The Philippines has become a hotbed for cryptocurrency adoption due to its tech-savvy population and growing internet penetration. In recent years, cryptocurrencies have grown significantly, with more people using digital currencies for various purposes, including remittances, investments, and online transactions.

This has led to the government’s development of a regulatory framework for virtual currencies, reflecting their positive outlook toward crypto adoption, albeit with caution.

The government’s optimism towards crypto adoption is evident as they continue to seek ways to regulate and monitor the market. This cautious approach is understandable, given the potential risks associated with cryptocurrencies, such as volatility and security concerns.

Regulation of the nation’s monetary policy

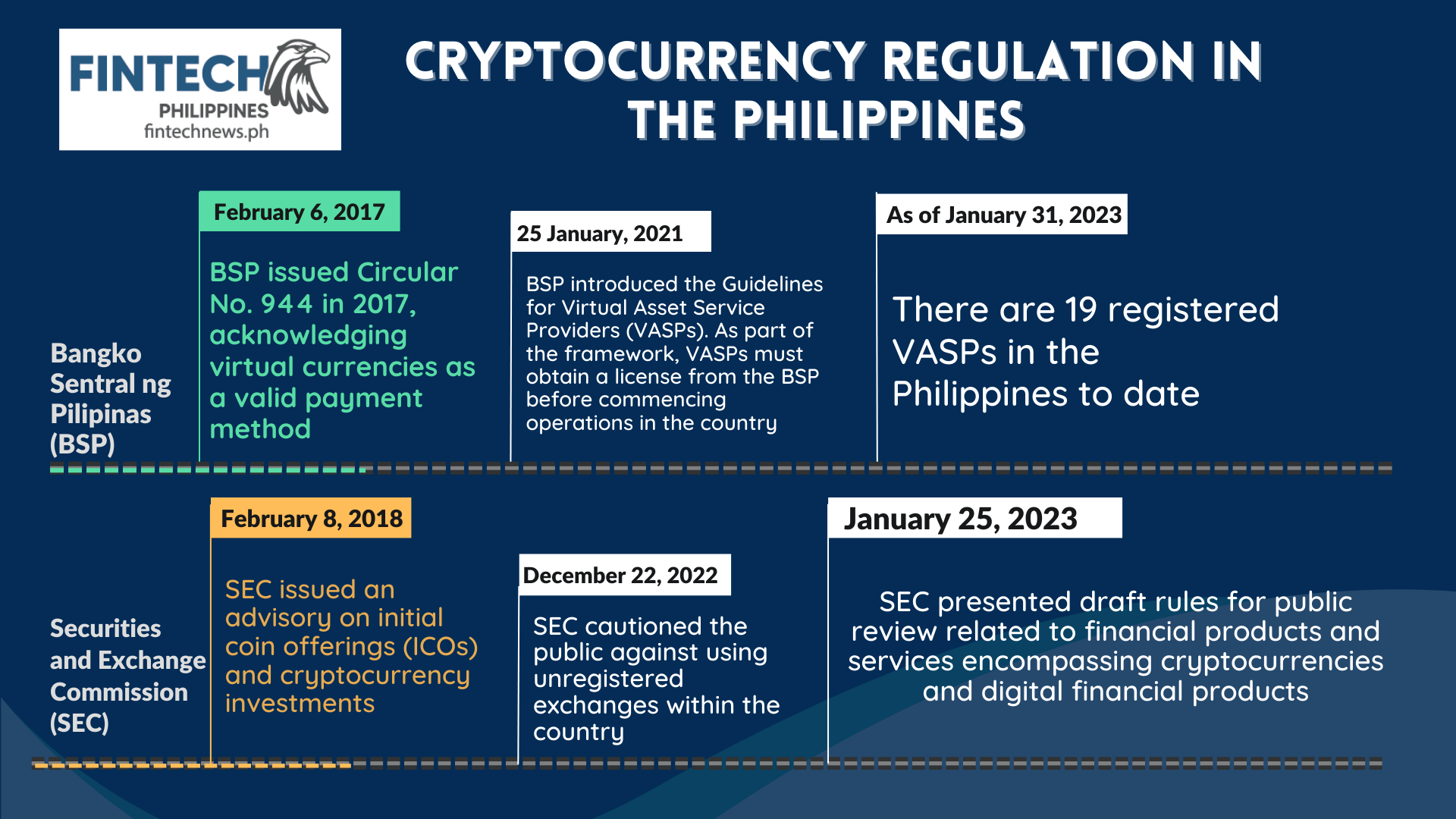

As the Philippines’ central bank, the Bangko Sentral ng Pilipinas (BSP) is crucial in regulating the nation’s monetary policy. In an effort to embrace the evolving financial landscape, the BSP issued Circular No. 944 in 2017, acknowledging virtual currencies as a valid payment method.

This circular mandated virtual currency exchanges to register with the BSP and adhere to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

Building upon these initial regulations, the BSP introduced the Guidelines for Virtual Asset Service Providers (VASPs) in 2021. These guidelines established a comprehensive regulatory framework for virtual currency exchanges in the Philippines.

As part of the framework, VASPs must obtain a license from the BSP before commencing operations in the country. Furthermore, the guidelines emphasize the importance of implementing effective Know Your Customer (KYC) and AML/CTF measures. VASPs must collect customer identification information and actively monitor transactions to detect and report suspicious activities.

As of January 31, 2023, there are 19 registered VASPs in the Philippines, including ABA Global Philippines, Inc. (trading as COEX STAR), Bloomsolutions, Inc., and the Philippine Digital Asset Exchange (PDAX). These VASPs provide various services, such as trading, remittance, and asset management, to cryptocurrency users in the country.

Regulation by the Securities and Exchange Commission

The Securities and Exchange Commission (SEC) is the government agency in charge of regulating the Philippines’ securities, investments, and financial instruments.

In 2018, the SEC issued an advisory on initial coin offerings (ICOs) and cryptocurrency investments, warning investors about the risks involved and mandating that companies conducting ICOs register with the SEC and adhere to securities regulations.

