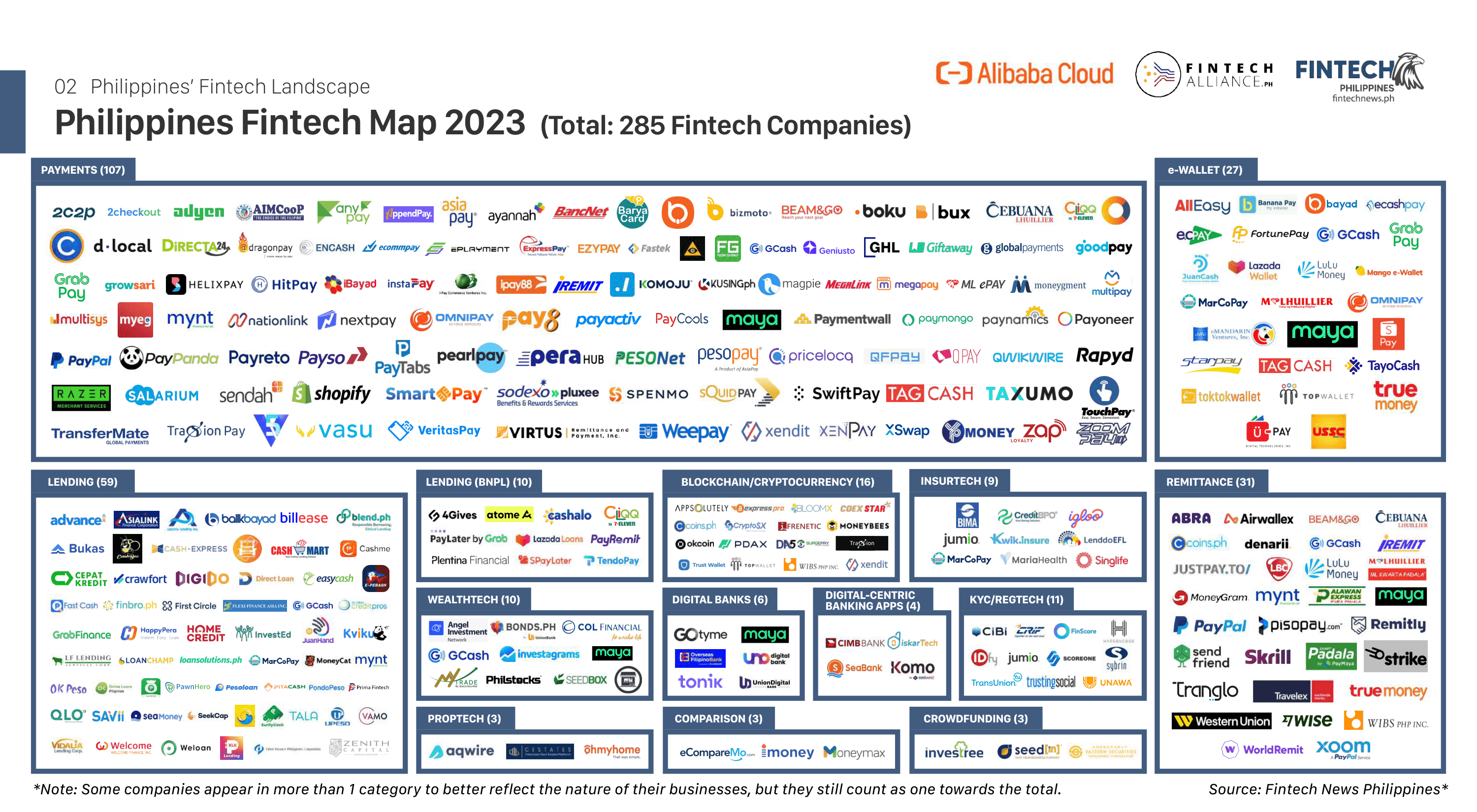

FinTech Startups in Philippines

Appsolutely takes customer rewards to people online in real time via the power of blockchain.

We lead the way to the future of rewards programs, and we want to grow your brand’s loyal customer base.

Bexpress Inc. is a BSP-registered cryptocurrency exchange company. We developed and provide an online trading platform for traders who wants to buy and sell with other traders (P2P exchange).

BloomX is a Manila-based financial technology startup providing modern blockchain solutions to money transfer businesses around the world. It was incorporated in October 2015 and has seen exciting growth in its first year of operation, attracting both investors and business customers alike with its cost-saving platform.

ABA Global Philippines Inc. under the trade name of COEXSTAR is officially registered with Securities and Exchange Commission (SEC) and was issued a Provisional Certificate of Registration as a Remittance and Transfer Company with a Type “B” Remittance Agent with Virtual Currency Exchange service from the Banko Sentral Ng Pilipinas (BSP).

Established in 2016, Moneybees is the first Cryptocurrency over-the-counter service in the Philippines, making the exchange between currencies and digital currencies more accessible to many.

Okcoin is one of the world’s largest and fastest growing cryptocurrency exchanges. We help millions of people buy and sell bitcoin, ethereum, miamicoin and many other crypto assets every day — but our work is a whole lot more than that: we’re building an inclusive future of finance. A future that opens new opportunities to learn financial literacy, store value, and build wealth for everyone.

Founded in 2018, the Philippine Digital Asset Exchange (PDAX) is an order-book exchange that offers Filipinos fair access to the top cryptocurrencies and other digital assets for the first time. Committed to ensuring security and liquidity, PDAX allows investors to trade with the Philippine Peso at globally competitive prices in real-time.

DA5 has partnered with Surge Mobile Access paving the way for the creation of the Surge Pay App, its hybrid digital wallet — designed to ride the wave of adoption in Blockchain by offering innovative solutions and services to address financial inclusion. SurgePay offers a secure, convenient and seamless way for users to send and receive money or crypto, pay bills, trade crypto via our P2P marketplace or token exchange and create or redeem crypto gift cards.

TraXion exists to help elevate the social-impact quotient (SIQ) of any business or organization it works with through transformative technology. Our goal is to ensure fairness for the most underserved segments of society by giving them access to the same services and benefits available to the rest of society.

TopWallet is a unique blockchain enabled and data encrypted mobile wallet. With its Electronic Money Issuer and Virtual Asset Service Provider licenses from the BSP, users can conduct financial transactions and trade / convert digital assets securely.

TopWallet is a unique blockchain enabled and data encrypted mobile wallet. With its Electronic Money Issuer and Virtual Asset Service Provider licenses from the BSP, users can conduct financial transactions and trade / convert digital assets securely.

Xendit is a financial technology company that provides payment solutions and simplifies the payment process for businesses in Indonesia, the Philippines and Southeast Asia, from SMEs and e-commerce startups to large enterprises. We enable businesses to accept payments, disburse payroll, run marketplaces and more. The platform is known for its speed (fast integration, builds), simplicity (easy integrations, pricing), and world-class 24/7 customer support.

eCompareMo is the Philippines’ largest financial marketplace connecting banks and insurance companies with millions of consumers looking for credit card, loan, and insurance products.

iMoney is South East Asia’s leading financial aggregator, helping consumers make #IntelligentMoney decisions for every #LifeMoment.

Moneymax is the Philippines’ largest personal finance marketplace for products such as car insurance, credit cards, and loans. Over 40 million Filipinos have benefitted from Moneymax’s services since its establishment in 2014 as part of Hyphen Group.

Asenso Tech Pte, Ltd., a fintech startup and end-to-end business accelerator for Asian micro, small, and medium enterprises (MSMEs), topped three fintech startups at the final pitch of the Asian Development Bank’s (ADB) Global AgriFin Innovation Challenge, a call for fintech solutions to support the agriculture Sector.

Asenso Tech Pte, Ltd., a fintech startup and end-to-end business accelerator for Asian micro, small, and medium enterprises (MSMEs), topped three fintech startups at the final pitch of the Asian Development Bank’s (ADB) Global AgriFin Innovation Challenge, a call for fintech solutions to support the agriculture Sector.

Seedin is Asia’s leading Business Financing Platform where local businesses seeking short-term financing connect with individuals and other businesses

A proud member of the Philippine Stock Exchange, multi-generation, stalwart securities brokerage in continuous operation since 1977. ESDC is a full service, online brokerage.

