Financial Inclusion

Gigacover Expands to the Philippines to Boost the Gig Workforce’s Financial Health

Singaporean financial health platform Gigacover announced its expansion into the Philippines to offer more inclusive insurance and healthcare options tailored for the local gig workforce in partnership with Etiqa and Aventus Medical. The company said that flexible and cost-effective group

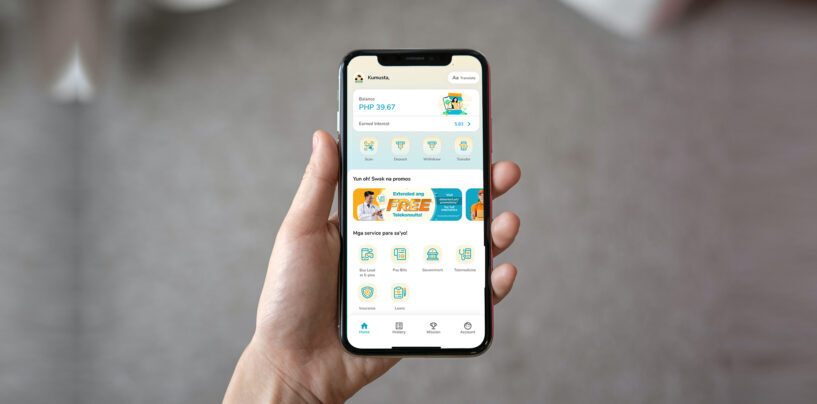

Read MoreRCBC’s DiskarTech App Recorded Phenomenal Growth Rate Since Last Year

Rizal Commercial Banking Corporation (RCBC), with its flagship financial inclusion app DiskarTech, has reached a five-digit organic growth in partner deposits by end of October versus same period last year. DiskarTech’s partner deposits recorded a 69,526 % and 12,765 %

Read MoreFormer Grab Execs Secure Funding for MSME Bookkeeping App Lista

Lista, a bookkeeping app for MSMEs based in the Philippines, has raised an undisclosed sum from oversubscribed round from 1982 Ventures, East Ventures, Saison Capital, Alternate Ventures, and other angel investors. The angel investors include former Grab Philippines’ President and

Read MorePhilippines’ Cantilan Bank Partners AFIN to Roll Out Mobile App for the Unbanked

Philippines rural bank Cantilan Bank (CANBNK) partnered the ASEAN Financial Innovation Network (AFIN) to launch its new mobile banking application “iCAN”. AFIN is a not-for-profit entity known for its open banking platform APIX and was established in 2018 by the

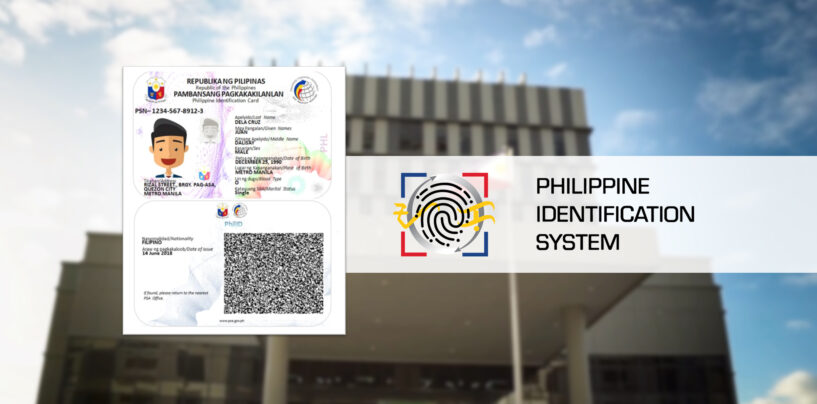

Read MorePhilSys: Key Building Block for Greater Financial Inclusivity in the Philippines

In August 2018, President Rodrigo Duterte signed the Philippine Identification System Act into law to create a national identification system where a single official identification card will be issued to every citizen that combines various government-issued identification. Through the act,

Read MoreFintech Alliance.PH Partners 10×1000 Tech to Roll Out Fintech Programme for Filipinos

Fintech training platform 10×1000 Tech for Inclusion launched its latest global Fintech Foundation Programme Flex, an online certificate programme with the goal to bridge digital skills gap to drive inclusion. Fintech Alliance.ph will collaborate with 10×1000 to recruit 100 learners,

Read MoreRCBC’s DiskarTech App Rakes In PHP 11.8 Billion in Transactions a Year After Launch

Rizal Commercial Banking Corporation’s (RCBC) financial inclusion super app DiskarTech has booked a gross transaction value in excess of P11.8 billion a year after its launch in July last year. This total throughput value is an aggregate of both organic

Read MoreBSP, French Development Agency Sign PHP 41.3 Million Grant for Financial Inclusion Push

Bangko Sentral ng Pilipinas (BSP) and the Agence Française de Développement (AFD) signed a grant facility agreement of 700,000 Euros (around PHP 41.3 million) to support the Philippines’s financial inclusion drive, especially among rural and women-owned enterprises. This will fund

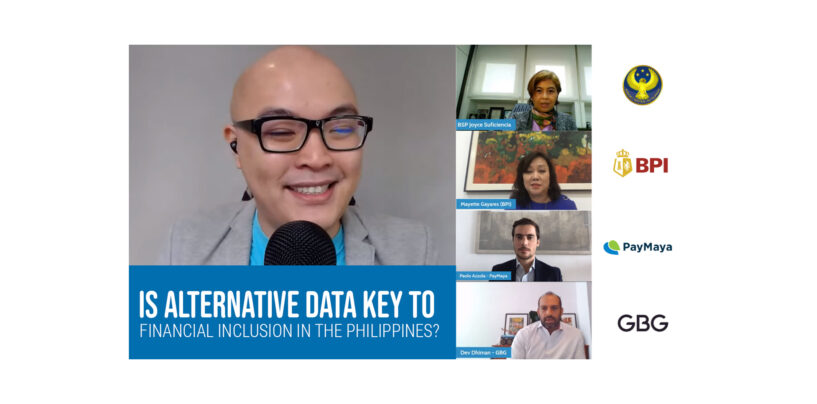

Read MorePhilippines Must Not Overlook Fraud Prevention in It’s Financial Inclusion Journey

Digital technologies and online platforms can help emerging markets advance financial inclusion by providing banking services to Gen Z’s, low-income households, and small businesses with typically little to no access to traditional financial institutions. But while unbanked populations can benefit

Read MoreMambu Says 33 Million Filipinos With Digital Wallets Remain Formally Unbanked

A recent study of 2,000 global consumers by Mambu, the market-leading banking and financial services platform, revealed that both banked and unbanked individuals feel underserved, with 56% of banked customers claiming that there are other services they should be able

Read More