Posts From Fintech News Philippines

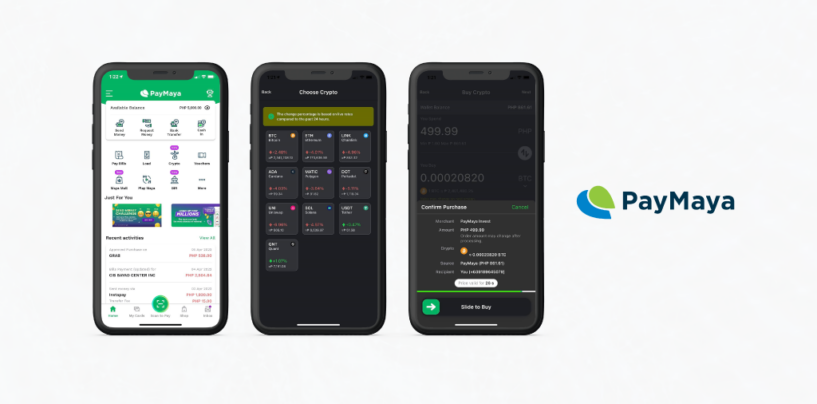

PayMaya Enables In-App Crypto Investments From as Low as PHP 1

Philippines digital wallet PayMaya has now enabled Filipinos to easily buy and earn cryptos such as Bitcoin and Ethereum from PHP 1 for an all-in-one app experience. Licensed by the Bangko Sentral ng Pilipinas (BSP), PayMaya is both an Electronic

Read MoreTonik Appoints Former Google, Meta Director as Its Chief People Officer

Philippines’ digital bank Tonik announced today the appointment of Manoj Varghese as its Chief People Officer to spearhead its growth and cultural integration. Manoj was formerly Google’s HR Director for Japan and Asia Pacific (JAPAC) as well as Director of

Read MorePhilippines’ Payment Infrastructure Undergoes Transformative Change

In the Philippines, the banking community is undergoing a major transformation to its payment infrastructure, a movement triggered by the convergence of several key drivers including changing customer behaviors, new regulations and advances in technology. During a recent webinar hosted

Read MoreTop Fintech Influencers in The Philippines

Esquire magazine has released its selection of the top fintech influencers in the Philippines, recognizing the men and women shaking up the industry, the investors and thought leaders directing the conversation, and the startup founders to watch for closely. This

Read MoreVelo Labs Partners PDAX to Enhance Cross-Border Payments to the Philippines

Velo Labs, a blockchain-based financial protocol enabling digital credit issuance and borderless asset transfer for businesses, and the Philippine Digital Asset Exchange (PDAX) have formed a partnership. The partnership aims to improve cross-border payments to the Philippines using blockchain technology.

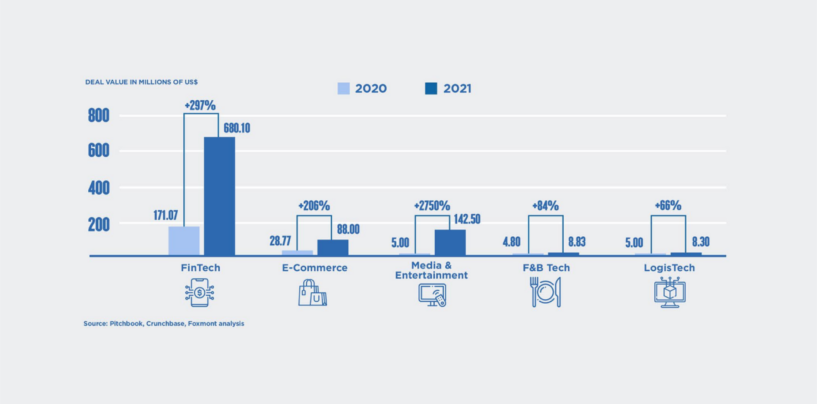

Read MoreFintech Takes Lion’s Share of Philippines Tech Funding for Second Consecutive Year

The Philippines’ fintech industry is blossoming on the back of surging funding activity, a conducive regulatory environment, and rapid adoption of digital financial services, a new report by the Boston Consulting Group (BCG) and Foxmont Capital Partners shows. In 2021,

Read MoreTonik Aims to Roll Out BNPL and Crypto Products in the Next Year

Philippines’ neobank Tonik marks its first year of operations in the country after securing a digital bank license from the Bangko Sentral ng Pilipinas (BSP) in June last year. Since its public launch, Tonik recorded PHP 1 billion (US$ 20

Read MoreAsian Firms Are Quick to Embrace Zero Trust Security Framework, Okta Survey Says

Over the past year, organisations in Asia have embraced the zero trust security framework at a fast pace, recognising the need to upgrade their IT security strategy to address the ongoing digital shift, according to a new survey by Okta,

Read MoreUnionDigital Bank Partners With YGG to Serve the Play-To-Earn Community

UnionDigital Bank, the digital bank entity of the Union bank of the Philippines, has signed a Memorandum of Understanding with global play-to-earn guild Yield Guild Games (YGG) during its first-ever Managers’ Summit. The partnership between UnionDigital Bank and YGG will

Read MoreThree Quarters of Filipino MSMEs Unable to Secure Funding in the Past 5 Years

More than three quarters (77%) of micro, small and medium-sized enterprises (MSMEs) in the Philippines have been unable to secure sufficient, or any, funding on at least one or more occasion over the last five years, according to a new

Read More