In the dynamic landscape of the Philippine fintech sector, 2023 has emerged as a pivotal year, signifying the nation’s determined stride toward enhanced financial inclusion and digital transformation.

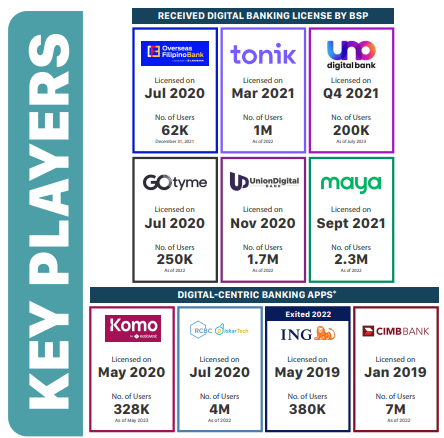

Digital banking in the Philippines is progressively making its mark, with significant shifts observed in recent years. The transition is marked by the Bangko Sentral ng Pilipinas (BSP) issuing Certificates of Authority (COA) to all six licensed digital banks in the Philippines.

With regulatory measures, technological integration, and strategic alliances coming into play, the Philippines is gradually embracing a new era of financial services.

The recently released Fintech Philippines Report 2023 encapsulates this journey, offering a panoramic view of the six licensed digital banks at the forefront of this evolution.

Overseas Filipino Bank

User Base: 62,000 (as of December 31, 2021)

The emergence of Overseas Filipino Bank in July 2020 signalled a change in the financial arena, presenting the country’s inaugural government digital-only and branchless bank.

The bank offers online account opening, mobile banking, and enhanced remittance services, catering to the specific requirements of overseas Filipinos. Another development was the introduction of a digital account opening platform, allowing overseas Filipinos and their beneficiaries to submit documents online.

Tonik Digital Bank

User Base: Over 1 Million (as of 2022)

Tonik Bank, co-founded by Greg Krasnov in 2020, has shown progress in the financial sector since its launch in March 2021. By 2022, the bank managed to onboard over 1 million users, an achievement for its first operational year.

In 2023, the bank reached a milestone by achieving unit profitability, indicating that its revenue per customer has surpassed the associated costs. Tonik Bank has also diversified its loan products, including Quick Loan, Flex Loan, and Big Loan, catering to various customer needs.

UNO Digital Bank

User Base: 200,000 (as of July 2023)

Following its licensure in the fourth quarter of 2021, UNO Digital Bank has steadily gained recognition, amassing a user base of 200,000 as of July 2023. The bank’s collaboration with 1Sari Financing Corporation has supported its objective of providing targeted financial solutions to sari-sari store owners and micro-enterprises.

Additionally, partnerships with established mobile wallet app GCash have enhanced the bank’s accessibility and user experience.

UnionDigital Bank

User Base: 672,122 (as of August 14, 2023)

UnionDigital Bank commenced operations in July 2022 and has experienced significant expansion.

By Aug 2023, the bank had amassed a user base of more than 670,000 (including both depositors and borrowers), marking its successful integration into the lives of Filipinos.

The bank’s deliberate partnerships with subsidiaries like Capital A, airasia superapp, BigPay, and mWell have played a role in its advancement.

Maya Bank

User Base: Over 1.5 Million (as of 2022)

Maya Bank, licensed in September 2021, has taken steps to enhance its digital banking offerings by introducing new features. The bank aims to attract a more extensive user base to utilise its digital banking services.

Maya Bank reported having over 1.5 million bank customers by 2022, and within three months of its launch, the bank amassed deposits amounting to P5 billion. Maya Bank’s “My Money. My Bank. My Way” initiative reflects its campaign to establish digital banking in the mainstream and empower Filipinos to manage their finances effectively.

GoTyme Bank

User Base: Over 1 Million (as of 2023)

GoTyme Bank, which obtained its license in July 2020, started with an initial user count of 250,000 as of 2022. With a goal to reach 10 million users within its first five years of operation, the bank has diligently worked towards this target.

GoTyme Bank has achieved a milestone by crossing the 1 million user mark as of 2023. Presently, the bank operates a network of over 300 digital kiosks throughout the Philippines, with plans for further expansion to encompass 450 kiosks by the end of 2023.

The 2023 Philippines Fintech Report

For those keen on a deeper understanding of these transformative narratives and the broader fintech context, the 2023 Philippines Fintech Report is an invaluable resource.

The report equips professionals, stakeholders, and enthusiasts with a comprehensive overview of the sector’s evolution through its extensive statistics, trends, and analysis collection.

These insights shed light on how digital banks reshape financial accessibility and inclusion in the Philippines.