Overseas Filipino Bank (OFBank), formerly Philippine Postal Savings Bank Inc. (PPSB), was transformed into the first government digital-only and branchless bank that is mandated to provide financial products and services tailored to the requirements of Overseas Filipinos.

Tonik is a transformative digital bank on a mission to revolutionize the way money works in Southeast Asia.

First ever fintech to be awarded an outright digital banking license in South East & South Asia

On path to building SEA’s first full-spectrum digital bank.

UNO is on a mission to provide ONE digital interface to solving all your financial needs with speed and ease

UNO and UNObank are brand names/subs of DigiBankASIA Pte. Ltd

UnionBank empowers consumers to live their best lives through the latest financial innovations.

Maya is the all-in-one money platform that is bringing Filipinos bolder ways to master their money. It is powered by a unique integrated financial services ecosystem that addresses the ever-evolving needs of today’s generation of money makers through cutting edge technology.

CIMB Bank Philippines aims to help all Filipinos seize life’s moments and reach their life goals by providing innovative digital banking solutions and services. CIMB Bank has successfully onboarded 5.1 million customers since its establishment in December 2018.

SeaBank Philippines, Inc. (A Rural Bank) is part of Sea Limited (NYSE: SE), a global consumer internet company founded and headquartered in Singapore and listed on the New York Stock Exchange. It operates three core businesses across digital entertainment, e-commerce, as well as digital payments and financial services, known as Garena, Shopee, and SeaMoney, respectively.

Komo is EastWest’s exclusively digital bank that can help you save, grow, and manage your money faster. If you ever need help with personal finance and money management, we’re just a hey away!

We are a start-up financial technology company working towards serving the unbanked and the digital transformation of the Philippine economy.

CIS Bayad Center, Inc or BAYAD is the country’s pioneer and leader in the Outsourced Payment Collection Industry. Now, more than ever, we continue to blaze the trail in the industry by providing a dependable bills collection solution to its corporate partners, creating business opportunities or its franchisees, and offering the public a reliable and convenient bills payment service.

Ecashpay Asia provides alternative payment solutions which allows enterprises, online businesses and individuals to send and receive money around the world.

Ang Payment Center Ng Bayan! Pay for your Utilities, Loans, Cable, Internet, Airline Tickets & Load your phone thru our Merchant Partners nationwide.

Fortune Pay is a mobile wallet app that enables users to enjoy an easy, fast and secure way of digital payment. Fortune Pay is owned and operated by Easypay Global EMI Corp.

Buy load, pay bills, send money, pay using GCash QR, shop online, and more – all using the GCash App!

GrabPay is an eWallet within the lifestyle “super app” app, Grab. It is the largest ride hailing app in Southeast Asia and has over 100 million users. GrabPay not only allows users to store credit in app and pay for all the services Grab provides, it also lets users pay in store and online in place of cash and cards.

Innovating Business Solutions Through Convenient And Secure Payments JuanCash offers the latest scan-to-pay mobile payment solutions suited to your business requirements. Our seamless payment solutions allow your business to accept payments using the latest QR technology that is convenient & secured.

LuLu Financial Group is a leading name in financial service sector primarily dealing in foreign exchange, global money transfer and salary and wage administration. Starting off with their first branch in UAE in September 2009, the company today operates out of 11 countries with more than 225 branches worldwide.

SPEEDYPAY’s Mango e-Wallet promotes Cash-Less transactions and designed to minimize the need for Cash Withdrawals. Keeping the funds in the e-wallet have many benefits for users. The Mango e-Wallet can be used immediately to purchase goods from any Mango Authorized Merchants like Sari-sari stores for their daily necessities, and other value-added participating merchants.

MarCoPay is an eWallet platform where eMoney is stored, and is designed primarily for seafarers, their families and friends to support better quality of life. The eWallet is developed and maintained by MarCoPay Inc. (“MCP”), a Philippine corporation incorporated in 2019 in Manila, Philippines. MCP is duly licensed by the Bangko Sentral ng Pilipinas as an Electronic Money Issuer.

M Lhuillier Financial Services Inc. is one of the leading non-bank financial institutions in the Philippines with more than 3,000 branches nationwide. The company specializes in pawning, remittance, insurance and more.

OmniPay, Inc. is a non-bank financial institution (NBFI) supervised by the Central Bank of the Philippines. This is the first non-bank financial institution in the Philippines granted an electronic money issuer license.

Use PayLoro for fund transfer, e-Load, bills payment, QR payment, and Remittance. PayLoro is regulated by the Bangko Sentral ng Pilipinas.

Maya is the all-in-one money platform that is bringing Filipinos bolder ways to master their money. It is powered by a unique integrated financial services ecosystem that addresses the ever-evolving needs of today’s generation of money makers through cutting edge technology.

ShopeePay is SeaMoney’s mobile wallet, which provides users with easy access to digital payment services. Users make online payments, top up their wallet, transfer and withdraw funds, and make payments offline at thousands of our merchant partner locations, offering users a seamless shopping experience.

Starpay is the mobile wallet designed to make handling your money simple, secure, comfortable, and convenient. Use your Starpay wallet to pay bills, buy e-load, and send money with ease!

Tagcash is a regulated E-Money issuer based in Philippines and Europe, that develops fintech enabled mobile apps. Our Tagcash Wallet is the flagship product, enabling any individual, company or developer to create mini apps within Tagcash, or extend instantly to their own white label app.

TayoCash is a mobile app that turns your phone into a digital wallet. Shop, pay bills, buy load, send money, and do more! The company is licensed by the Bangko Sentral ng Pilipinas.

Toktok is a delivery service app designed to connect more people by delivering items door-to-door. Servicing every Filipinos Nationwide!

TopWallet is a unique blockchain enabled and data encrypted mobile wallet. With its Electronic Money Issuer and Virtual Asset Service Provider licenses from the BSP, users can conduct financial transactions and trade / convert digital assets securely.

TrueMoney is a leading international Fintech brand and is part of Ascend Money, a digital financial services venture of the Charoen Pokphand Group (CP Group) and Alipay/Ant Financial (Alibaba), two of the largest companies in Asia.

We are now one of the largest financial life platforms in Southeast Asia, growing from just 1 market to 6 markets in a span of 2 years. We currently have significant operations in Thailand, Cambodia, Myanmar, Indonesia, Vietnam and the Philippines.

U-Pay Digital Technologies, Inc. is a joint venture company between ABS-CBN Corporation and iBayad Online Ventures, Inc.

We engage in the business of digital commerce and payment services. We develop and provide mobile payment and technology solutions and services.

Your super remittance partner for U Cash Padala, Western Union, Moneygram, Ria and Xoom. With more than 870 stores nationwide, there’s always a USSC store nearby. Sa USSC Service Stores, #SuperKaDito!

BIMA is a Sweden-based mobile insurance platform that aims to deliver affordable & easy-to-use products to underserved families. Its products include Bima Smart Protection Service, which offers 3 budget-dependent insurance options, and TNT Secureload, a prepaid airtime service which comes with free accident micro-insurance coverage

CreditBPO is a financial technology company that aims to be an important partner to Philippine banks and financial institutions, corporations, small and medium enterprises, and the government in our common pursuit of business growth, by leveraging information technology to improve lending, procurement, and accreditation processes, enhance operational efficiency, and strengthen the country’s economy.

Igloo is a full stack insurtech startup founded in 2016. It leverages big data, real-time risk assessment and end-to-end automated claims management to create innovative B2B2C insurance solutions for platform partners and insurers. Igloo’s insurance solutions enable companies to eliminate their exposure to operational risk, create new revenue streams and optimise and enhance existing products.

When identity matters, trust Jumio. Jumio’s mission is to make the internet a safer place by protecting the ecosystems of businesses through a unified, end-to-end identity verification and eKYC platform. The Jumio KYX Platform offers a range of identity proofing and AML services to accurately establish, maintain and reassert trust from account opening to ongoing transaction monitoring.

Kwik.insure is an online insurance marketplace that promises easy and reliable insurance.

We are the pioneers of using alternative data to make better decisions. With over 10 years experience in risk modeling, we offer unrivalled expertise. We are a growing global team of data scientists, credit risk experts, developers and business development professionals. We are creative, ambitious and diverse. Our ability to find meaning in large, unstructured data is your key to better business decisions.

