Financial Inclusion

Home Credit Philippines Expands Its Reach to Include More Sectors

Consumer finance company Home Credit Philippines (HCPH) announced that it has further expanded its services to several sectors to bring Filipinos closer to the lifestyle they want. Home Credit said that it will continue to find more opportunities to expand

Read MoreBSP Says More Than 50% Of Filipinos Now Own a Financial Account

The Bangko Sentral ng Pilipinas (BSP) reported that more than half of the country’s adult population now owns a financial account. The 2021 Financial Inclusion Survey (FIS) conducted by BSP showed that account ownership surged to 56 percent in 2021,

Read MoreFilipino E-wallet GCash Reached 66 Million Users in June 2022

Philippines’ mobile wallet GCash has reached 66 million registered users as of June 2022 according to President and CEO Martha Sazon during the Mobile 360 Asia Pacific Fintech Summit held in Singapore. During the summit, Martha shared how collaborations with

Read MorePhilippines Gov’t to Accelerate Roll Out of PhilSys ID, Says Finance Secretary Diokno

Finance Secretary Benjamin Diokno said that the government will accelerate the rollout of the Philippine Identification System (PhilSys ID) to expand public access to financial products and services and achieve e-governance. Former President Rodrigo Duterte had previously issued an executive

Read MorePhilippines’ Post Office Partners With UBX to Drive Financial Inclusion

The Philippine Postal Corporation (Post Office) has partnered with UBX, a fintech unit created by the Union Bank of the Philippines, to launch a capacity development project which will allow the postal agency to offer financial services. Under the partnership,

Read MorePhilippines to Get Gov’t Agencies to Support National Financial Inclusion Strategy

The Malacañang palace, the official residence and principal workplace of the Philippines’ president, has approved a circular institutionalising the whole-of-government support for the implementation of the National Strategy for Financial Inclusion (NSFI 2022-2028). This also pushes for the adoption of

Read MoreBSP Lauds the Government’s Move to Shift to Digital Payments

The Bangko Sentral ng Pilipinas (BSP) says the issuance of the executive order on the adoption of digital payments for government disbursements and collections is a welcome move. The executive order mandates all departments, agencies, and instrumentalities of the government,

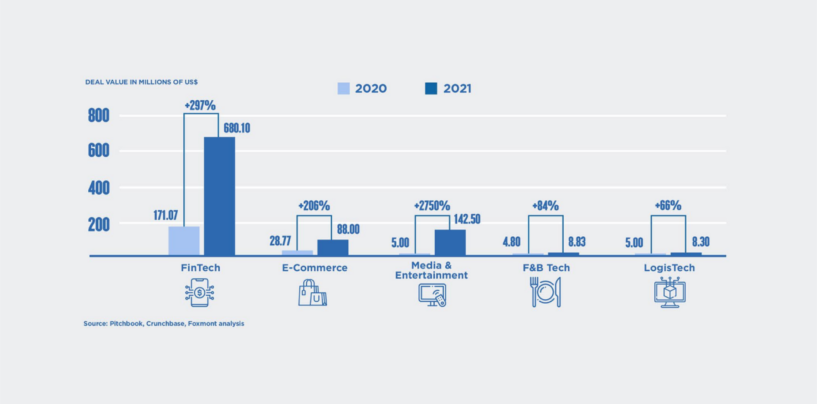

Read MoreFintech Takes Lion’s Share of Philippines Tech Funding for Second Consecutive Year

The Philippines’ fintech industry is blossoming on the back of surging funding activity, a conducive regulatory environment, and rapid adoption of digital financial services, a new report by the Boston Consulting Group (BCG) and Foxmont Capital Partners shows. In 2021,

Read MoreFintech Alliance.PH Set to Bolster BSP’s New Financial Inclusion Strategy

The Fintech Alliance.PH remains committed to bolster the Philippines’ government bold moves to ensure more of the unbanked and underserved population will be onboarded into the formal financial system in the next six years. In a hybrid live and online

Read MoreBSP Aims to Meet Its Financial Inclusion Target by 2023 With New Blueprint

The Bangko Sentral ng Pilipinas (BSP) has rolled out an updated National Strategy for Financial Inclusion (NSFI) 2022-2028. The NSFI is a blueprint for broad-based growth and financial resilience, and shows the collective commitment of the government, private sector, and

Read More