According to the latest report from Gobi-Core, the Philippines’ tech ecosystem continues to be one of the most resilient in Southeast Asia.

However, despite this impressive growth, the Philippines still faces a significant challenge: a need for more tech talent.

The burgeoning issue has been a point of contention for many startups and companies in the country, and it is one that the government is looking to address.

IT Business Process Association of the Philippines (IBPAP) President and CEO, Jack Madrid, recently told the European Chamber of Commerce of the Philippines that the attrition rate in the country’s Information Technology and Business Process Management (IT-BPM) sector is between 30 to 40 percent, and has increased since 2021.

Jack Madrid

“While the industry is optimistic about growth in 2022, one of the challenges facing the industry is a “pressing talent shortage,” he said.

“There is difficulty in finding enough people to fill roles. There is too much attrition in our industry, which has put price pressure on our salaries; there is also a misalignment of talent and supply and access to this talent,” Madrid added. “Another challenge is the fast-rising salaries, especially for niche skills.”

A growing industry needing more tech talent in Philippines

With favourable market conditions and incentives to support it, the archipelago’s tech industry is growing at a rapid pace. Still, the pool of talent for hire can leave firms feeling wanting.

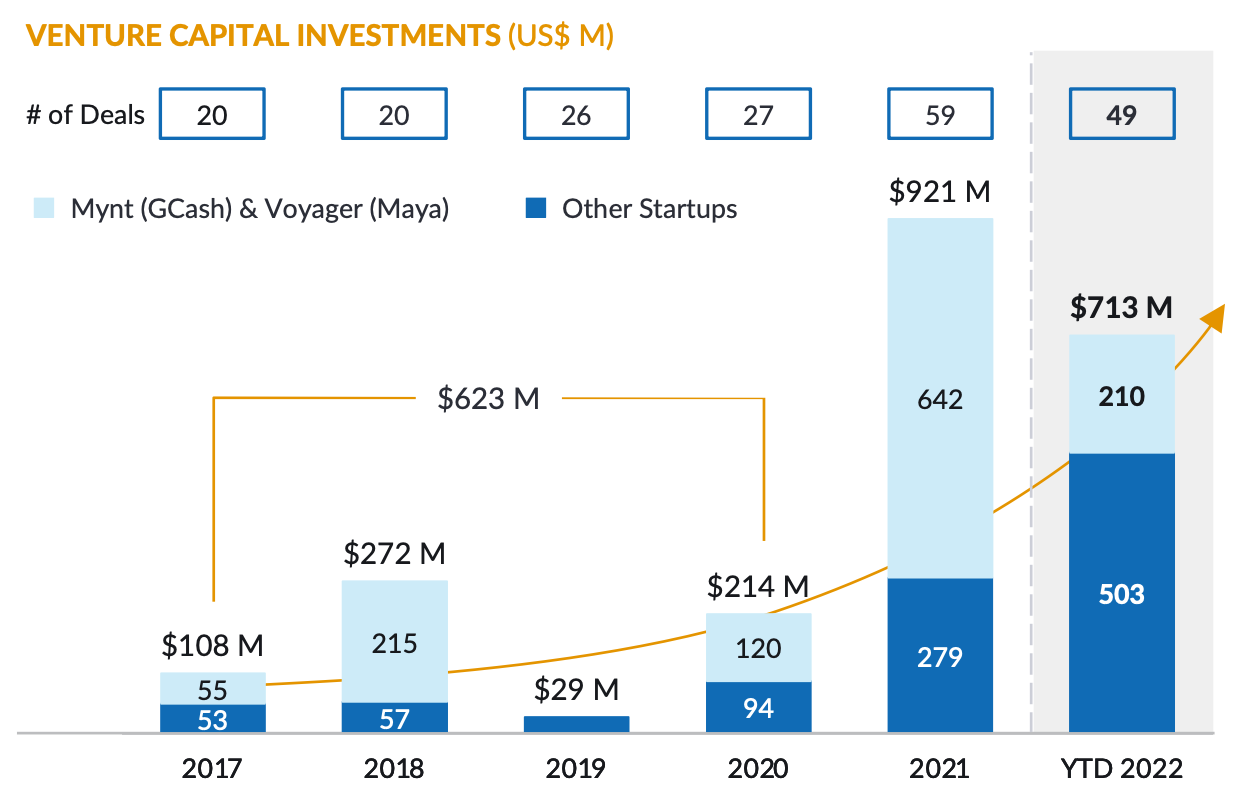

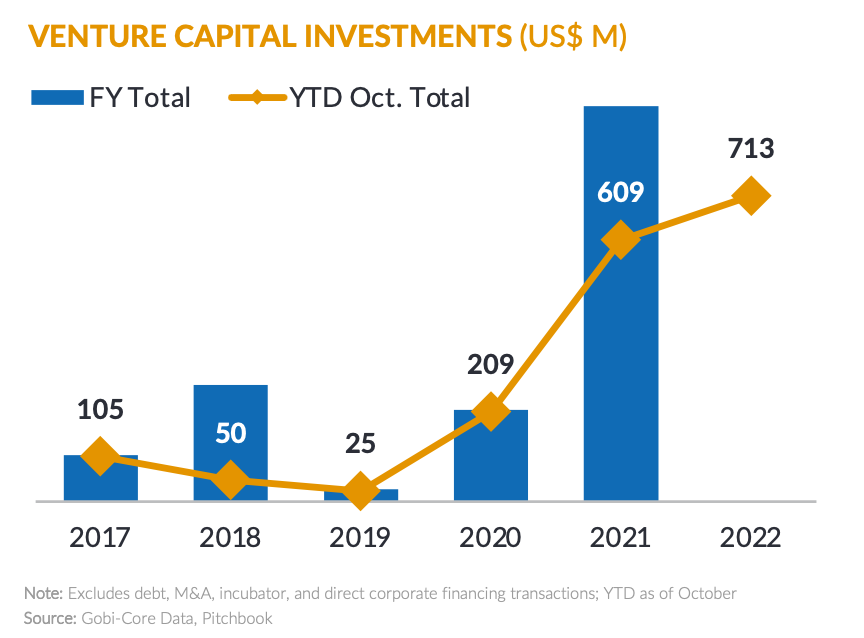

Venture capital investment in 2021 soared to PHP345 billion (US$609 million), almost tripling the figure of PHP116 billion (US$209) million from 2020. According to the Philippine Venture Capital Report 2022 by Boston Consultancy Group, funds raised by the country’s startups have reached PHP187 billion (US$310 million) in the first two months of 2022, with fintech continuing the lead in deal value for the second consecutive year.