MarCoPay is an eWallet platform where eMoney is stored, and is designed primarily for seafarers, their families and friends to support better quality of life. The eWallet is developed and maintained by MarCoPay Inc. (“MCP”), a Philippine corporation incorporated in 2019 in Manila, Philippines. MCP is duly licensed by the Bangko Sentral ng Pilipinas as an Electronic Money Issuer.

Maria Health – The first and only online marketplace in the PH dedicated to making it simple & easy for any Filipino to get healthcare.

SingLife is a fully digital insurer, providing technology and transparency in insurance and wealth management. Singapore Life was founded to fill in the digital gaps through innovative technology.

We are the leading credit bureau in the Philippines providing workforce, business and business and consumer solutions to enable faster and better decision-making across the lending and hiring space.

CRIF is a global company specializing in credit bureau and business information, outsourcing and processing services, and credit solutions. Established in 1988 in Bologna (Italy), CRIF has an international presence, operating over four continents (Europe, America, Africa and Asia).

FinScore is an alternative credit scoring company that is powered by telco data and advanced analytics. Our credit scoring models and platform and fraud detection solutions help financial institutions reduce defaults, increase approval rates and combat fraud.

HyperVerge is a B2B SaaS company providing AI-based identity verification (KYC) & business verification (KYB) solutions for companies in Fintech, BFSI, Insurance, Lending, Gaming, Logistics, EdTech across 195+ countries. HyperVerge is the No.1 player in the APAC market by volume and product maturity. HyperVerge has on-boarded 700 million identities till date and its AI has been trained on diverse facial variations and ID formats.

The digital economy runs on trust. After all, you do need to know who you’re dealing with. IDfy helps with that.

When identity matters, trust Jumio. Jumio’s mission is to make the internet a safer place by protecting the ecosystems of businesses through a unified, end-to-end identity verification and eKYC platform. The Jumio KYX Platform offers a range of identity proofing and AML services to accurately establish, maintain and reassert trust from account opening to ongoing transaction monitoring.

ScoreOne is a fintech provider of alternative lending solutions for credit scoring, fraud detection & identity check. It brings innovations into emerging markets by supplying mobile financial services to the underbanked. The company’s products use cutting-edge algorithms, machine-learning & data sciences to provide real-time credit-scoring & Lending-As-A-Service solutions. ScoreOne is committed to sustainable development, enhancing financial inclusion in developing areas by harnessing the potential of Big Data.

Sybrin has grown considerably over the past two decades to become a leading global technology company in the provision of payment and information processing solutions with particular emphasis on Voucher Processing, EFT, Day 2, Automated Clearing Houses, Mobile Commerce, Host Banking enhancements, and KYC amongst leading corporations, banks, and clearing houses. Today we are a well-respected supplier in the banking and corporate sectors.

TransUnion is a global information and insights company that makes trust possible between businesses and consumers, by ensuring that each consumer is reliably and safely represented in the marketplace.

Trusting Social reinvents credit scoring by combining Big Data technology with social, web and mobile data. Founded in June 2013 by a group of tech genius and visionary risk experts in the U.S., we are reaching out to customers all over the globe, from the U.S., to Europe and Asia Pacific.

The most comprehensive regulatory tech (“regtech”) startup in Southeast Asia, Unawa accelerates your capability to operate in the digital economy as you start, grow, and scale your business.

Advance is the first salary on-demand provider in the Philippines. We extend financial services to employees by way of their employers to improve engagement, financial wellness, and enrich a company’s core benefits program.

Asialink Finance Corporation is one of the leading and fastest-growing finance companies in the Philippines.

balikbayad is a service of First Digital Finance Corporation, a SEC licensed Finance Company

We are a buy now, pay later app that splits customers’ payments into interest-free or interest-bearing installments. BillEase is used both as sales optimization tool and alternative payment method by 400+ online merchants in the Philippines.

Blend.PH is a peer-to-peer funding platform owned and managed by Inclusive Financial Technologies, Inc., which aims to promote responsible borrowing and ethical lending. This is where borrowers and lenders meet.

Bukas is an education financing platform on a mission to democratize access to higher education in the Philippines. In partnership with leading education institutions, we offer affordable financing solutions for Filipino students. As of writing, we have funded thousands of students and counting, and we continue to extend our reach and our impact nationwide.

We are fast-paced startup online lending company. We always make sure we deliver the best quality of service and environment for clients and employees. Working at a rapidly expanding company typically means you will have plenty of exposure for challenging assignments and benefit to your growth. We always appreciate the amount of effort that employees put into their job and we will assure that their efforts are significantly appreciated.

Cash-Express (legal name Cash-Express Philippines Financing Inc. under the business style and name of Cash-Express – formely CashXpress South-East Asia Lending Inc.) is the FinTech company – the online lending platform in the Philippines, that provides easy, advanced, and fast way to get a credit to local clients at their fingertips through mobile or pc connectivity. The approval can be finalized in a few minutes, and the borrower can get funds in his/her account in no time. The company is established on March 10, 2019.

CashJeep is an online lending app that offers easy access to their debt that they can use to open a business, pay for tuition, or pay for their monthly bills. Through this, we believe that we can help Filipinos improve their lives in this simple way.

As such, we promise Cashjeep to continue improving our quality of service to further enhance and improve the lives of our fellow Filipinos.

Acknowledging the strong connections of Singapore with its neighboring country, Philippines, Cash Mart once again did a breakthrough by crossing the seas to bring unparalleled loan solutions to the Filipino people with the same perseverance and enthusiasm Singaporeans have been enjoying for more than 45 years.

Cepat Kredit Financing, Inc. is a fast-growing Filipino-owned financing company that provides a focused portfolio of products and services for Overseas Filipino Workers (OFW), both land-based and sea-based, and motorcycle and tricycle unit owners.

Crawfort Finance is one of Singapore’s most reputed and trusted licensed moneylender. Since our inception, we have disbursed more than 200,000 loans and have won an award from the Singapore’s Prestige Brand Awards 2019.

Digido believes every hard-working Filipino should have access to convenient, secure, and affordable financial tools.

A loan product issued by iDirect Finance Company, Inc., which is a finance company licensed by the SEC of the Philippines. Direct Loan is your partner for a cash loan. We strive to provide convenient and friendly credit loan service to Filipinos. Easy loan application, get funding in pesos, and make your family life better in the Philippines.

Easycash is a financial service company that provides loans to help Filipino seafarers and their families.

E-Perash is a Philippine fintech company that provides accessible financial services to all Filipinos. We aim to give alternative financial services to underserved customers. By availing our easy loan application process, E-Perash can meet your financial needs and help you build your financial identity. Simply submit a picture of one valid Government-issued ID and fill out the application form to start. Within minutes, our loan decision can be communicated via our app and your money can be instantly transferred to your preferred cash-out option.

Fcash Global Lending INC provides easy non-collateral and no guarantee required online loan service to every ordinary borrower, to help every Filipino solve their financial problems.

Finbro is an online lending platform in the Philippines that helps you get quick loans to cover unexpected expenses. We make sure that your lending experience is simple, fast, and convenient.

A trailblazer in Financial Technology (FinTech), First Circle was founded by Patrick Lynch and Tony Ennis to empower Small and Medium Enterprises (SMEs) in growth markets by financing their business-to-business (B2B) trade transactions. Thus helping them grow by providing convenient access to financial services. First Circle believes that strong businesses should have access to capital based on meritocracy; not hindered by insufficiencies of collateral or the mere relationships and connections one may have.

Everything we do is focused on providing accessible and affordable financing services to the Filipino people.

Buy load, pay bills, send money, pay using GCash QR, shop online, and more – all using the GCash App!

We’re Global CreditPros, one of the first FinTech companies in the Philippines. What we do is simple (but not really!) – we provide a holistic suite of financial offerings for Filipinos. We’re advocates of Financial Inclusion and Financial Literacy! Our goal is to provide financial access to people and through a financial wellness journey – guide them onto a path of retirement!

GrabPay is an eWallet within the lifestyle “super app” app, Grab. It is the largest ride hailing app in Southeast Asia and has over 100 million users. GrabPay not only allows users to store credit in app and pay for all the services Grab provides, it also lets users pay in store and online in place of cash and cards.

As a global tech-driven consumer finance company, Home Credit understands how technology can impact people’s lives. In all nine countries we are present in, from Czech Republic and Kazakhstan all the way to the Philippines, we use technology to change how people buy and afford the things they need.

