Philippine Startup Investment Reaches New High; Fintech Takes Lion’s Share in Early-Stage Funding

by Fintech News Philippines April 4, 2023In 2022, startup investment reached new heights in the Philippines, defying trends observed around the world and the global funding downturn.

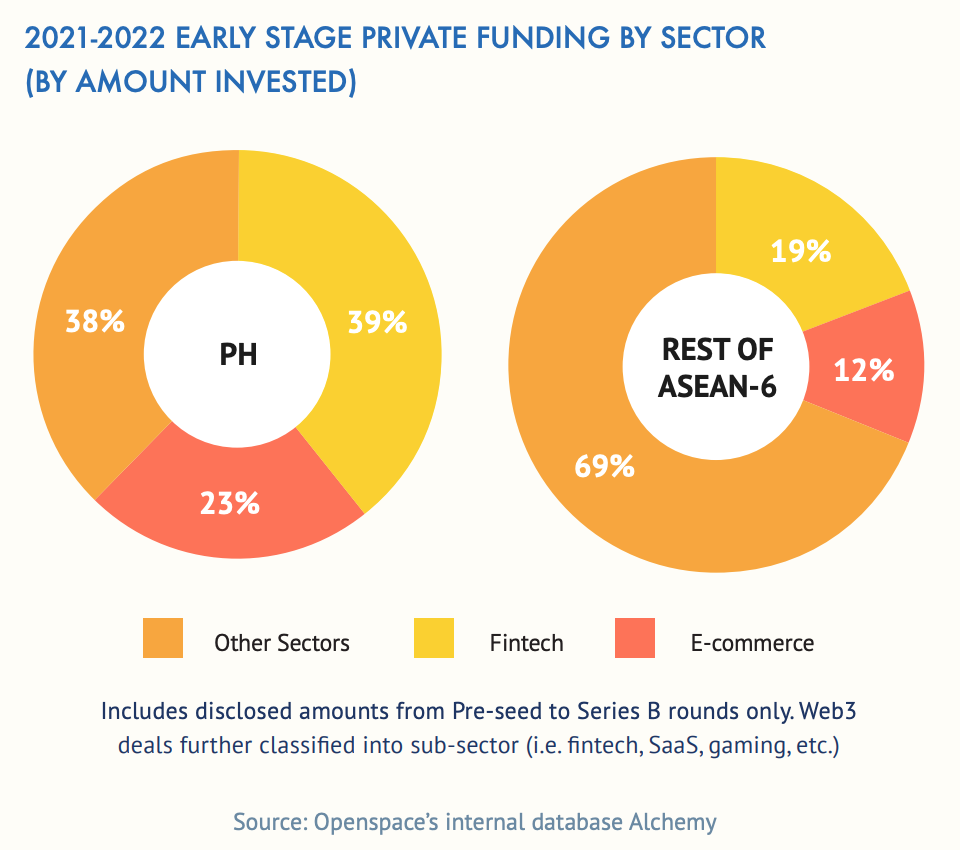

Fintech companies took the lion’s share in early-stage private funding, securing 39% of all investments raised in 2021-2022, a new report by Foxmont Capital Partners, a venture capital (VC) fund supporting Filipino entrepreneurs, says, showcasing the sector’s important weight in the local startup ecosystem.

The annual Philippine Venture Capital Report, released last week, looks at the state of venture funding in the Southeast Asian country, sharing key trends emerging as well as insights from industry stakeholders.

