelled during the COVID-19 pandemic, generating more market value than the entire banking sector.

Data revealed that the combined market value of the top three fintech firms in the country increased by US$3 billion between January 2021 and January 2023, surpassing the US$2.2 billion growth of traditional banks.

Source: On the Verge of a Digital Banking Revolution in the Philippines, McKinsey & Co.

“Over the past two years, the three largest fintechs and digital banks in the Philippines generated more market value than all traditional banks combined,” McKinsey Southeast Asia senior partner Guillaume de Gantès, associate partner Hernan Gerson, and partner Kristine Romano, the authors of the research, stated.

According to the article, established Philippine banks have been sluggish in embracing the transformative aspects of digital finance. McKinsey noted that Bank of the Philippine Islands (BPI), controlled by the country’s oldest conglomerate Ayala Corp., recently introduced the Vybe e-wallet on its mobile app, providing services similar to GCash and Maya.

Meanwhile, Union Bank of the Philippines, under the leadership of the Aboitiz Group, has begun offering fully digital financial services to underbanked consumers through its UnionDigital Bank offering, together with its equity partners Insular Life and Social Security System.

“While competition in digital financial services is clearly intensifying, dominant players have yet to emerge outside the mobile-payments subsector. Six digital banks have recently launched operations in the Philippines, but none are currently lending at scale,” the report stated.

McKinsey also highlighted that dynamic fintech firms such as GCash and Maya have expanded their services to encompass lending, investment, insurance, and marketplace platforms.

BSP plots inclusive digital finance course in the Philippines

“The Philippines presents highly attractive opportunities for expansion, but the entry strategies chosen by foreign firms and existing Filipino conglomerates will significantly impact their growth and competitiveness,” the authors advised.

McKinsey outlined in the wide-ranging research that fully foreign-owned banks meeting specific criteria — such as being established, reputable, financially sound, and willing to share banking technology — are eligible for universal banking licenses. Domestic and foreign banks now require the same minimum capital requirement of US$55 million to obtain this license, eliminating the need for separate licenses.

Source: On the Verge of a Digital Banking Revolution in the Philippines, McKinsey & Co.

In 2020, the Bangko Sentral ng Pilipinas (BSP) approved the creation of a digital banking license, allowing full foreign ownership with a reduced capital requirement of just US$19 million, provided the bank maintains a principal or headquarters in the Philippines.

“The opportunities presented by the vast greenfield market for digital finance in the Philippines far outweigh the risks, but a keen awareness of the challenges facing fintech service providers will offer a critical advantage,” the authors concluded.

Financial services demand outweighing banking penetration

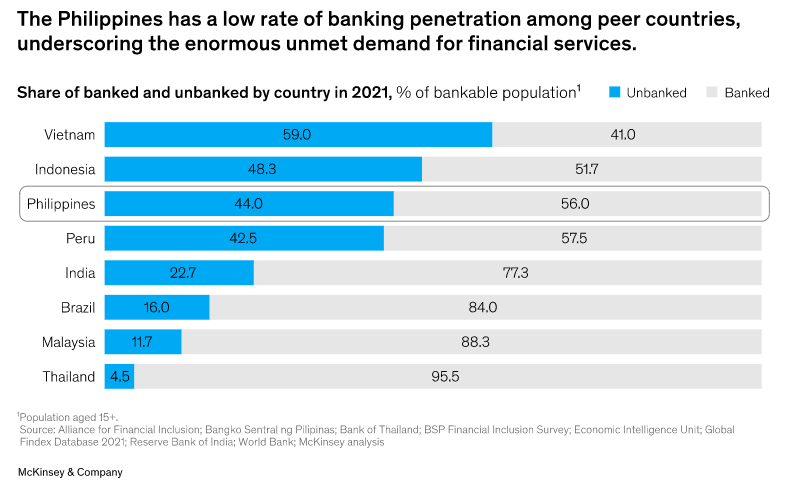

The Philippines has one of the swiftest population growth rates globally, and the bankable population is projected to escalate from 65 million in 2022 to 85 million by 2030 — a 30% surge according to the Philippines Economic Update December 2022 data from the World Bank.

As the demand for financial services grows, banking revenue in the country is expanding at an annual compound growth rate of nine to 10%, with banking revenue pools projected to triple by 2030.

Despite this, the Philippines’ banking penetration rate stands at a meager 56%, significantly lower than other emerging markets like Thailand (95.5%), Malaysia (88.3%), Brazil (84%), India (77.3%), and Peru (57.5%). Traditional banks, focused primarily on wholesale banking, have been slow to reach new customers beyond their existing client base.

“The Philippines has a low rate of banking penetration compared to peer countries, highlighting the significant unmet demand for financial services,” the study underscored.

Under the Digital Payments Transformation Roadmap, the BSP aims to increase the number of banked Filipino adults to 70% and shift 50% of total retail transactions to electronic channels by 2023.