The Fintech Philippines Report 2023: Financial Inclusion Drive Starts to Bear Fruit

by Johanan Devanesan August 7, 2023In the Philippines, the fintech sector has been expanding at an unparalleled rate, transforming how individuals and companies handle financial dealings, as evidenced in the 2023 edition of the Fintech Philippines Report, produced by Fintech News Philippines in collaboration with FinTech Alliance.ph and supported by Alibaba Cloud.

As a developing nation with a significant number of unbanked and underbanked citizens, the Philippines offers an opportune landscape for fintech solutions to narrow the financial inclusion gap and provide its people with enhanced access to financial services.

This surge is propelled by the cohesive efforts of both governmental and private entities, underpinned by judicious choices of policymakers. The role played by regulatory bodies and government departments in championing this progression is vital, laying the groundwork for fintech startups and conventional financial entities to both innovate and flourish.

The Fintech Philippines Report 2023 examines the state of the fintech sector in the Philippines, noting the pivotal developments in regulations that is helping foster a digital financial ecosystem in the country, along with notable new highlights being spearheaded by the central bank, Bangko Sentral ng Pilipinas (BSP) and complementary bodies such as the Securities and Exchange Commission (SEC).

Laying the groundwork for digital financial services

Recognising the necessity of nurturing fintech innovation to realise financial inclusion objectives, the regulators in the Philippines have been diligently paving the way for digital financial services. These digital-first business models come with evolving standards and rules, aiming to refresh both the conventional financial services and emerging fintech ventures.

The Fintech Philippines Report 2023 sheds light on how the Bangko Sentral ng Pilipinas (BSP) is revising e-money and Electronic Money Issuer (EMI) regulations. Key changes include new requirements concerning risk management, transaction boundaries, interoperability, and liquid assets. Notably, there’s a three-year halt on non-bank EMI licences for regulatory review and enhancement, with revised capital prerequisites set at PHP 200 million for large-scale EMIs and PHP 100 million for their smaller counterparts.

Banks with a digital focus — particularly thrift, rural, and cooperative ones — might be mandated by the BSP to maintain a minimum capital of PHP 1 billion, given their primary focus on digitised financial products and services that are handled wholly digitally from start to finish, utilising platforms and channels akin to those used by digital banks.

The report emphasises the updated electronic Know-Your-Customer (e-KYC) system, now incorporating digital identification and validation for customer integration in BSP-overseen financial establishments. This includes the new Philippine Identification System (PhilSys)-enabled e-KYC overseen by the Philippine Statistics Authority (PSA).

BSP advocating sustainability principles and practices

The central bank is poised to introduce added incentives to endorse sustainable and eco-friendly financing within the nation. These incentives, such as an augmented single borrower’s cap and a null reserve requisite rate, are integral to the BSP’s Strategy for Sustainable Central Banking, commenced in December 2022. This 11-point strategy champions sustainability principles within both the BSP’s domain and the Philippines’ expansive financial ecosystem.

Of significant note, by the end of August 2022, three-quarters of the surveyed universal/commercial banks had backed green projects, with the overall loans touching P829.7 billion (US$14.35 million) by end-June 2022.

The total outstanding loans of the respondent banks to green/sustainable projects represent approximately 7% of the Philippine banking system’s total loan portfolio as of mid-2022, with the biggest financing support going towards renewable energy (89%), sustainable water and wastewater management (56 %), and energy efficiency and green buildings (both 50%).

Financial inclusion efforts bear fruit

The Fintech Philippines Report 2023 details how the Philippines is well on its way to achieving the BSP’s target of at least half of the financial transactions in the country being digital, progressing the growth in financial account ownership and digital payments under the Digital Payments Transformation Roadmap (DPTR), and leveraging technology that engenders open finance with the aims of providing greater access to financial services, address challenges and promote financial inclusion.

As of 2022, 42.1% of retail payments in the country are now digital, and there are over 41 million active e-money accounts, equivalent to 49% of the population in 2022. Financial account ownership rose to 65.6% in 2022 from 56% in 2021, and the number of Filipino adults with bank accounts rose to 50.3 million from 42.9 million in 2021 — while the number of Filipinos without an account dropped significantly.

Moreover, 2022 experienced breakthroughs in the digitisation of crucial payment methods, such as the launch of PESONet Multiple Batch Settlement transfers and the Interoperable Bills Pay Facility.

The initiation of the Open Finance PH Pilot in 2023 is another milestone. Ten leading institutions will partake in an 18-month-long test phase, exploring functionalities like account consolidation, credit analysis, and product evaluation. The insights gathered will be used to sculpt an inclusive open finance structure for the nation.

This initiative aligns with the objectives of the BSP Circular No. 1153, the Regulatory Sandbox Framework of 2022. This framework encourages fintech startups to trial novel financial solutions such as account aggregation, payment initiation, credit scoring, and product comparison within a controlled setting.

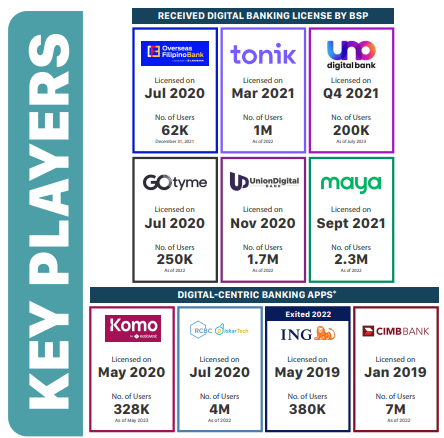

Digital-exclusive banks in the Philippines have been experiencing exponential growth since all six were operationalised by August 2022. They are collectively championing financial integration for the predominantly young and unbanked populace through a myriad of initiatives.

Prominent ventures include UnionDigital Bank’s collaboration with Tala, introducing an e-wallet tailored for unbanked Filipinos, and UNO Digital Bank’s alliance with 1Sari Financing Corporation to support small businesses.

Various other projects that are in line with the Philippine Development Plan 2023-2028 and the National Strategy for Financial Inclusion 2022-2028 have also been outlined in the Philippines Fintech Report 2023, such as the Government Philippine Mobile or eGov PH one-stop shop application, and the Paleng-QR Ph program to promote cashless payments in public trade.

Meanwhile, the SEC has unveiled draft regulations governing cryptocurrencies and other blockchain-derived financial products. However, following the far-reaching FTX exchange collapse, the SEC has momentarily postponed these regulations to safeguard investors better.

Philippines Fintech Map 2023

The 2023 report features the latest edition of the Philippines Fintech Map, comprising a growing environment which now sports at least 285 fintech companies. With a number of new entrants, payments has overtaken lending with the largest share of fintech related firms in the Philippines under its umbrella, with the report indicating over a third of the companies in the Map are under payments (37%).

Lending is the second-biggest segment with 20% (down from 27% the previous year), followed by remittances (11%) and e-wallets (9%). Other segments represented this year include blockchain and cryptocurrency (5%), lending offshoot buy-now-pay-later or BNPL (3%), insurtech (3%), know-your-customer (KYC)/regtech (3%), wealthtech (3%), digital banking (3%), proptech (1%), crowdfunding (1%), and comparison platforms (1%).

The 2023 report summarises a promising trajectory for fintech in the Philippines, with a harmonised blend of regulatory changes, technological advancements, and strategic partnerships driving the nation’s financial inclusion and digital transformation.

| Download the Fintech Philippines Report 2023 here |