There are 30 million under-resourced youth in the Philippines who can’t afford higher education and upskilling to move up in life. Due to their risky situation and lack of collateral, young but high potential dreamers are considered unbankable by formal financial institutions. Moreover, with less jobs available due to the pandemic, the youth entering the labor market for the first time will be at a great disadvantage competing with older, more experienced jobseekers. In short, the future of young Filipinos is presently a game of odds. InvestEd exists to change this unfair reality.

JuanHand is your partner for cash loans. It is one of the unique Fintech platforms in the Philippines to provide you with financial mobility whenever and whatever. The simple application and approval process lets you borrow money instantly.

Kviku is the first service that works with customers in online mode, without the help of a human operator! Its operation is fully automated. Any day of the week, regardless of the time, holidays or non-working days, loans are given instantly.

LF Lending Services Corporation is a privately held company founded for the sole purpose of providing Filipinos with easily accessible loans.

At LF Lending, we strive to break the stigma that non-bank lenders only charge usurious rates. We wish to extend an option outside the traditional banks. Our services include short term multi-purpose loans with rates that are reasonably priced, ensuring every client has been properly evaluated and amortizations are proportionate.

LoanChamp is an online lending platform with the mission to provide fast, easy and affordable finance.

Loansolutions.ph provides loan assistance by connecting you to our network of reputable lending institutions. This gives you the power to apply for many loan products with just one application form and be offered with the one that best fits your financing needs, at the comfort of your own home – you won’t need to line up to loan anymore.

MarCoPay is an eWallet platform where eMoney is stored, and is designed primarily for seafarers, their families and friends to support better quality of life. The eWallet is developed and maintained by MarCoPay Inc. (“MCP”), a Philippine corporation incorporated in 2019 in Manila, Philippines. MCP is duly licensed by the Bangko Sentral ng Pilipinas as an Electronic Money Issuer.

MoneyCat Online Philippines service will bring you financial solutions easily, quickly for up to 180 days.

OKPeso is a SEC licensed online cash loan application providing safe loan service in the Philippines.

Online Loans Pilipinas is a fintech platform that caters digital financial solutions in response to Filipinos needs. We are focused on online micro and consumer financing and we aim to uplift the financial well-being of customers.

Pautang Online is an online lending app in the Philippines where you can get loans and cash transfers from the comfort of your home, with a quick and easy application and approval process, 24/7 live customer service, and fast loan disbursement.

PawnHero Pawnshop is the first online pawn shop in SE Asia and aims to reshape the industry by providing an affordable personal loan off a wide range of items.

Pesoloan understands that compliance is at the heart of financial service organizations, which is why we are proud to be a SEC registered company, offering a digitized mobile platform.

One of the trusted and best service loans in the Philippines! PitaCash is committed to provide quality cash loans with transparency, accessibility, and useful for the customer care of the Filipinos.

PondoPeso is one of the Fintech platforms which can provide a financial help to all Filipinos. Safe,

Prima Fintech Lending Corp is an international non-bank financial institution founded in 2017. In 2019 company expanded to Indonesia & Philippines. The company operates in 2 countries and focuses on lending Primarily to people with little or no credit history. As of 2019 the company has served already over 5 million active customers.

QLO (Quick Loans Online) is a cost-free and risk-free salary loan facility powered by MRACC that companies can use to augment their employee benefits. By providing employees quick access to cash that cater to their urgent financial needs, QLO enhances a company’s employee retention and productivity.

In response to the needs of our clients (heightened during the pandemic), SAVii’s offering has expanded beyond financial assistance to include on-demand learning, mental health support, and relevant FREE insurance protection. SAVii is the translation of our evolution into a holistic tool for empowerment of your workforce.

ShopeePay is SeaMoney’s mobile wallet, which provides users with easy access to digital payment services. ShopeePay allow users to make online payments, top up their wallet, transfer and withdraw funds, and make payments offline at thousands of our merchant partner locations, offering users a seamless shopping experience.

We are an online lending marketplace. MSMEs can register at seekcap.ph and apply for a hassle-free business loan. We partnered with trusted lenders to offer you the best loan products in the market. Our loan offers range from Php 50,000 up to P20M with interest rates as low as 2%.

Tala is a financial technology company on a mission to build a financial system that works for everyone. Our first product is a lending app that instantly underwrites and delivers credit to customers who have little or no formal borrowing history. Tala has disbursed over $1B to more than 4 million customers across East Africa, the Philippines, Mexico, and India who use Tala loans to start and expand small businesses, pay school fees and bills, and build more stable financial lives.

U Peso, a fast growing fin-tech Company headquartered in Singapore providing online financial services to all Filipinos nationwide with Valid ID’s. It’s a sister company of PTX Lending Investors Inc. Since August 2018, we started the operation here in the Philippines with cash loan first, and will develop in to more sectors like consumer finance such as consumer goods and services installments and big data credit investigation and so on. So far, we already have around 10,00 active borrowers.

Vamo Lending Inc. operates under the umbrella of VIA SMS Group, one of the leading financial organizations in Europe and Asia. With over 700 000 customers, Vamo brings with it the best talents and technology.

Vamo.ph understands the local market need for an easy and manageable loan product that helps its clients to achieve financial flexibility and ease of access. We offer credit lines that can be accessed anytime and repayment schemes to suit every budget situations.

Vidalia is a company based in the Philippines that specializes in offering short term loans to Filipinos, particularly to migrant workers.

WELCOME FINANCE, INC. offers retail loans, both non-collateralized (Personal Loans, Seaman’s Loan, Salary Loan and collateralized (Auto Loan)

Weloan offers legit personal loans that meet your borrowing needs with low interest, quick approval.

Yulon Finance Philippines Corporation a new subsidiary 100% invested by Yulon Finance Corporation. The core businesses of the Company are new car, used car financing and to develop financing facilities for machinery, equipment and commercial vehicles.

Zenith Capital is a financing company that facilitates quick and easy-to-access business loans to Philippine SMEs and corporations. We aim to ease the various scales of financial challenges that businesses face. By facilitating the help you need, you’ll be set to work on your goals.

Atome is part of Advance Intelligence Group, one of the largest independent financial services-focussed technology startups in Asia. Backed by investors such as Softbank Vision Fund 2, Warburg Pincus, Northstar Group, Standard Chartered Bank and Singapore-based EDBI, the Group has raised over USD 700 million in funding to-date and has secured capital in excess of USD 1 billion supporting its credit book.

Cashalo’s fintech solutions are designed to create unprecedented value for its customers and merchant partners. Through its mobile-app, Cashalo provides millions of underserved and underbanked Filipinos with access to fast, transparent, and secure access to credit – anytime, anywhere! This empowers more hardworking Filipinos to build financial identities, improve their financial health, and realize their potential by enabling them to participate in the formal economy.

CLIQQ Rewards is 7-Eleven’s loyalty program (formerly Every Day! Rewards). Earn points by presenting your loyalty barcode every time you buy at 7-Eleven.

Cashalo’s fintech solutions are designed to create unprecedented value for its customers and merchant partners. Through its mobile-app, Cashalo provides millions of underserved and underbanked Filipinos with access to fast, transparent, and secure access to credit – anytime, anywhere! This empowers more hardworking Filipinos to build financial identities, improve their financial health, and realize their potential by enabling them to participate in the formal economy.

Cashalo’s fintech solutions are designed to create unprecedented value for its customers and merchant partners. Through its mobile-app, Cashalo provides millions of underserved and underbanked Filipinos with access to fast, transparent, and secure access to credit – anytime, anywhere! This empowers more hardworking Filipinos to build financial identities, improve their financial health, and realize their potential by enabling them to participate in the formal economy.

Launched in 2015, PayRemit started as a payment gateway installed in e-Commerce shops that cater to Filipino migrant workers so they can pay and update their SSS, Pag-IBIG, and Philhealth contributions. In 2017, PayRemit was transformed into a PayRemit Shop on Facebook, making it possible for migrant workers to shop online and pay with remittance. Today, PayRemit has evolved into an e-commerce platform dedicated to Filipino and Indian migrant workers so they can shop for their families back home.

Plentina gives emerging market consumers and businesses the tools they need to grow their financial wellness. We leverage artificial intelligence and corporate partnerships to unlock more financial services to more creditworthy consumers.

