Sumsub Makes Presence at Philippine Fintech Festival 2023

by Fintech News Philippines November 21, 2023Fintech companies in the Philippines and the ASEAN region are gearing up this week for the Digital Pilipinas Festival from November 20 to 24.

This event, known for its valuable networking opportunities and fostering innovative collaborations, serves as a dynamic platform for tech startups, established institutions, and technology enthusiasts to come together and explore the latest trends, cutting-edge technologies, and transformative ideas in finance and technology.

It also presents an opportune moment for Sumsub, a comprehensive full-cycle verification platform, to interact with industry players and prospective clients ranging from compliance and anti-fraud experts to Chief Security Officers (CSOs) and Chief Product Officers (CPOs).

Introducing Sumsub

Sumsub was founded in 2015 as an identity verification company. They developed an in-house anti-fraud detection technology based on the founders’ forensic technology experience and neural network expertise.

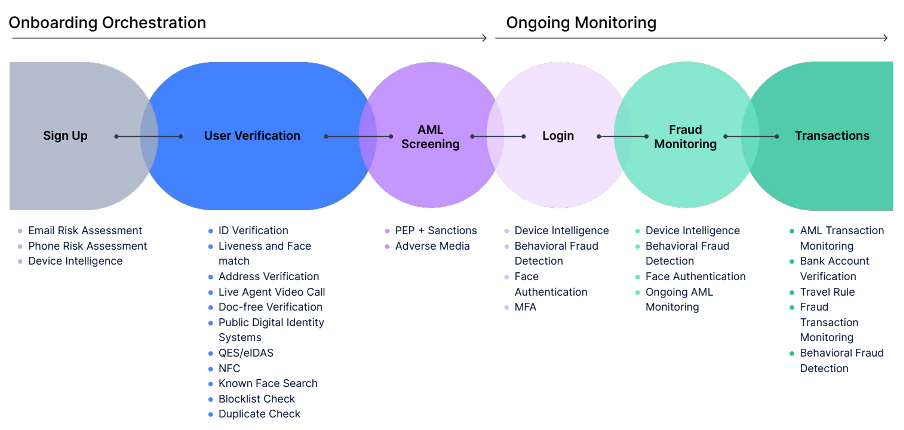

This was later transformed into a fully automated anti-fraud and AML solution for onboarding. Since then, Sumsub has expanded its horizons by adding natural transaction and compliance monitoring/reporting capabilities.

This has led to its position today as a full-cycle verification platform, ensuring security throughout the whole user lifecycle. From rapid user and business verification to fraud prevention and adept case management, Sumsub has it covered.

Digital fraud on the rise in ASEAN

Sumsub’s internal stats show that an alarming 70 percent of fraud activity occurs after the initial Know Your Customer (KYC) onboarding phase. Recent breakthroughs in artificial intelligence (AI) and deepfake technology add even more complexity to fraud detection.

Deepfakes, a synthetic image of a person digitally manipulated to appear to be someone else, are becoming a persistent threat.

According to internal data, the percentage of the most prevalent fraud types, forged and edited IDs, rose to 30 percent in the Philippines within the same period compared to the previous year. Fraud in the online gaming industry rose more than five times correspondingly.

The financial losses from business disruptions, penalties, and fines can be astronomical. That is why partnering with a full-cycle verification and fraud expert like Sumsub is crucial to empower businesses to chart their growth trajectories confidently.

What makes Sumsub stand out

With AI and machine learning at its core, Sumsub’s products are primed for the future. The recent introduction of the advanced Deepfake Detector, incorporated into its Liveness solution, underlines the company’s dedication to counteracting sophisticated fraud threats.

The company’s human behavioural monitoring capabilities allow it to identify fraud potential before it happens.

Recognition in the industry is a testament to commitment and quality. Sumsub’s inclusion in the 2023 Gartner Market Guide for Identity Verification speaks volumes.

The Gartner Market Guide, curated by expert researchers and advisors, sheds light on emerging market trends in identity verification, making the choice easier for businesses.

The Sumsub AI Suite for APAC

Sumsub’s comprehensive suite of services is built on AI-powered algorithms, making verification swift and efficient. Their KYC service ensures businesses can seamlessly verify users worldwide using various methods- ID, biometric, document verification, or liveness detection.

It further supports AML screening, checking users against global sanctions and watchlists. With the ability to cater to different industries, from fintech to digital assets and online gaming, it’s a versatile platform that adapts to evolving business needs.

Sumsub secures the whole user journey with one platform. Click here for a list of document types accepted by Sumsub for verification in the Philippines.

Schedule a Meeting at the Philippine Fintech Festival 2023

For industry professionals attending the event, this is a unique opportunity to speak with our representative, understand our identity verification solutions, and more. Schedule a meeting today.

By consolidating compliance processes and creating a secure environment across diverse Asian markets, they’re ensuring businesses can confidently chart their growth trajectories.