In Asia, bigtechs and new digital banking challengers are rapidly gaining ground, forcing incumbent banks to rethink their business strategy and become a part of the super-app ecosystem, a new report by Finextra, in association with Infosys Finacle and OneSpan, says.

The paper, titled The Future of Digital Banking in Asia 2022, explores Asia’s booming digital banking ecosystem and highlights emerging trends.

Asia has emerged as the leader in banking innovation these past couple of years, a trend driven by the region’s large population of unbanked, demand for inclusive and accessible banking services, and rising Internet penetration.

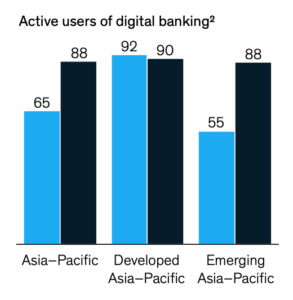

In Asia Pacific (APAC), digital banking has reached a new level of maturity with 88% of consumers now actively using digital banking, a 25% point increase from 2017’s 65%, according to McKinsey’s 2021 Personal Financial Services (PFS) survey. Non-traditional financial services, like fintech apps and e-wallets, are also seeing growing adoption, with penetration rising from 40% in 2017 to 51% in 2021.

Active users of digital banking, Source: McKinsey Asia-Pacific PFS survey 2021

These market shifts have been led by governments for the most part, which have introduced over the past years a number of amendments and regulations to promote competition and stimulate innovation in the banking sector.

Hong Kong has welcomed eight digital banks, Singapore awarded four digital banking licenses in late-2020, the Philippines has issued six digital banking licenses, and Malaysia unveiled in April the much anticipated five winners of its digital banking licenses. Thailand has also started working on guidelines for virtual banks.

Indonesia, on the other hand, doesn’t have a dedicated digital banking framework, having instead introduced new rules to facilitate the introduction of digital banks through acquisitions.