In late December 2022, the SEC cautioned the public against using unregistered exchanges within the country, noting that many of these exchanges were allowing Filipinos to access their platforms unlawfully. This underscores the importance of utilizing regulated exchanges for cryptocurrency transactions in the Philippines.

On January 25, 2023, the SEC presented draft rules for public review related to financial products and services encompassing cryptocurrencies and digital financial products.

The proposed guidelines aim to enact a newly enacted law, granting the SEC more authority to enforce regulations, oversee the market, and perform inspections and surveillance. The guidelines also expand the meaning of security to encompass “tokenized securities products” and other financial products employing blockchain or distributed ledger technology (DLT).

Taxation of cryptocurrencies in the Philippines

The Philippine government has recently implemented a capital gains tax of up to 15 percent on cryptocurrency transactions to regulate and tax the growing digital asset market. This tax applies to profits made from the sale or exchange of cryptocurrencies and purchases made using cryptocurrencies.

Under the new regulations, Filipino citizens who own or trade cryptocurrencies are required to report their capital gains during their annual tax filings.

There have been discussions by the government about implementing new taxes on crypto by 2024, causing concerns that Manila may adopt India’s approach and levy a 30 percent flat tax on all crypto earnings.

These new rules are designed to bring more transparency to the cryptocurrency market and ensure that profits made from digital assets are properly reported and taxed. The government hopes this move will generate additional revenue and help protect investors from potential fraud and market manipulation.

Benefits of cryptocurrency regulations in the Philippines

The Philippines has taken significant steps to develop a comprehensive regulatory framework for cryptocurrencies, ensuring a safe and secure environment for users and businesses. These cryptocurrency regulations in the Philippines promote transparency, protect consumers, and prevent illicit activities such as money laundering and terrorist financing.

Users can have peace of mind knowing that the government is actively monitoring and regulating the industry, ensuring their rights and obligations are protected. Additionally, businesses may feel more inclined to accept digital currency payments, increasing the country’s adoption and use of cryptocurrencies.

With more clarity through regulations, cryptocurrency users can better understand their rights and obligations, potentially encouraging more businesses and services to accept digital currency payments. With a proactive approach to cryptocurrency regulation, the Philippines continues establishing itself as a leading player in the global digital currency landscape.