Financial Inclusion

How 6 Licensed Digital Banks in the Philippines Have Progressed

In the dynamic landscape of the Philippine fintech sector, 2023 has emerged as a pivotal year, signifying the nation’s determined stride toward enhanced financial inclusion and digital transformation. Digital banking in the Philippines is progressively making its mark, with significant

Read MoreBehind PNB’s Digital Strategy Which Onboarded Over 300% New Users

In the ever-evolving banking and finance landscape, the digital revolution has emerged as a driving force, revolutionising how financial services are delivered and consumed. With a focus on enhancing customer satisfaction, Philippine National Bank (PNB) began a strategic effort in

Read MorePhilippines Moves Closer to Open Finance Ambitions

The Bangko Sentral ng Pilipinas (BSP), backed by the International Finance Corporation (IFC) and the World Bank, has launched the Open Finance PH Pilot, moving a step closer towards its ambition to leverage open banking and data sharing to advance

Read MoreThe Fintech Philippines Report 2023: Financial Inclusion Drive Starts to Bear Fruit

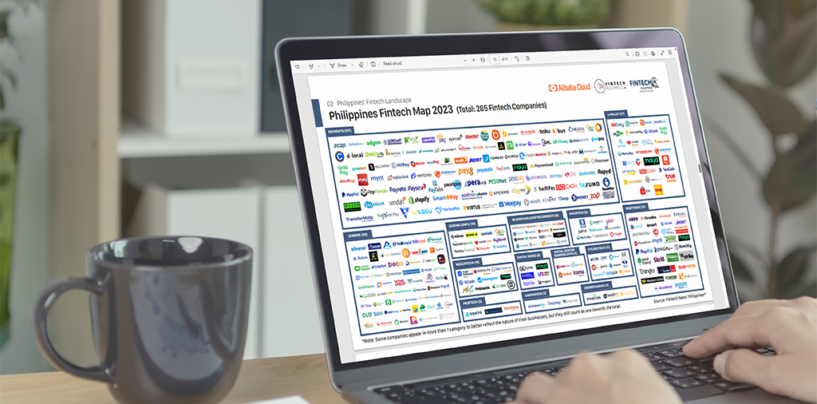

In the Philippines, the fintech sector has been expanding at an unparalleled rate, transforming how individuals and companies handle financial dealings, as evidenced in the 2023 edition of the Fintech Philippines Report, produced by Fintech News Philippines in collaboration with

Read MoreFinancial Inclusion in the Philippines: The Synergy of Fintech and Rural Banks

In the Philippines, financial inclusion remains a pressing issue, particularly in rural areas where access to financial services is limited. This lack of access can perpetuate a cycle of poverty that is difficult to overcome. The traditional rural banking sector

Read MoreThe Philippines is Fertile Ground for Digital Banking Growth

Recognising the need to foster fintech innovation to achieve financial inclusion goals, regulators in the Philippines are laying the groundwork for digital financial services and digital-first business models, introducing new digital banking licenses, creating a real-time payments system, and establishing

Read MoreFinancial Services Revolution: Salmon’s Drive to Promote Inclusion

The economy in the Philippines is expanding at record speed, and its dynamic population – young, growing, and savvy at using mobile technologies – is set to become the key benefactor of the economic opportunities it creates, with a little

Read MoreHow Embedded Finance Is Revolutionising Financial Services in Southeast Asia

Embedded finance is a thriving trend that is rapidly changing the banking and financial services landscape in Southeast Asia. With around 290 million unbanked consumers in the region, embedded finance has the potential to help improve financial inclusion for those

Read MoreIs Philippines Falling Short of Its PhilSys Digital Identity Ambitions?

This month, the Bangko Sentral ng Pilipinas (BSP) issued the latest rules outlining the minimum digital identification and verification requirements for financial institutions, otherwise known as electronic ‘know-your-customer’ procedures, or e-KYC. Seeking to promote seamless identity verification and customer due

Read MoreBSP Gives Nod for New Rules on e-KYC Using Digital IDs

The Bangko Sentral ng Pilipinas (BSP) has approved amendments to its due diligence regulations to include electronic Know-Your-Customer (e-KYC) using digital identity. The new rules set out the requirements for the use of digital identification and verification as part of

Read More