Posts From Fintech News Philippines

UnionBank Picks METACO and IBM to Set Up Its Digital Asset Custody Operations

The Union Bank of the Philippines has selected METACO, a provider of security-critical software and infrastructure to the digital asset ecosystem, to implement its digital asset management services. The bank will leverage METACO Harmonize which is its digital asset orchestration

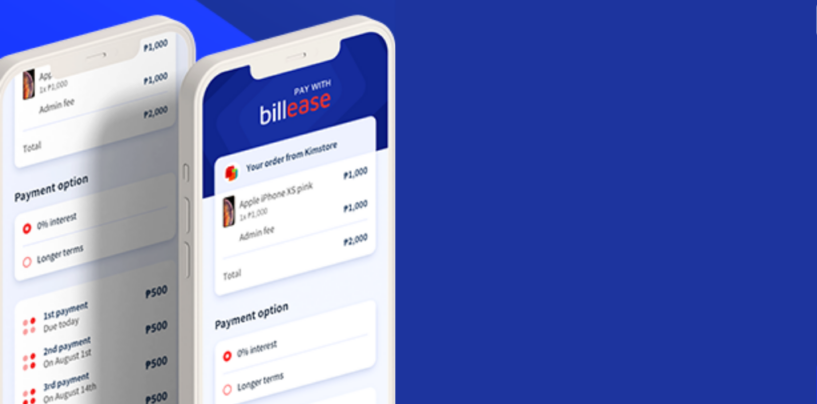

Read MorePhilippines’ BNPL Platform BillEase Closes US$11 Million Series B

Philippines’ Buy Now Pay Later (BNPL) platform BillEase announced that it has closed its Series B funding round with US$ 11 million in fresh equity. The round was led by BurdaPrincipal Investments, the growth capital arm of German media and

Read MoreSEC Greenlights Investree Philippines for Permanent Crowdfunding License

The Securities and Exchange Commission (SEC) has granted Investree Philippines a permanent license to operate as a crowdfunding platform following a review of the company’s operations since the issuance of its provisional license in January 2021. Investree Philippines is a

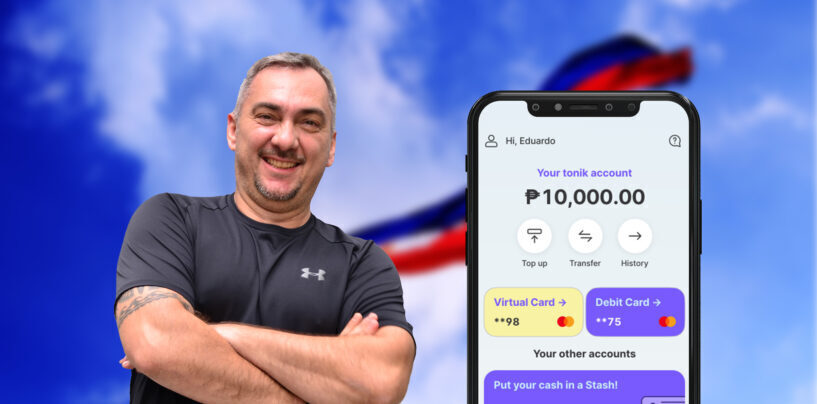

Read MoreTonik Taps Google Cloud to Build its Digital Bank

Philippines’ neobank Tonik announced that it is has built on Google Cloud’s advanced platform to deliver its financial services in just 10 months. The bank had leveraged Google Cloud’s expertise in scalable infrastructure, application programming interface (API) management, machine learning (ML)

Read MoreBangko Sentral Ng Pilipinas Launches Open Finance Framework

The Bangko Sentral ng Pilipinas (BSP) has formally launched the Open Finance Framework, which aims to promote collaborative partnerships and digital transformation as key enablers towards economic resilience and financial inclusion. Open Finance is the extension of data sharing principles,

Read MoreASEAN Fintech Group Expands Into the Philippines With Acquisition of Jazzypay

ASEAN Fintech Group (“AFG” or the “Group”), a venture corporation that specializes in accelerating fintech adoption through accretive value has acquired JazzyPay Inc valued at US$1.8m. JazzyPay is a digital payments provider that allows businesses of various sizes and types

Read MoreYear End Message to Our Readers – Offline From 23rd December to the 2nd January

Fintech News Philippines would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year. We will be taking a break from the 23rd December 2021 to the 2nd January 2022. Until

Read MoreFintech in the Philippines: 2021 in Review

In 2021, the Philippines’ fintech industry continued to grow and mature, building on accelerated adoption of digital channels amid COVID-19, investors’ optimism on the prospect of fintech in the Southeast Asian nation, and continued effort from the government to foster

Read MoreRussian Digital Bank Tinkoff Taps Finastra to Power Its Philippines Expansions Plans

Moscow-based digital bank Tinkoff announced that it has selected financial services software provider Finastra’s Fusion Essence Cloud core banking solution to power its planned expansion into the Philippines. Finastra’s next generation, cloud-native system will enable Tinkoff to bring a new

Read MoreTonik Surpassed US$100 Million in Consumer Deposits in Less Than a Year

Philippines’ digital bank Tonik announced that it has surpassed PHP 5 billion (US$100 million) in consumer deposits 8 months after its launch of commercial operations. Tonik had previously secured PHP 1 billion (US$20 million) in consumer deposits within a month

Read More