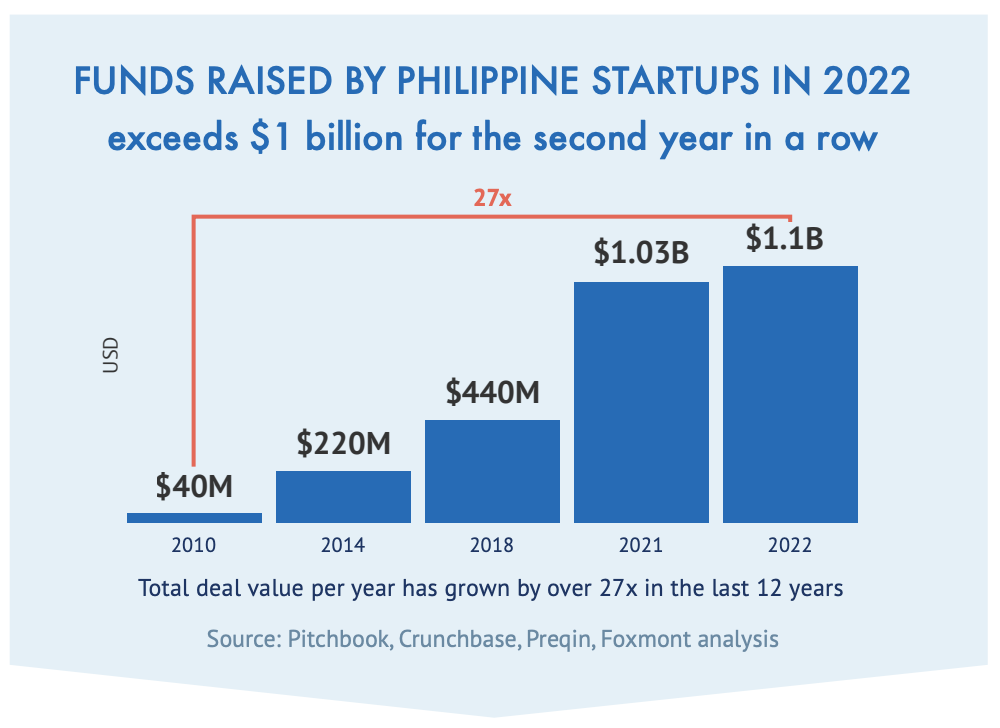

According to the report, startup funding in the Philippines reached new levels last year, totaling US$1.1 billion in 2022. The sum represents an increase of nearly 7% from 2021’s previous record of US$1.03 billion and a 27-fold increase from 2010’s mere US$40 million.

Funds raised by Philippine startups per year, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

These metrics are in contraction with global trends seen in 2022 as venture and growth investors scaled back their investment pace amid market instability, geopolitical turmoil, and looming fears of a recession. Total venture funding last year amounted to US$415.1 billion, marking a 35% drop from a record 2021, data from business analytics platform CB Insights show.

In the Philippines, the outlook for 2023 remains optimistic, data from the Foxmont Capital Partners show. As of February 2023, the country had already recorded 17 startup deals, putting the Philippines on track to reach 23 deals by the end of the first quarter of 2023. The figure would put Q1 startup investment at pre-COVID-19 levels, demonstrating investors’ bullishness in the prospect of technology and digital platforms in the nation.

Quarter on quarter deal volume, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

In 2021 and 2022, fintech remained investors’ sector of choice in the Filipino startup landscape. Companies in the industry secured 39% of all early-stage startup funding raised those years, ahead of e-commerce, the second biggest startup category with a 23% market share, data from the report shows.

2021-2022 early stage private funding by sector (by amount invested), Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

Fintech’s sectorial dominance also extended to mid- and later stages startups, with companies like Mynt, the fintech firm behind GCash, Voyager Innovations, the owner of Maya, and Growsari raising significant rounds of funding, it notes.

Mynt, which operates the country’s largest e-wallet app, secured US$300 million in an investment round in November 2021 after tripling its gross annual transaction value within a year; Voyager Innovations, the owner of all-in-one banking app Maya, raised US$210 million in April 2022 to expand its digital financial services ecosystem; and Growsari, a platform for digitizing small businesses, raised US$77.5 million for its Series C round in March 2022 to expand into new store formats, build a logistics and fulfillment network and make new hires.

A booming digital economy

Soaring startup funding activity in the Philippines comes on the back of a booming digital ecosystem that has seen consumers increase their usage of digital platforms to shop, have their food delivered, and conduct payment transactions.