Venture Capital Investments. Source: Gobi Core

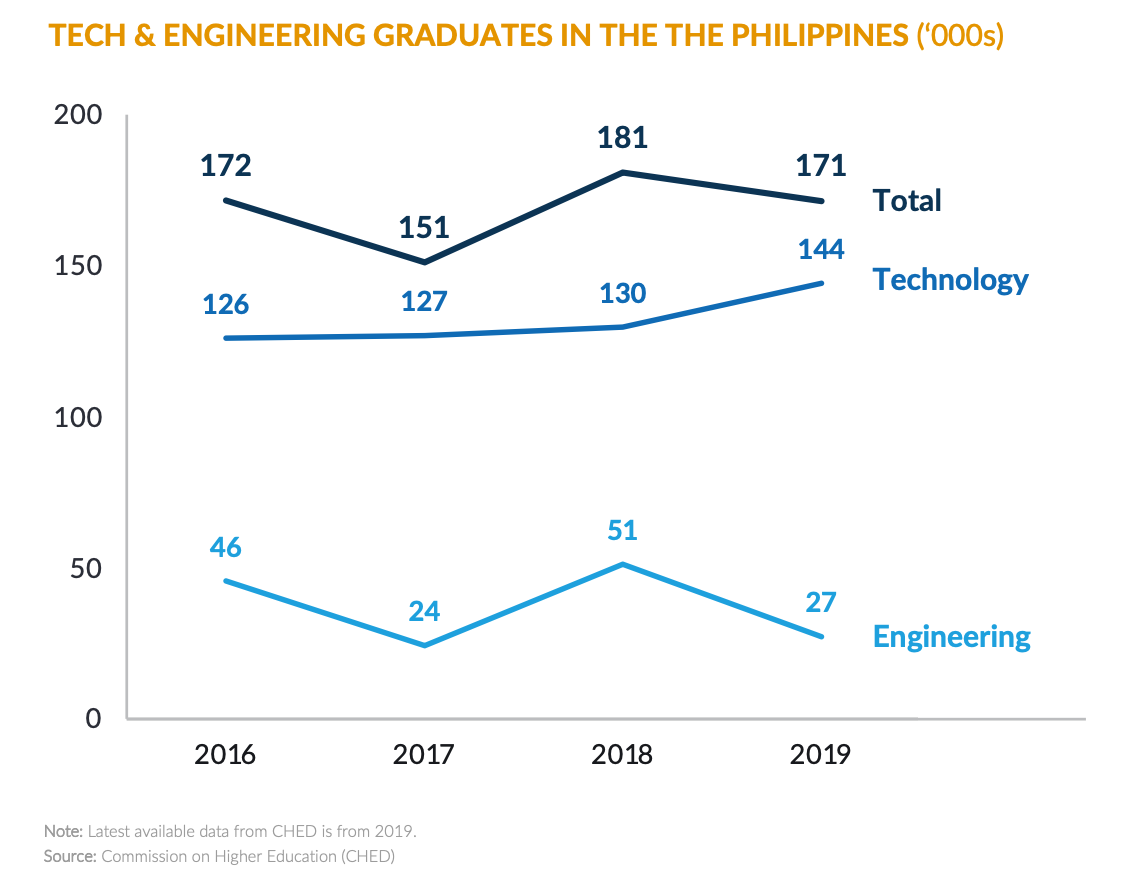

In stark contrast, the number of tech and engineering graduates in the Philippines remains stagnant at around 150 to 180 thousand. Gobi-Core estimates that 2020 and 2021 produced even fewer graduates due to the consistent enforcement of national lockdowns and the shift to online learning classes during the height of the COVID-19 pandemic.

Tech and Engineering Graduates. Source: Gobi Core

A compounding factor to the issue is that jobs in Computer / IT currently have the highest median monthly salaries among all industries — with salaries that are 73 percent above average at the Junior level, 113 percent above average at the Supervisor level, and 55 percent above average at the Manager level.

This will add to the headcount costs, resulting in less-well-funded startups getting squeezed out if the talent supply needs to grow in tandem with the demand.

Carlo Delantar

“We will continue to see exponential growth in digital consumption as we move forward into a post-pandemic world. This will translate into escalating demand for new digital products and services, which will herald the emergence of new entrepreneur-led startups operating in emerging industries beyond the formidable ‘Iron Triangle’ of fintech, e-commerce, and logistics,” revealed Gobi-Core General Partner and Gobi ASEAN Circular Economy Head, Carlo Chen-Delantar.

“Even as today’s macroeconomic environment shows signs of a slowdown, we foresee growing potential in the flow of venture capital into these new startups. However, their growth will be tempered by the lack of talent – the lifeblood of every startup ecosystem,” Delantar continued.

Post Pandemic effects

One of the significant post-pandemic effects is more startups emerging in light of job cuts and entrepreneurship trends. In fact, the country is now home to 2,439 tech startups, with new companies being founded daily, and the Philippines Department of Trade and Industry reports that fintech and e-commerce remain the country’s top-performing sectors.

As of October 2022, the Philippines has seen fundraising rounds closed by entrepreneur-led startups, bringing the total funds raised north of PHP283 billion (US$500 million), nearly doubling the total amount raised in 2021.

Venture Capital. Source: Gobi Core

While GCash and Maya steal all the headlines in the Philippines, companies such as Lista (that raised P289.17 million or US$5.1 million in funding led by Singapore-based Openspace Ventures) and troubled PayMongo (who entered into a partnership with Atome) are other fintech firms drawing attention and funding.

Other notable mentions include GrowSari, with a total of PHP623 billion (US$110 million) raised funds, and Philippine Digital Asset Exchange (PDAX), raising more than PHP283 billion (US$50 million).

The emergence of Gen-Z to fill the tech talent crunch in Philippines

E-commerce and logistics remain among the most significant venture investments in the Philippines economy from the likes of the region’s powerhouses such as Lazada. With more than P113.08 billion (US$2 billion) injected into the ecosystem over the last five years, Gobi-Core expects the up-and-coming generation of startups to create more jobs.