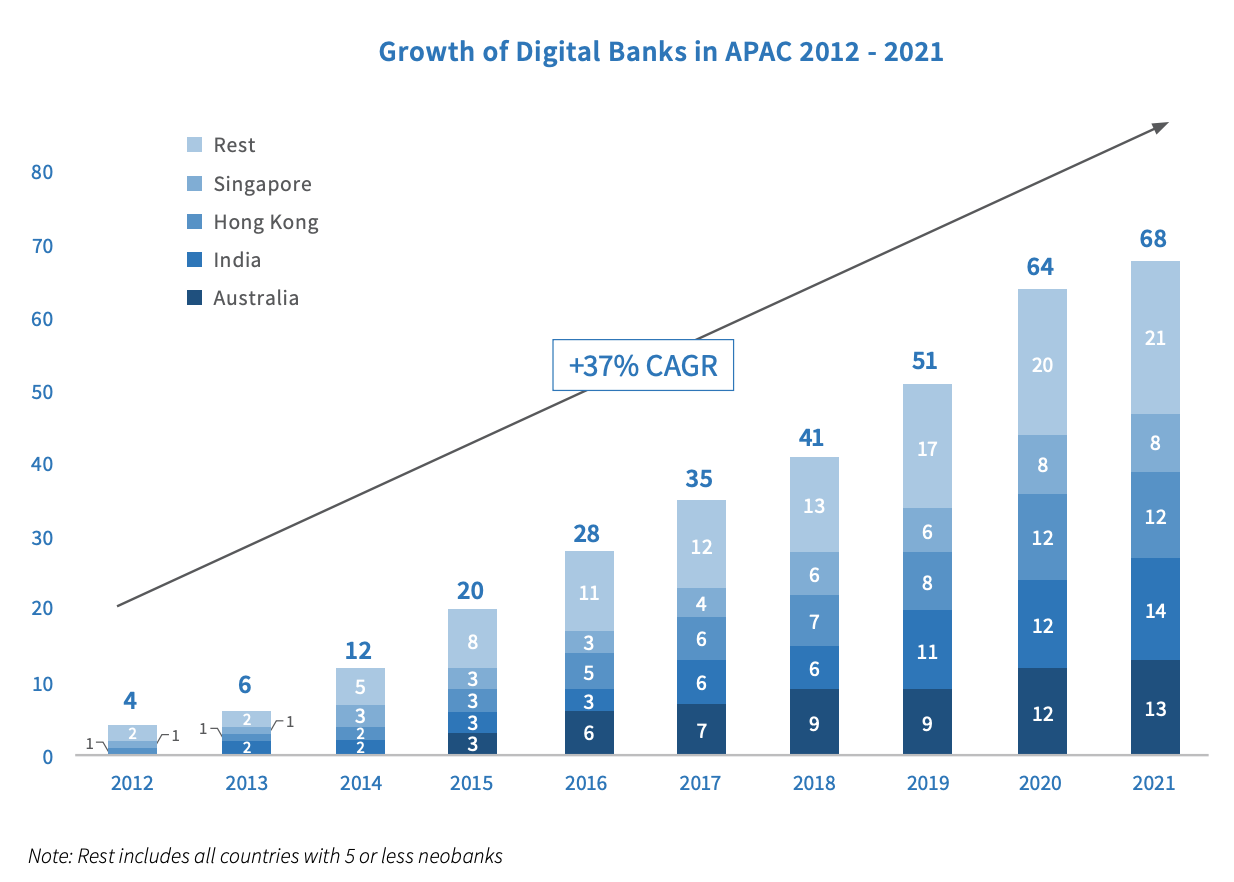

The Boston Consulting Group (BCG) estimates that APAC was home to around 50 digital banks as of mid-2021, among which were some of the world’s most successful ones.

The rise of super-apps

In addition to the entry of new market players facilitated by enabling regulations, the region has also witnessed the emergence of so-called super-apps, a breed of tech giants that act as the gateways to consumers, providing anything from ride-hailing, logistics and food delivery, to digital payments and loans.

Super-apps are disrupting traditional methods for engaging underserved market niches and retaining current customers with mobile apps that provide functionality beyond traditional financial services, Samuel Bakken, Director of Product Marketing at OneSpan, wrote in a commentary in the report.

Tencent-backed WeChat, for example, is one of the leading and most sophisticated super-apps in APAC, bundling together online messaging, social media, marketplaces, and services. Through its integrated digital bank WeBank, the group now serves over 200 million individual banking customers and 1.2 million small and medium-sized enterprises, making it the biggest digital bank in APAC, according to a 2021 report by Swiss digital banking tech provider Banking, Payments: Context (BPC) and Dutch fintech consultancy firm Fincog.

Growth of digital banks in APAC 2012-2021, Source: Digital Banking in Asia Pacific, Fincog, BPC

In South Korea, Kakao embraced a similar strategy to Tencent, starting off as a messaging app before adding an e-wallet to the platform and finally becoming a full-fledged digital bank. Leveraging network effects and KakaoTalk’s massive customer base of 53.3 million monthly active users worldwide, KakaoBank was able to reach profitability after less than two years in operation.

KakaoBank started trading in August 2021, becoming the first neobank in Asia to go public. With 34 million customers, KakaoBank is the fourth largest neobank in APAC, according to the report.

The road ahead for incumbents

Super-apps are putting increasing pressure on incumbents due to their scale, resources and capabilities, Bakken wrote. When considering to develop a super-app, FI’s should firstly consider what value and services they want to offer their audience in the digital journey and secondly, they need to ensure the security of such service.

Incumbents must leverage application programming interfaces (APIs) to enable faster payments, simplify unbundling of services and improve data sharing for open banking, the report says. They should also make greater use of cloud computing to improve customer experience and financial accounting in areas such as payments and credit scoring.

However, when developing financial super-apps, banks must keep in mind that an extensive digital ecosystem also means a wider attack surface for criminals and more potential vulnerabilities for them to take advantage of, Bakken warned.

Therefore, it is extremely critical for banks to ensure the security of their digital services and team up with experienced security partners to put in place efficient safeguards that won’t impede user experience.

As mobile banking grows in popularity and given that mobile apps execute in a potentially hostile environment, the protection of mobile apps on the client-side with mobile app shielding is imperative too.

Cyberattacks and breaches are surging in Asia. In 2021, the continent became the most-attacked region in the world, receiving 26% of attacks detected by IBM’s security offering, X-Force. Finance and insurance organisations were attacked most frequently in the region, making up 30% of the incidents X-Force remediated.