Posts From Fintech News Philippines

Tonik Surpassed US$100 Million in Consumer Deposits in Less Than a Year

Philippines’ digital bank Tonik announced that it has surpassed PHP 5 billion (US$100 million) in consumer deposits 8 months after its launch of commercial operations. Tonik had previously secured PHP 1 billion (US$20 million) in consumer deposits within a month

Read MoreGigacover Expands to the Philippines to Boost the Gig Workforce’s Financial Health

Singaporean financial health platform Gigacover announced its expansion into the Philippines to offer more inclusive insurance and healthcare options tailored for the local gig workforce in partnership with Etiqa and Aventus Medical. The company said that flexible and cost-effective group

Read MoreFintech Philippines Report 2022 Highlights the Rise of Crypto and Advent of Digibanks

In the Philippines, the fintech sector is developing at a rapid pace, fueled by booming digitalization, a favorable regulatory landscape, and ongoing effort by the government to help boost financial inclusion, a new report jointly produced Fintech News Philippines and

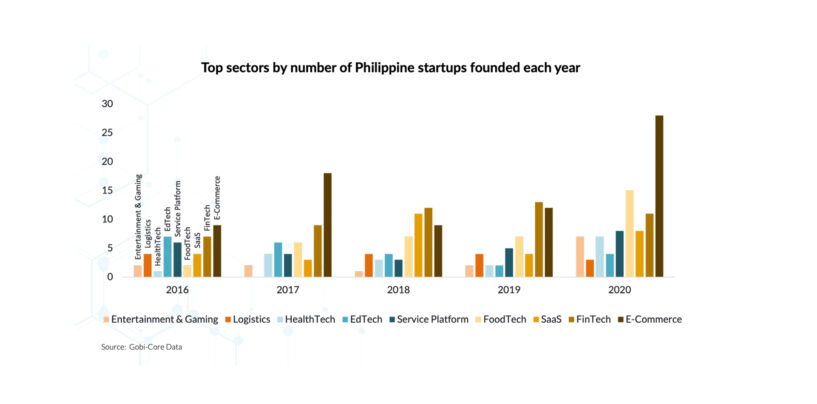

Read MorePhilippines’ New Generation of Startups Will Boost E-Commerce and Fintech

The Philippines is entering its third generation of startups, building on the groundwork laid by early tech pioneers and innovators during the past two decades. This new generation of startups are now thriving on the back of government support and

Read MorePhilippines’ SEC Issues Guidelines to Stamp Out Predatory Lending Practices

The Securities and Exchange Commission (SEC) has issued draft guidelines for the registration and operation of online lending platforms (OLPs) to stamp out abusive and predatory practices. The proposed guidelines will apply to both existing and newly registered financing and

Read MoreBSP Encourages Public to Use Digital Wallets for Holiday Gift Giving

The Bangko Sentral ng Pilipinas (BSP) is encouraging the public to use digital wallets when sending cash gifts this holiday season. The central bank said that using digital money as an alternative means of giving cash gifts is highly recommended

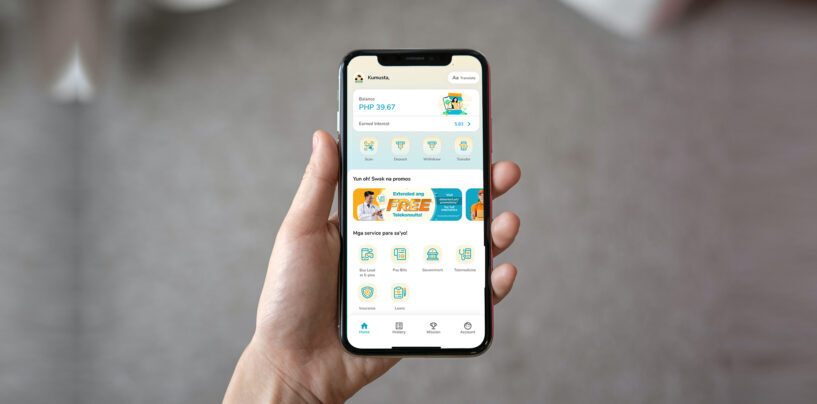

Read MoreRCBC’s DiskarTech App Recorded Phenomenal Growth Rate Since Last Year

Rizal Commercial Banking Corporation (RCBC), with its flagship financial inclusion app DiskarTech, has reached a five-digit organic growth in partner deposits by end of October versus same period last year. DiskarTech’s partner deposits recorded a 69,526 % and 12,765 %

Read MorePLDT and Smart Secure Online Transactions With Vesta’s Anti-Fraud Tools

Philippines’ telecommunications company PLDT and its wireless unit Smart Communications announced that they are utilising Vesta’s anti-fraud solutions to enhance the protection of their online transactions. Vesta is an end-to-end transaction guarantee platforms for online purchases, and its anti-fraud solution

Read MoreBNPL Startup Plentina Raises US$2.2 Million to Accelerate Regional Expansion

Plentina, a Buy Now Pay Later (BNPL) startup for emerging markets, announced that it has raised US$2.2 million in a latest funding round led by New York-based venture capital firm TMV, bringing its total funds raised to US$5.7 million. Joining

Read MoreFintech Alliance.PH Inks Agreement With the Anti Money Laundering Council

The Fintech Alliance.PH announced that it has signed the Information Sharing Protocol (ISP) with the Anti-Money Laundering Council (AMLC) to bolster the fight against money laundering and terrorism financing in the country. The AMLC is the Philippines’ Financial Intelligence Unit

Read More