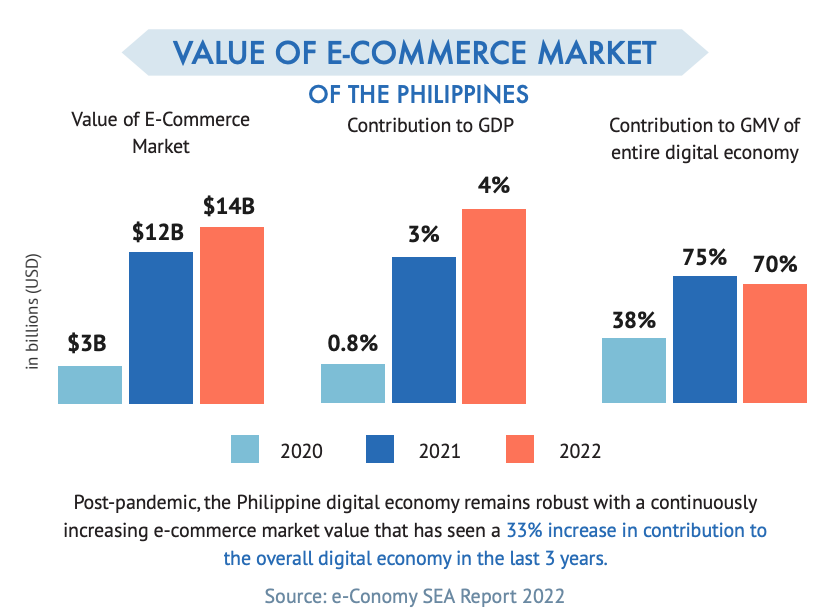

During the pandemic, Filipino shoppers increased their number of purchases by 57%, the report says, and between 2021 and 2022, the value of the Philippines’ e-commerce market grew by more than 16%, rising from US$12 billion to US$14 billion.

Value of e-commerce market of the Philippines, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

In the digital financial services space, non-cash transactions continued their upward trend in 2022 with more growth are expected this year onwards.

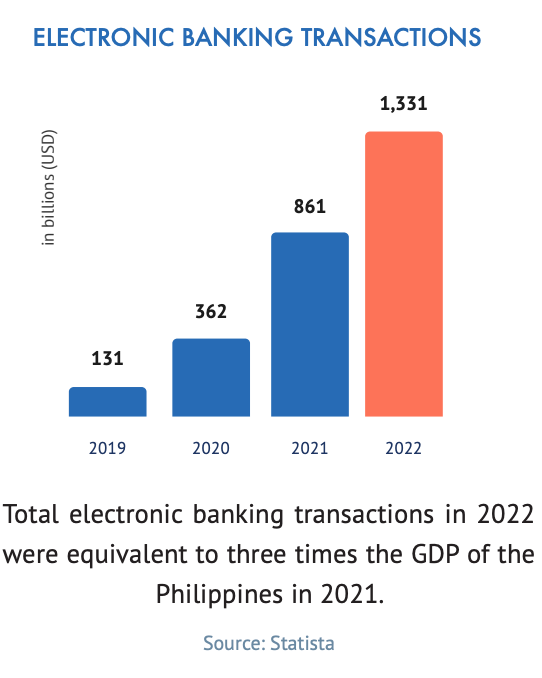

Total electronic banking transactions totaled US$1,331 billion last year, up more than 50% from 2021’s US$861 billion, the report says, while mobile wallet transactions reached US$28.6 billion, nearly doubling that of 2020.

Electronic banking transactions, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

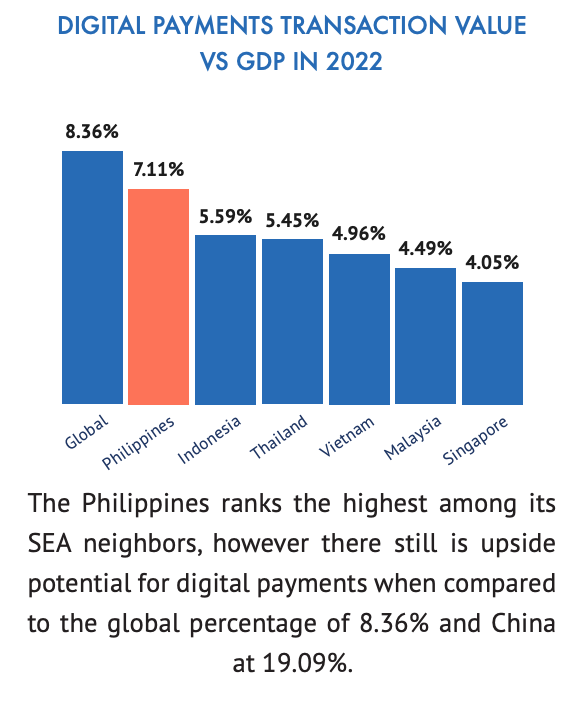

At the same, digital payments transaction value represented 7.11% of the Philippines’ gross domestic product (GDP) in 2022, a figure that puts the Philippines ahead of its Southeast Asian counterparts in terms of digital payments penetration.

Despite leading the region, the report notes that the rate still falls behind the global average of 8.36%, implying strong growth prospects.