SPayLater is a financial solution that provides users with payment flexibility via a seamless digital experience. It allows users to buy now but with the choice of paying for their purchases later. Users can choose from various payment schemes ranging from one month up to a maximum of twelve months.

TendoPay is a fully licensed employee benefit and financial service provider regulated by the SEC and BSP. We provide the most innovative employee benefits and services like: life & health insurance, savings and cash loans, employee rewards and many more.

2C2P is a global payments platform helping businesses securely accept payments across online, mobile and in-store channels. The company is headquartered in Singapore and operates across Southeast Asia, North Asia, Europe and the US. It is the preferred payments platform provider of regional airlines, travel companies and global retailers.

2Checkout is the digital commerce & payments provider that helps companies sell their products and services via multiple channels, acquire customers across multiple touch points, increase customer and revenue retention, leverage smarter payment options and subscription billing models, and maximize sales conversion rates. The company’s clients include ABBYY, Absolute, Bitdefender, FICO, HP Software, Kaspersky Lab, and many more companies across the globe.

Adyen (AMS: ADYEN) is the financial technology platform of choice for leading companies. By providing end-to-end payments capabilities, data-driven insights, and financial products in a single global solution, Adyen helps businesses achieve their ambitions faster. With offices around the world, Adyen works with the likes of Meta, Uber, H&M, eBay, and Microsoft.

AIMCooP adapts centralized recording and accounting and fully implemented on-line real-time business transactions throughout its branches nationwide. It is recognized as the top 20 cooperatives in the Philippines and received awards from various government entities for its support and compliance to government regulations and standards.

AnyPay is the new way of accepting payments in the Philippines.

Make it as easy as possible to pay. Modular or combined with other services, our payment technologies ensure swift implementation. What’s more, you can flexibly adapt our proven standard solutions to suit each country and application. Lastingly slash your operating costs and boost your sales.

AppendPay app is a next generation mobile application and online system that links APPEND members around the country to a wide array of loan platforms and eCommerce channels. Append aimsto provide an automated payment of AppendPay’s registered MFI and Application of MFI Loan servicethat will help the user to have a convenient and secured transaction.

AsiaPay is a world-class electronic payment service, solution, technology provider, and merchant aggregator in Asia. We provide a comprehensive array of secured, advanced, and integrated payment processing solutions and technologies to banks, payment service providers, and merchants. We have partnerships with international card associations, banks, payment companies, and debit cards all over Asia.

Ayannah provides affordable and accessible digital financial services for the world’s emerging middle class.

BancNet was the first and is now, the largest Automated Teller Machine Consortium (ATM) in the Philippines. It was also the first multi-bank, multi-channel electronic payment network in the country. As a multi-channel payment gateway, BancNet enables its customers to transact, not only at any ATM anywhere, anytime, but also at point-of-sale (P.O.S.), the Internet or through mobile phones.

BaryaCard is a simple, mobile daily tool to save and use money effectively. With BaryaCard, ASKI members can easily save the change from their purchases or payments with the various ASKI Cooperatives. They can then use that saved money for later purchases at the Cooperatives. No more losing barya, or keeping it stashed and unused.

CIS Bayad Center, Inc or BAYAD is the country’s pioneer and leader in the Outsourced Payment Collection Industry. Now, more than ever, we continue to blaze the trail in the industry by providing a dependable bills collection solution to its corporate partners, creating business opportunities or its franchisees, and offering the public a reliable and convenient bills payment service.

BeamAndGo Pte Ltd is a social impact FinTech that enables migrant workers to meet their family needs and financial aspirations.

We inherently believe in building family security and resilience to uplift the lives of migrant workers, their families and future generations, that is why we are leading a movement for financial inclusion, education and management for migrant workers and their families.

Remit via Bizmoto from Australia to the Philippines for just $6.50! Stay tuned as we have a massive promotion coming!

Remit via Bizmoto from Australia to the Philippines for just $6.50! Stay tuned as we have a massive promotion coming!

Grow your business with BUx, the Philippines’ leading payment gateway. Whether you’re an individual seller, freelancer, SME or large enterprise, offer a range of payment methods from e-wallets, installments and more.

Formally established in 1988, the PJ Lhuillier Group of Companies (PJLGC) is a dynamic, multi-industry company that owns and operates businesses dealing with financial services such as pawning, remittance, microinsurance, micro savings, and business to business micro loan solutions.

CLIQQ Rewards is 7-Eleven’s loyalty program (formerly Every Day! Rewards). Earn points by presenting your loyalty barcode every time you buy at 7-Eleven.

Coins.ph delivers financial services over mobile to the 300+ million people in Southeast Asia who are currently unserved by traditional banks. Our platform runs on Blockchain technology and is built on top of existing retail infrastructure (30,000+ cash-in/cash-out locations), cutting down on one of the biggest cost components of retail banking.

dLocal powers local payments in emerging markets connecting global enterprise merchants with billions of emerging market consumers across APAC, Latin America, and Africa. Global companies can receive payments, send pay-outs and settle funds globally without the need to manage separate pay-in and payout processors, set up numerous local entities, and integrate multiple acquirers and payment methods in each market.

We’re a company 100% focused on simplifying payments for businesses and individuals worldwide. Making it secure, reliable, innovative 24-7. Bridging the gap between traditional finance and the digital economy.

Dragonpay is the Pioneer and Leader in Alternative Payments for the Philippine E-Commerce Market. A Trusted payment partner of major local and international merchants and government agencies.

Digipay is a digital payments and financial services platform with a mobile wallet, an industry leading biller ecosystem, and an interoperable backend.

Electronic Network Cash Tellers, Inc. (ENCASH), has made great inroads in providing ATM service to the Philippine countryside. As the first Independent ATM Deployer in the Philippines, ENCASH provides privately-owned ATMs to areas not deemed viable by commercial banks, allowing users in remote locations to conveniently obtain access to their finances.

Ecommpay is a payment service provider and a direct bank card acquirer. We create tailor-made data-driven technologies for e-commerce clients to make online payments worldwide. The company ensures money movement in one click; our payment gateway facilitates an omnichannel payment process, combining acquiring capabilities, 100+ payment methods, mass payouts, and technological innovation within a single, seamless integration. Our clients enjoy reduced operational costs, reduced time to market in the case of business expansion, and the synergy between conversion and security. Ecommpay has 6 offices globally, employing over 700 people.

Eplayment brings the world of virtual finance, esports, and entertainment to every Filipino as a fun, secure, and convenient organization. We see a world that users can comfortably and proudly identify themselves with, securely engage with each other, and experience the fullest potential of entertainment and financial technology combined.

ExpressPay, Inc. is a subsidiary company of Sagesoft Solutions Incorporatedwhich is a spinoff company of Touch Solutions Incorporated. It is known as an I.T. Company; an open-system based Solutions Company that caters to the high demand of Enterprise Resource Planning (ERP) and accounting software packages. Today, we are offering 6-in-1 service and those are (1) Local and International Money transfer that offers multiple channels; (2) Bills payment service; (3) Local and International Travel and tours that provides complete air and sea travel itinerary services, (4) Prepaid Loading that offers huge discounts and allows you to generate more dealers and retailers; (5) Courier service offers nationwide delivery at the most affordable cost and (6) XP Market Place an online shop that sells well-known brands such Nokia, Lenovo and Hanabishi at a Dealer Rate.

Ezypay is an award-winning fintech company that specialises in processing subscription and recurring payments. Since 1996, Ezypay has helped local Australian and New Zealand businesses generate revenue and settle complex financial scenarios with repeat customers the easy way. To date, Ezypay has processed over $3 billion worth of subscription payments.

FASTEK PAYMENT SOLUTIONS INC., was incorporated in January 2020. It is the fastest-growing Payments Solutions provider and Hardware & Software developer in the Philippines. Working with different partners nationwide, Fastek aims to digitize and systemize the way businesses handle different financial aspects of their company.

The better way to get paid. FasterPay is a digital e-wallet platform which is FCA regulated and non-VC funded. Transparent, friendly and flexible, FasterPay provides businesses from all backgrounds the opportunity to expand their revenue to a global scale.

The better way to get paid. FasterPay is a digital e-wallet platform which is FCA regulated and non-VC funded. Transparent, friendly and flexible, FasterPay provides businesses from all backgrounds the opportunity to expand their revenue to a global scale.

Buy load, pay bills, send money, pay using GCash QR, shop online, and more – all using the GCash App!

