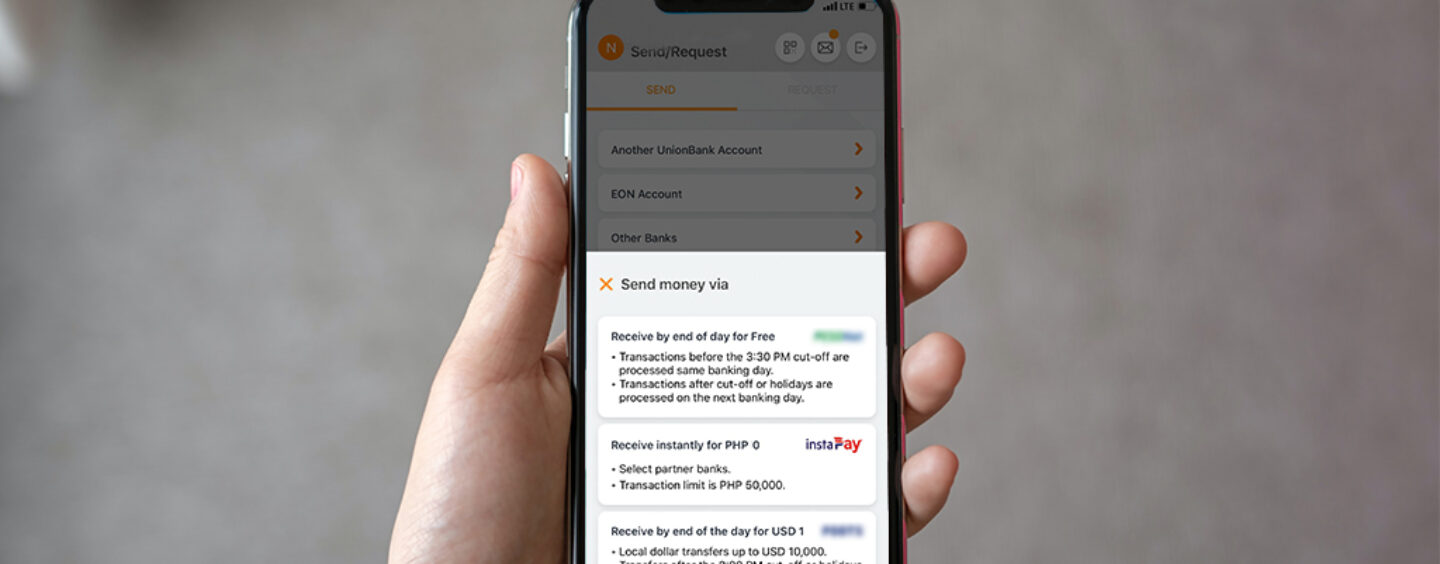

Union Bank of the Philippines (UnionBank) announced that it has extended its free Instapay transfers or instant transfers between accounts of participating central bank-supervised banks and non-bank e-money issuers in the Philippines until the end of the year.

The bank said it is leveraging its “phygital” (physical-digital) banking leadership – providing the best combination of both physical and digital channels – to achieve this goal.

Since the start of the quarantine period, UnionBank boosted its mobile and web banking platforms for retail and corporate customers namely UnionBank Online and The Portal, respectively, to enable clients to safely do their banking transactions from home.

UnionBank was also among the first banks to waive its online fund transfer fees, and deployed its Bank On Wheels to bring its bank branches at the doorstep of its customers.

UnionBank has around 50 fully digital bank branches called The ARK, which seek to handhold customers to the future of banking by providing them the right combination of friendly-physical and efficiently-digital experience.

Meanwhile, UnionBank’s fintech arm UBX, has facilitated the release of cash subsidies through the deployment of mobile automated teller machines (ATMs) to its rural bank partners and financial cooperatives where beneficiaries of the government’s Social Amelioration Program can withdraw their money quickly.

UBX has also begun linking its rural bank members to its new network that includes Cebuana Lhuillier, LBC, Palawan Express and PeraHub.

This enables customers of these rural banks to send funds and payments to over 11,000 branches of the four remittance centers nationwide.

Edwin Bautista

The bank president and CEO Edwin Bautista earlier said amid an uncertain future, UnionBank remains committed to still provide best-in-class banking experience to the public.

UnionBank was recently recognized as the second most helpful bank in the Asia-Pacific, next to South Korea’s largest digital-only bank KakaoBank, by the BankQuality Consumer Survey on Retail Banks – an online survey conducted last April 1-30, 2020 and covering total 11,000 respondents, with 1,000 each coming from China, Hong Kong, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam.

This article first appeared on fintechnews.sg