Digital payments transaction value versus GDP in 2022, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

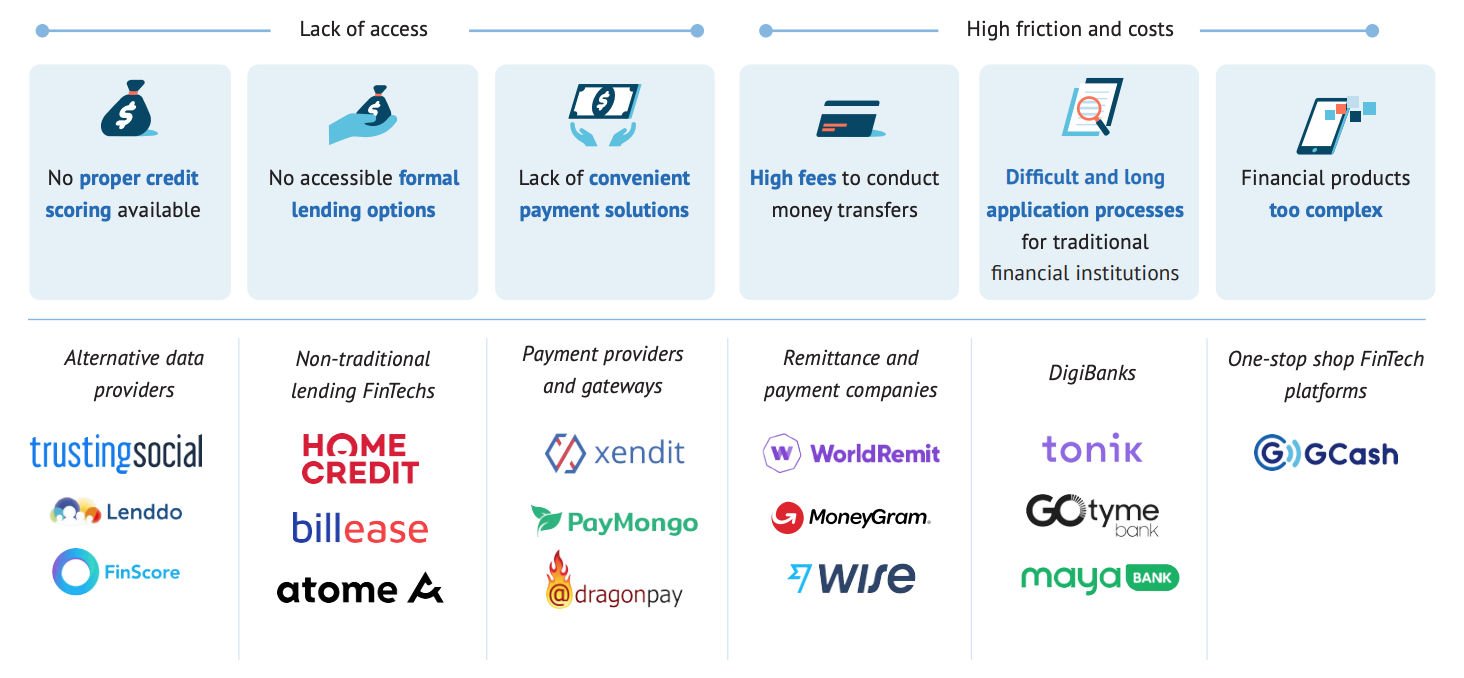

The Philippines has seen its fintech sector surge over the past years, a growth that’s been driven by market inefficiencies and unmet needs. Alternative data providers like Trusting Social, Lenddo and FinScore have emerged to address the lack of proper credit scoring; companies such as Home Credit, Billease and Atome are providing accessible lending options; and startups like Xendit, PayMongo and Dragonpay are delivering seamless and convenient payment methods for the digital age.

Digital financial services in the Philippines and the problems they tackle, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