Geniusto is a technology ‘enabler’ for banks and credit unions, payment providers, remittance companies, and eMoney issuers on an international scale. Our digital banking and payment solutions are relied on by regulated institutions in a dozen countries across Europe and the UK, Southeast Asia, and the USA.

Winner of prestigious Asia’s Corporate Excellence and Sustainability Awards 2019 as Asia’s Best Performing Company, GHL is at the forefront of Asian payment space alongside with more than 100 global and regional renowned payment schemes and brands. GHL reach transcends across 6 countries; Malaysia, Thailand, Philippines, Indonesia, Singapore, and Australia – stretching over a vast footprint of 380,000 payment points across the region.

Giftaway® is an eGift® platform that makes it easy for businesses to reward and incentivize stakeholders such as employees and customers.

The platform also powers the eGift programs of the Philippines’ top merchants such as SM, Robinsons, Puregold, Rustans, Nike, Power Mac, Jollibee, Max’s Group, and The Bistro Group.

Giftaway and eGift® are registered trademarks of Giftaway Inc.

Global Payments (NYSE: GPN) is a Fortune 500® payments technology company, delivering the leading complete worldwide commerce ecosystem.

Our unique, connected infrastructure unifies every aspect of commerce, from issuer solutions to payments, and the innovative software that delivers seamless customer experiences. Headquartered in Atlanta, Georgia, we’re a worldwide team of approximately 25,000 people—including local experts on the ground in nearly 40 countries. Together, we support thousands of businesses across more than 100 industries. Empowering commerce for everyone.

Goodpay is the fastest-growing, next-generation payments platform. Designed and Created by GoodTech

GrabPay is an eWallet within the lifestyle “super app” app, Grab. It is the largest ride hailing app in Southeast Asia and has over 100 million users. GrabPay not only allows users to store credit in app and pay for all the services Grab provides, it also lets users pay in store and online in place of cash and cards.

GrabPay is bridging the gap for economies that are still very cash dependent yet striving for a cashless society. With GrabPay, merchants can reduce the cost of managing cash as well as increase the payments experience for shoppers.

GrowSari is a tech-enabled B2B platform that helps the Philippines’ over one million sari-sari stores get better service level, assortment, and access to new services, outfitting them with both the infrastructure and tools they need to transform themselves from simple FMCG outlets to comprehensive service hubs for the nation’s grassroots communities.

HelixPay provides e-commerce technology for ticketing and the creator economy in the Philippines.

HitPay is a one-stop payment platform for SMEs, on a mission to empower businesses with easy access to digital payments. From no-code e-commerce plugins to affordable credit card readers, we help thousands of merchants bring their business dreams to life. HitPay is backed by Tiger Global, Global Founders Capital, Y Combinator, HOF Capital, and angel investors.

iBayad Online Ventures, Inc. is a FinTech (Financial Technology) start-up company in the exciting field of mobile payments and e-commerce. Our company endeavors to bring innovative solutions for micro entrepreneurs and SME’s, with the purpose of empowering their businesses with technology, which will allow them to remain relevant and competitive, in their respective industries. We likewise aim to deliver beneficial financial services to the unbanked and underbanked sector of society, who remain unreached and unserved by traditional financial institutions.

Instapay’s digital account is specially designed for the needs of your workers. Instapay account’s mobile app is linked to Instapay Mastercard which makes it extremely convenient for your employees to receive their salaries into their Instapay accounts. Instapay is regulated by Bank Negara Malaysia (Central Bank of Malaysia) and empowers your workers while simplifying the salary payment process for you.

We are one of the leading e-payment processing solutions provider and a direct agent of Western Union. We currently provide e-payment and logistics services for major government agencies in the Philippines. We handle over 15,000 daily transactions servicing Filipinos across the archipelago.

iPay88 Holding Sdn Bhd is the leading regional Payment Gateway Provider in South East Asia. Since 2006, iPay88 has successfully provided e-commerce and online payment services to more than 10,000 merchants regionally and globally.

I-Remit, Inc. is the largest non-bank Filipino-owned remittance company. Its vision is to be the ultimate choice remittance service provider globally. I-Remit pursues this vision and relentlessly relies on the innovative drive of the organization to be able to provide more meaningful and more accessible services to its customers.

JustPayto is a technology company that enables digital payments and money transfers for individuals and businesses. JustPayto offers convenient inter-bank, inter-institution, inter-platform, inter-currency money transfers. The company creates a frictionless ecosystem with any bank, any financial institution, and any e-wallet. The company makes traditional cash-based and digital cash-less payment methods work together – credit/debit cards, bank fund transfer, online banking, over-the-counter, e-wallet, and cryptocurrency.

Headquartered in Tokyo, Japan, Degica is a leading provider of Japanese digital commerce solutions: our ePayment Platform Komoju provides global businesses and developers the access they need to grow and succeed in the Japanese market. We build and manage online sales for Retail, Digital, and Gaming companies that are looking to establish and expand their business presence in Japan and South Korea.

KUSINGph is a digital currency platform especially created for the farmers, fisherfolks, out of school youths, students, and for the Filipino community which empowers them to conveniently transfer & receive, deposit, and withdraw anytime, anywhere!

We make payments super easy. Whether you want to sell online, build a mobile app, or just collect payments from your customers, Magpie has the tools and features you need.

Megalink Inc is a fully owned subsidiary of Hitachi Ltd offering outsourced banking and Fintech solutions in the Philippines.

MEGAPAY turns your phone into a loading station. The newest, safest and most convenient way to sell prepaid products. Using the MEGAPAY app you can now load all networks plus other prepaid products anytime anywhere in the world.

Shop online. Pay with cash at any M Lhuillier Branch.

No credit card needed! With ML ePay you can pay for your online purchases in cash at any M Lhuillier branch.

Moneygment is a mobile-based payments solution designed by Togetech Inc. for self-employed individuals. Through the app, users can pay their government contributions and taxes, settle utility bills, loans, insurance and investment payments.

We automatically route payments through the most optimal channels, ensuring the highest transaction success rates in the market.

MULTISYS TECHNOLOGIES CORPORATION (MULTISYS) is a software engineering solutions firm that provides a wide range, cost-effective, and full scale service to tailor-fit and empower businesses.

MYEG PH is a one-stop provider of e-government solutions and payment services which allow Filipinos to transact with government agencies anytime, anywhere.

Nationlink (under Infoserve Incorporated) is a registered International Financial Technology Company based in the Philippines. It is regulated and supervised by Bangko Sentral ng Pilipinas as a “Non-Bank Financial Institution”.

We envision communities that are made strong through the provision of innovative and accessible financial services. For 36 years, We have impacted numerous bottom tiered-financial institutions through the platform of banking, remittance, payment services, electronic money, and mobile/web-based financial services.

NextPay is a better alternative to bank accounts for small businesses and entrepreneurs in the Philippines. Collect customer payments, manage company finances, and pay for their expenses to any bank or eWallet, all on one digital platform.

OmniPay, Inc. is a non-bank financial institution (NBFI) supervised by the Central Bank of the Philippines. This is the first non-bank financial institution in the Philippines granted an electronic money issuer license.

Pay8, Inc. is a Filipino owned company, in partnership with Facil-IT-8 Communication Corp. We provide complete solutions of ground-breaking technology from system development, integration, installation and setup of necessary equipment, as well as management and support services in the communications area, with a focus on information and new media improvement. Pay8’s mission is to enable innovation through collaboration.

Payactiv is the best way for employees to get financial relief between paychecks, a service needed by two-thirds of the workforce. We give businesses the tools essential to ease the financial stress of their employees and build a higher performing workforce.

Payment Innovation, Inc. (“PayCools”) is a SaaS focusing on Business Solutions with operations in Southeast Asian countries, particularly in Indonesia, the Philippines, and Malaysia. PayCools includes finance, payment, and business solutions.

Maya is the all-in-one money platform that is bringing Filipinos bolder ways to master their money. It is powered by a unique integrated financial services ecosystem that addresses the ever-evolving needs of today’s generation of money makers through cutting edge technology.

Paymentwall is a global payment platform that unites over 150 payment methods, including credit and debit cards, bank transfers, e-wallets, prepaid cards, and mobile carrier billing, covering the full spectrum of local payment methods in a single integration. In addition, Paymentwall offers a comprehensive set of payment services, including a proprietary risk management engine, dispute management service, customizable payment flows, settlement services, reporting, and analytical tools.