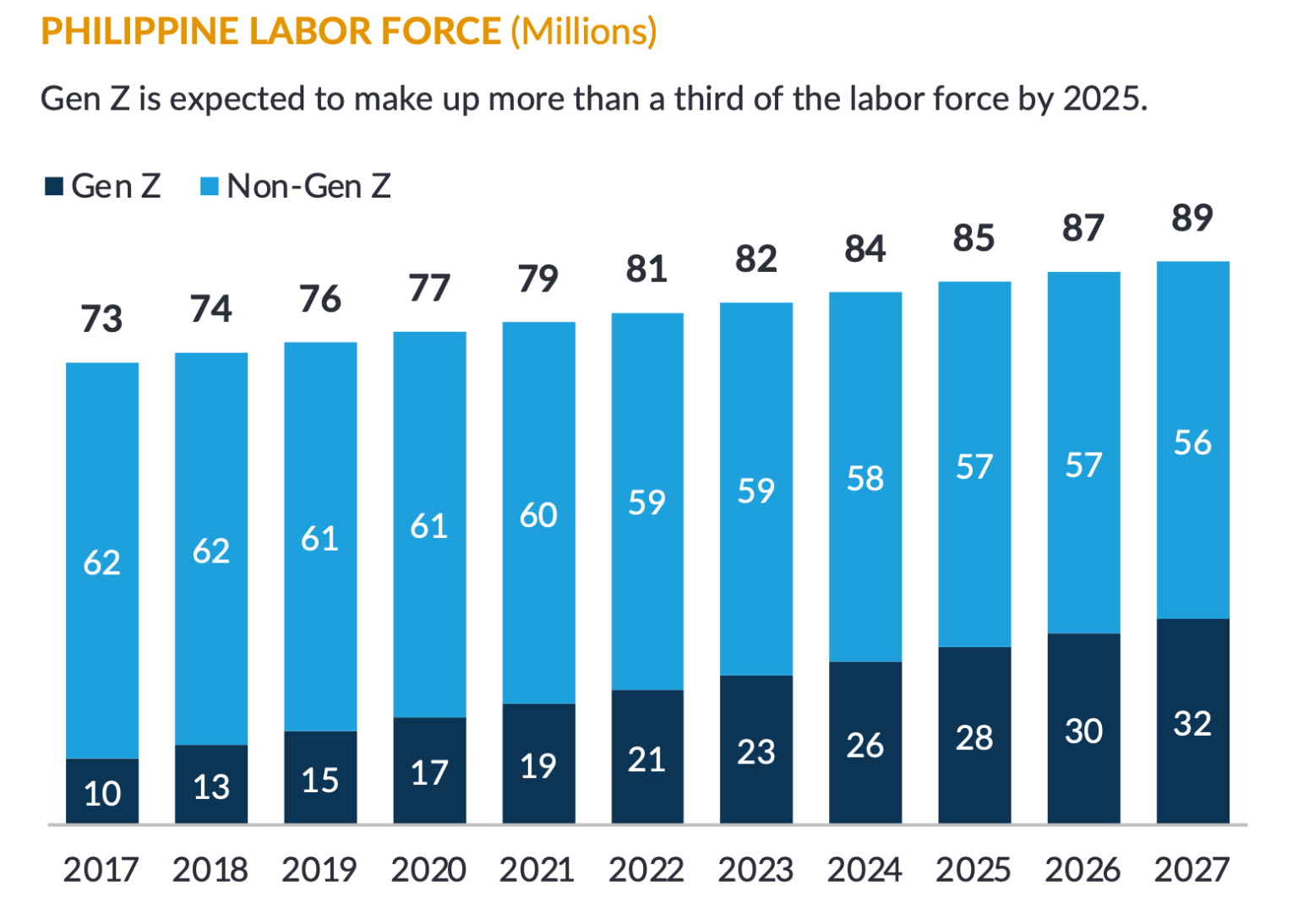

And as the workforce grows younger with the entry of Gen Z, who grew up with technological advances and innovations in recent years, it is pivotal to equip them with the right skills to complement their receptiveness towards jobs in the technology sector, to meet the demands for tech talent in the country.

Gen Z is expected to make up more than a third of the labour force by 2025. Source: Gobi Core

Delantar concluded, “The local talent pool has the potential to grow, especially with the digitally native Gen Z entering the workforce. We recommend adopting long-term, cost-efficient talent acquisition strategies, such as coding boot camps, internship programmes, and university competitions.”