Digital banking as a top fintech theme

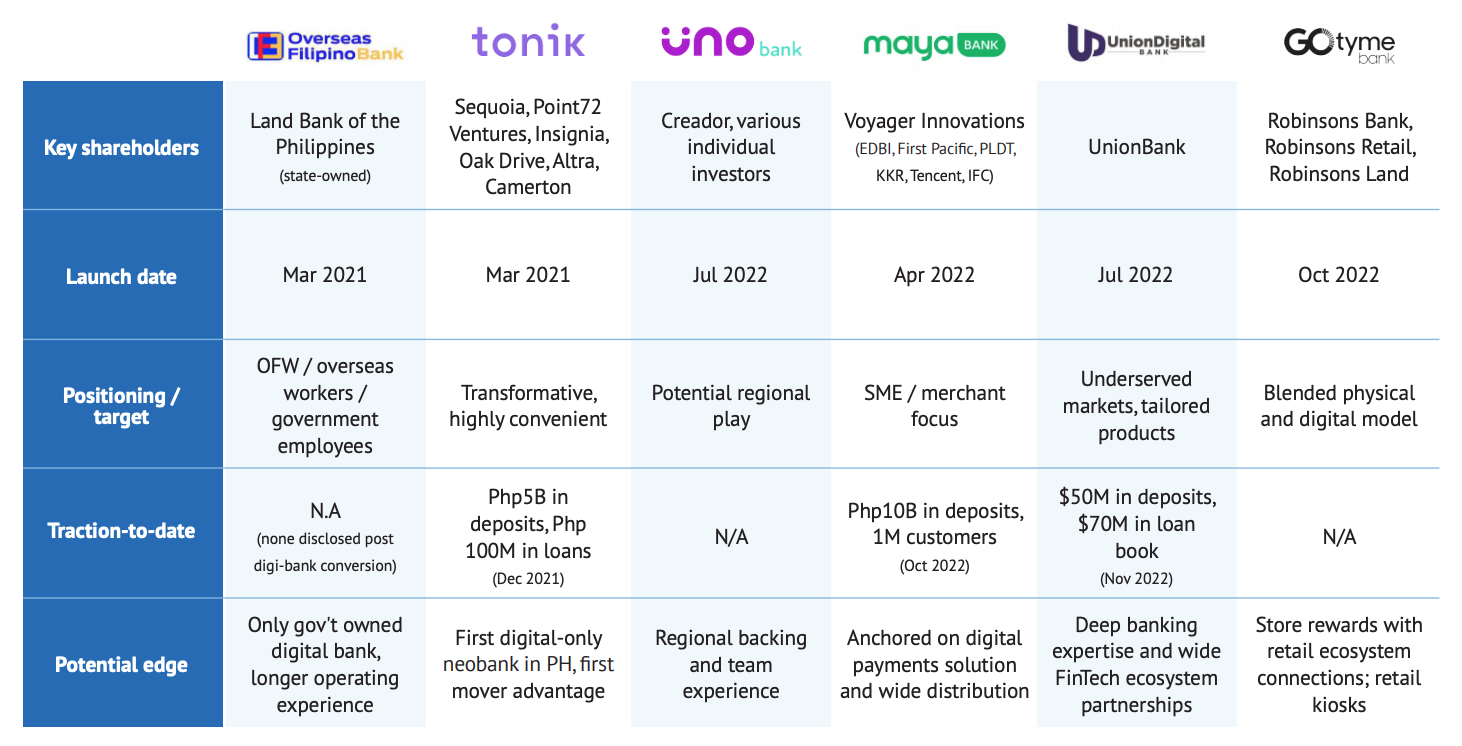

Digital banking is another fintech segment that’s risen in popularity in the Philippines. Tonik, which is owned by a Singapore company, managed to attract PHP 5 billion (US$100 million) worth of deposits within only eight months after it went live. Maya Bank, which is owned by Voyager Innovations, hit the one million customer milestone and PHP 10 billion (US$200 million) worth of deposits just five months after its launch. And UnionDigital Bank, the digital banking arm of Union Bank of the Philippines, amassed 1.73 million customers, reached US$70 million in loan book size and collected US$50 million deposits in only four months.

Digital banking in the Philippines has emerged on the back of favorable new regulations approved by the central bank back in 2020. Six entities have so far been granted a digital banking license and all of them have launched operations.

Overseas Filipino Bank focuses on Filipinos working abroad and other overseas Filipinos. GoTyme Bank, a joint venture of Tyme, a multi-country digital banking group, with members of the Gokongwei Group, operates under a blended physical and digital model and allows consumers to visit one of the kiosks around the nation to create an account and receive a debit card. Maya Bank is developing an all-in-one banking app that combines savings, deposits, credit and more. Tonik is a digital bank that offers retail financial products including deposits, loans, savings accounts, payments, and cards. UnionDigital Bank focuses on serving the needs of the underserved communities. And UNOBank, which is backed by Singapore-based DigibankASIA, is building a full-spectrum digital bank focusing on making banking simpler and more accessible.

The Philippines’ six digital banks, Source: Philippine Venture Capital 2023 Report, Foxmont Capital Partners, March 2023

Featured image credit: Edited from Freepik