At Paymongo, we help businesses in the Philippines accept online payments from multiple channels fast and easy, in just minutes. We believe that the way we transact should be an enabler of trust and efficiency. Our mission is to become the invisible engine of commerce that gives everyone the opportunity to participate and succeed in the rapidly transforming digital economy.

Paynamics Technologies Inc. is a Payment Service Provider and Software Development company based in Manila, Philippines. Our company offers various electronic payment products such as creditcard/debit card processing, check processing and other alternative payments such as bank transfers, ewallets and vouchers.

At PayPal, we believe that now is the time to democratize financial services so that moving and managing money is a right for all citizens, not just the affluent. We are driven by this purpose, and we uphold our cultural values of collaboration, innovation, wellness and inclusion as our guide for making decisions and conducting business every day. It is our duty and privilege to be customer champions and put those we serve at the center of everything we do.

PayPanda’s ultimate goal is to deliver quality customer service in this fast-paced environment. We offer this alternative online approach where all goods and services purchased through various eCommerce platforms may now be conveniently settled through our payment portal. We have partnered with numerous banks and non-banks for the ease of both payment by the Customers and collection on the Merchant’s side.

Payoneer is the world’s go-to partner for digital commerce, everywhere. From borderless payments to boundless growth, Payoneer promises any business, in any market, the technology, connections and confidence to participate and flourish in the new global economy.

By working with Payreto, clients and employees alike can propel their growth by taking advantage of the global reach and experience of Payreto in the financial services space. Our financial industry workflow expertise allows us to cover nearly any tasks behind the operations of neo or established banks, acquiring or issuing banks, fintech companies, payment providers, crypto wallet issuers, etc, (anywhere in the world).

PAYS0 is a payment gateway solutions provider that offers customizable payment processing services to meet the evolving needs of businesses in the Philippines.

PayTabs is an online, mobile, social & next generation payment processing powerhouse for merchants and super merchants.

By working with Payreto, clients and employees alike can propel their growth by taking advantage of the global reach and experience of Payreto in the financial services space. Our financial industry workflow expertise allows us to cover nearly any tasks behind the operations of neo or established banks, acquiring or issuing banks, fintech companies, payment providers, crypto wallet issuers, etc, (anywhere in the world).

PERA HUB is the country’s foremost urgent transaction center for money with over 3,000 locations nationwide which provides its customers with a comprehensive scope of reliable financial services in one location. PERA HUB is the retail brand of PETNET Inc.

Philpay PPMI (formerly PESONET)

We are duly recognized by the Bangko Sentral ng Pilipinas (BSP) as the country’s Payment System Management Body (PSMB).

PesoPay is the leading online payment gateway in the Philippines, allowing merchants to accept online payments via credit cards, debit payments and even over-the-counter cash payments.

Never overpay for fuel again. Maximize your fuel budget and enjoy big savings with PriceLOCQ!

QFPay is a global mobile payment technology, service and solution provider based in Beijing, China. The payment company has been partnering with various mobile wallet providers including Alipay, WeChat Pay, China UnionPay, among others, servicing over 1 million+ merchants across Asia and executing over 500 million mobile payment transactions totaling USD30 billion+ in transaction value over the last 6 years.

Your best payment partner, expertise in Credit Card and QR Code payments. We help you accept online payments easily, fast and securely. Helping your business thrive in the cashless new era.

Qwikwire is an invoicing and payments platform for large enterprises. It specializes in complex payments where the clients use ERP systems like SAP and Oracle and standard API integrations are inadequate.

Razer Merchant Services is Southeast Asia’s leading financial services provider. Operating in 8 countries and growing, we partner with five top ten online companies worldwide. Razer Merchant Services offers single API integration for businesses to seamlessly integrate credit card payment, online banking, e-wallet and cash-over-counter solutions.

Qwikwire is an invoicing and payments platform for large enterprises. It specializes in complex payments where the clients use ERP systems like SAP and Oracle and standard API integrations are inadequate.

Sendah Philippines is an e-commerce website that enables our Overseas Filipinos to send gifts to their families and friends in the Philippines.

Shopify is a leading global commerce company, providing trusted tools to start, grow, market, and manage a retail business of any size. We improve commerce experience with a platform and services that are engineered for reliability, while delivering a better shopping experience for consumers everywhere. Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as Allbirds, Gymshark, PepsiCo, Staples, and many more.

Pluxee is the leading global employee benefits and engagement partner that opens up a world of opportunities for everyone. A new brand with big ambitions for the future, we’re committed to working with local communities, responsibly and sustainably.

Spenmo is an all-in-one payables software that provides businesses the visibility, comfort, and control over how, when and why money is leaving the company.

SquidPay is a rising payment solutions company that aims to provide a convenient way of electronic payment and collection through a stored value card and mobile application.

Starpay is the mobile wallet designed to make handling your money simple, secure, comfortable, and convenient. Use your Starpay wallet to pay bills, buy e-load, and send money with ease!

Tagcash.com is the ultimate platform for social media monetization, group collaboration, and streamlined efficiency. Using embedded crypto and fiat ewallets for micropayments, Tagcash.com offers a range of cutting-edge features and tools that empower groups, influencers, and companies to monetize their online presence and increase their productivity.

The company, Taxumo, aims to spur economic growth by helping MSMEs, professionals and freelancers focus on the core business by freeing them from one of their major stressors — tax compliance. Taxumo is a BIR accredited Tax Software Provider that automates the computation, filing and payment of business taxes for the above identified markets. It’s an end-to-end mobile responsive web application that allows these business owners and professionals to file and pay their business taxes anytime, anywhere!

The ONLY Patented Payment terminal that offers the ultimate convenience in all sort of payments.

TransferMate is a global B2B payments technology firm, enabling companies to send and receive cross-border payments faster and easier than ever before. It has built one of the largest portfolios of payment licences worldwide, including 200+ countries & territories / 140+ currencies / 92 licenses.

TraXion exists to help elevate the social-impact quotient (SIQ) of any business or organization it works with through transformative technology. Our goal is to ensure fairness for the most underserved segments of society by giving them access to the same services and benefits available to the rest of society.

V5 INTERNATIONAL is a technology company that builds economic infrastructure for the internet. Businesses of every size—from new start-ups to large corporates—using the company’s software to accept online and offline payments. V5 also provides Software as a Service (SaaS) for a diversified range of financial products, enabling new companies to get started and grow their revenues, and established businesses accelerate into new markets and launch new business models.

A Worldwide Digital Network Ecosystem to Make, Send or Receive Local, Regional or Global Payments – Anywhere, Anytime

VeritasPay is a payment provider that develops face-to-face, online, and unattended payment solutions. Each are also inclusive of terminal and customer support services. The company is flexible with interfacing as it is able to integrate with banks, acquirers, payment networks, and enterprises.

VIRTUS PAYMENT

Virtus Remittance and Payment Inc., Handles Various Payment Services. Even if it is a payment service, the optimal method is completely different depending on the service type. Since there are various settlement services, we will propose the most suitable services according to the customer’s service form and situation.

Weepay Payment Processing Corporation or simply WEEPAY is a company established in the Philippines in 2007. It was initially an online payment division of then Accord Capital Equities Corp. (ACEC) which handles its e-Commerce and Online Payment Gateway Facility.

Xendit is a financial technology company that provides payment solutions and simplifies the payment process for businesses in Indonesia, the Philippines and Southeast Asia, from SMEs and e-commerce startups to large enterprises. We enable businesses to accept payments, disburse payroll, run marketplaces and more. The platform is known for its speed (fast integration, builds), simplicity (easy integrations, pricing), and world-class 24/7 customer support.

Xenpay, Inc., a bills payment solution that connects rural areas to a more accessible bill payment system.

XSwap is designed for fast-paced entrepreneurs with growing businesses. In a few minutes, you can get a business account and start paying employees and suppliers in bulk, collecting sales from customers, and monitoring company cashflow. And that’s just the beginning – more services coming soon!

Regulated and Licensed by Bangko Sentral ng Pilipinas (BSP) YOmoney is a fast-interactive wallet (E-wallet) where Clients can easily digitize their salary or commission disbursement needs and give more value and convenience to their whole organization.

