OmniPay is the First Non-Bank on BSP’s Real-Time Payment System

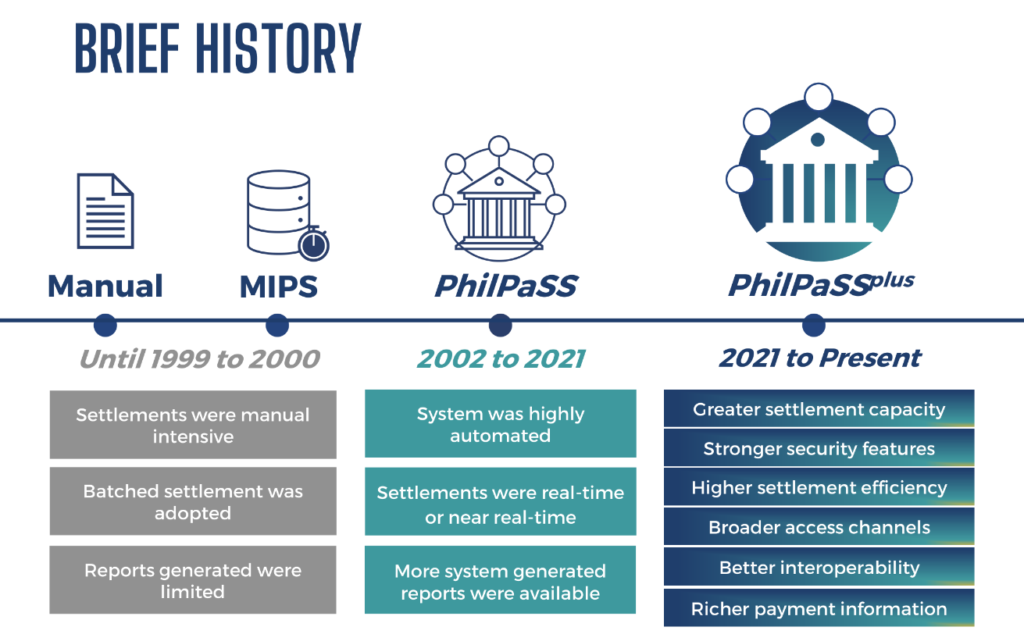

by Fintech News Philippines January 10, 2024The Bangko Sentral ng Pilipinas (BSP) recently integrated OmniPay, Inc. into its PhilPaSSplus system, marking it as the first non-bank electronic money issuer (EMI) to participate in the BSP’s Real Time Gross Settlement (RTGS) payment system. This inclusion underlines OmniPay’s status as the inaugural non-bank EMI licensed and overseen by the BSP.

BSP Assistant Governor Mary Anne P. Lim

Assistant Governor Mary Anne P. Lim of the BSP commented on this development, stating,

“Giving non-bank electronic money issuers access to the RTGS system is in accordance with the National Payment Systems Act, authorising the BSP to determine the institutions that are allowed to participate in payment systems owned and operated by it, and those that can open an account with the BSP for settlement purposes.”

This step towards a more inclusive national payment system enables non-bank financial institutions to conduct efficient and low-risk fund transfers independently, without reliance on a sponsoring RTGS participant.

The access to PhilPaSSplus allows these non-banks like OmniPay to directly engage in the secure and efficient transfer and maintenance of funds, involving the central bank in these operations. Highlighting the global trend of increasing diversity in RTGS system participation, Assistant Governor Lim assured that the BSP has established safeguards for the entire Peso RTGS payment system.

Source: BSP

Currently, 236 institutions utilise PhilPaSSplus for settling significant transactions and retail payment clearing outcomes from ATMs, InstaPay, PESONet, and check transactions. This group includes various banking and financial entities, encompassing universal and commercial banks, thrift banks, rural banks, digital banks, Non-bank Quasi-Banks (NBQBs), Clearing Switch Operators (CSOs), Financial Market Infrastructures (FMIs), and non-bank EMI participants.

The BSP is one of the initial central banks to broaden direct access for non-bank entities to central bank settlement services. This move aligns with the efforts of international standard-setting bodies, which are currently developing access guidelines. These guidelines aim to maintain manageable risks as payment systems evolve, particularly with the entry of new players and the advancement of financial technologies.

Featured image credit: Edited from Unsplash