ZoomPay’s Smart Payment Kiosk, gains Xytrix Systems Corporation, the much needed advantage in extending financial inclusion to the large unbanked sector of the population. Bridging the gap in financial inclusion of the unbanked population is Xytrix Systems Corporation’s primordial objective in its Financial Technology services offering.

AQWIRE is Global Property Marketplace that fully utilizes Smart Contract technology to process cross-border real-estate transactions.

C Estates connects people around the world to seamlessly transact and conveniently buy and sell real estate properties. Whether to verify a document, confirm notarization, validate asset’s ownership, buy or sell a property or finding someone to manage properties, C Estates has got everything you need to do your business in one place.

One-stop proptech ecosystem, providing efficient and seamless real estate transaction solutions.

Abra is the world’s leading crypto wealth management service. We’re forever changing how people think about investing and protecting their wealth.

Airwallex is a leading global financial platform for modern businesses, offering trusted solutions to manage everything from payments, treasury, and spend management to embedded finance. With our proprietary infrastructure, Airwallex takes the friction out of global payments and financial operations, empowering businesses of all sizes to unlock new opportunities and grow beyond borders.

BeamAndGo Pte Ltd is a social impact FinTech that enables migrant workers to meet their family needs and financial aspirations.

We inherently believe in building family security and resilience to uplift the lives of migrant workers, their families and future generations, that is why we are leading a movement for financial inclusion, education and management for migrant workers and their families.

Formally established in 1988, the PJ Lhuillier Group of Companies (PJLGC) is a dynamic, multi-industry company that owns and operates businesses dealing with financial services such as pawning, remittance, microinsurance, micro savings, and business to business micro loan solutions.

Coins.ph delivers financial services over mobile to the 300+ million people in Southeast Asia who are currently unserved by traditional banks. Our platform runs on Blockchain technology and is built on top of existing retail infrastructure (30,000+ cash-in/cash-out locations), cutting down on one of the biggest cost components of retail banking.

Denarii Cash enable money transfer using mobile wallet to help overseas workers to send money home with zerofees.

Buy load, pay bills, send money, pay using GCash QR, shop online, and more – all using the GCash App!

I-Remit, Inc. is the largest non-bank Filipino-owned remittance company. Its vision is to be the ultimate choice remittance service provider globally. I-Remit pursues this vision and relentlessly relies on the innovative drive of the organization to be able to provide more meaningful and more accessible services to its customers.

JustPayto is a technology company that enables digital payments and money transfers for individuals and businesses. We offer convenient inter-bank, inter-institution, inter-platform, inter-currency money transfers. The company creates a frictionless ecosystem with any bank, any financial institution, and any e-wallet. The company makes traditional cash-based and digital cash-less payment methods work together – credit/debit cards, bank fund transfer, online banking, over-the-counter, e-wallet, and cryptocurrency.

Luzon Brokerage Corporation (LBC) was founded in the 1950’s as a brokerage and air cargo event. LBC initially operated as an air cargo forwarding service provider and was the first to introduce 24-hour air cargo delivery service in the country. LBC soon became a respected leader offering fast and reliable Express Courier and Money Remittance service throughout the Philippines. Today, LBC offers the widest coverage and network with over 1,000 strategically located branches nationwide.

LuLu Financial Group is a leading name in financial service sector primarily dealing in foreign exchange, global money transfer and salary and wage administration.

M Lhuillier Financial Services Inc. is one of the leading non-bank financial institutions in the Philippines with more than 3,000 branches nationwide. The company specializes in pawning, remittance, insurance and more.

MoneyGram is a global provider of innovative money transfer services and is recognized worldwide as a financial connection to friends and family. Whether online, or through a mobile device, at a kiosk or in a local store, we connect consumers any way that is convenient for them. We also provide bill payment services, issue money orders and process official checks in select markets.

MoneyGram is a global provider of innovative money transfer services and is recognized worldwide as a financial connection to friends and family. Whether online, or through a mobile device, at a kiosk or in a local store, we connect consumers any way that is convenient for them. We also provide bill payment services, issue money orders and process official checks in select markets.

Maya is the all-in-one money platform that is bringing Filipinos bolder ways to master their money. It is powered by a unique integrated financial services ecosystem that addresses the ever-evolving needs of today’s generation of money makers through cutting edge technology.

At PayPal, we believe that now is the time to democratize financial services so that moving and managing money is a right for all citizens, not just the affluent. We are driven by this purpose, and we uphold our cultural values of collaboration, innovation, wellness and inclusion as our guide for making decisions and conducting business every day. It is our duty and privilege to be customer champions and put those we serve at the center of everything we do.

MoneyGram is a global provider of innovative money transfer services and is recognized worldwide as a financial connection to friends and family. Whether online, or through a mobile device, at a kiosk or in a local store, we connect consumers any way that is convenient for them. We also provide bill payment services, issue money orders and process official checks in select markets.

SendFriend is a blockchain-enabled payment platform, powering B2B payments across borders. For the millions of overseas workers who overpay for international money transfer every year, SendFriend leverages blockchain technology to reduce the cost of service by 65% from the industry average.

Skrill provide digital payments solutions to consumers and businesses around the world. From betting and trading to shopping to gaming, our online and mobile payment solutions help customers make payments when and how they want to. Our business solutions let companies of all sizes trade in a global marketplace.

MAYACENTER (former Smart Padala)

Your trusted Smart Padala is now Maya Center, your new one-stop money shop.

Strike’s mission is to build a more connected financial world. Strike allows users to send and receive money anywhere, instantly, with no fees. Strike believes that open payment networks enable universal participation in the financial system, ushering in a new digital economy with truly borderless money transfers. Strike leverages Bitcoin’s open payment network to offer users the first global peer-to-peer payments app and a novel bitcoin-native neobanking experience.

Tranglo is a global cross-border payment processing hub that supports business payments, mass payout, payment collection, money transfer and mobile top up. We have offices in Kuala Lumpur, Jakarta, Dubai and London.

Founded in 1976 Travelex has grown to become one of the market leading specialist providers of foreign exchange products, solutions and services, operating across the entire value chain of the foreign exchange industry in more than 20 countries. We have developed a growing network of over 900 ATMs and more than 1,100 stores in some of the world’s top international airports and in major transport hubs, premium shopping malls, high street locations, supermarkets and city centres.

TrueMoney is a leading international Fintech brand and is part of Ascend Money, a digital financial services venture of the Charoen Pokphand Group (CP Group) and Alipay/Ant Financial (Alibaba), two of the largest companies in Asia.

We are now one of the largest financial life platforms in Southeast Asia, growing from just 1 market to 6 markets in a span of 2 years. We currently have significant operations in Thailand, Cambodia, Myanmar, Indonesia, Vietnam and the Philippines.

Western Union helps you send money and provide for your loved ones almost anywhere in the world. Whether you’re sending money for education, healthcare or groceries, we offer money transfer services to help you send your support to family quickly.

We’re making a positive, irreversible change in the world of finance. Together. People on every continent around the world are choosing Wise to help them live, travel and work internationally. We’re the fairest, easiest way to send money overseas.

We’re changing the way people send money abroad. We’re taking something complicated and making it simple.

We’re the world’s largest angel network. Our online platform makes it quick and easy for entrepreneurs to upload their pitch, connect with investors and get funded. If you’re looking for funding or interested in investing, we’d love to hear from you.

Invest in the future and help your country while you save and earn with Bonds.PH – the easiest and most accessible way to buy and sell treasury bonds in the Philippines.

COL Financial Group, Inc. is the Philippines’ leading online stockbroker, with its online platform that offers access to both stocks and the country‘s top mutual funds. Established in 1999 and formerly known as CitisecOnline, COL Financial is trusted by over 290,000 clients today.

Buy load, pay bills, send money, pay using GCash QR, shop online, and more – all using the GCash App!

Investagrams is a one stop shop to financial freedom. It provides a handy guidance for people who wants to start their journey in the world of stock market.

Helping Filipinos to a better tomorrow. The online trading division of Abacus Securities Corporation.

Maya is the all-in-one money platform that is bringing Filipinos bolder ways to master their money. It is powered by a unique integrated financial services ecosystem that addresses the ever-evolving needs of today’s generation of money makers through cutting edge technology.

Geared towards a more technology-driven stock market industry, Philstocks Financial Inc. continuously innovates its products and services to make the stock market more accessible for the investing public.