The fintech space in the Philippines has been growing rapidly in 2023, with several developments that have shaped the industry and the country’s financial inclusion.

The fintech sector in the Philippines witnessed significant growth in 2023 which reflects the country’s progressive approach towards embracing digital transformation in finance.

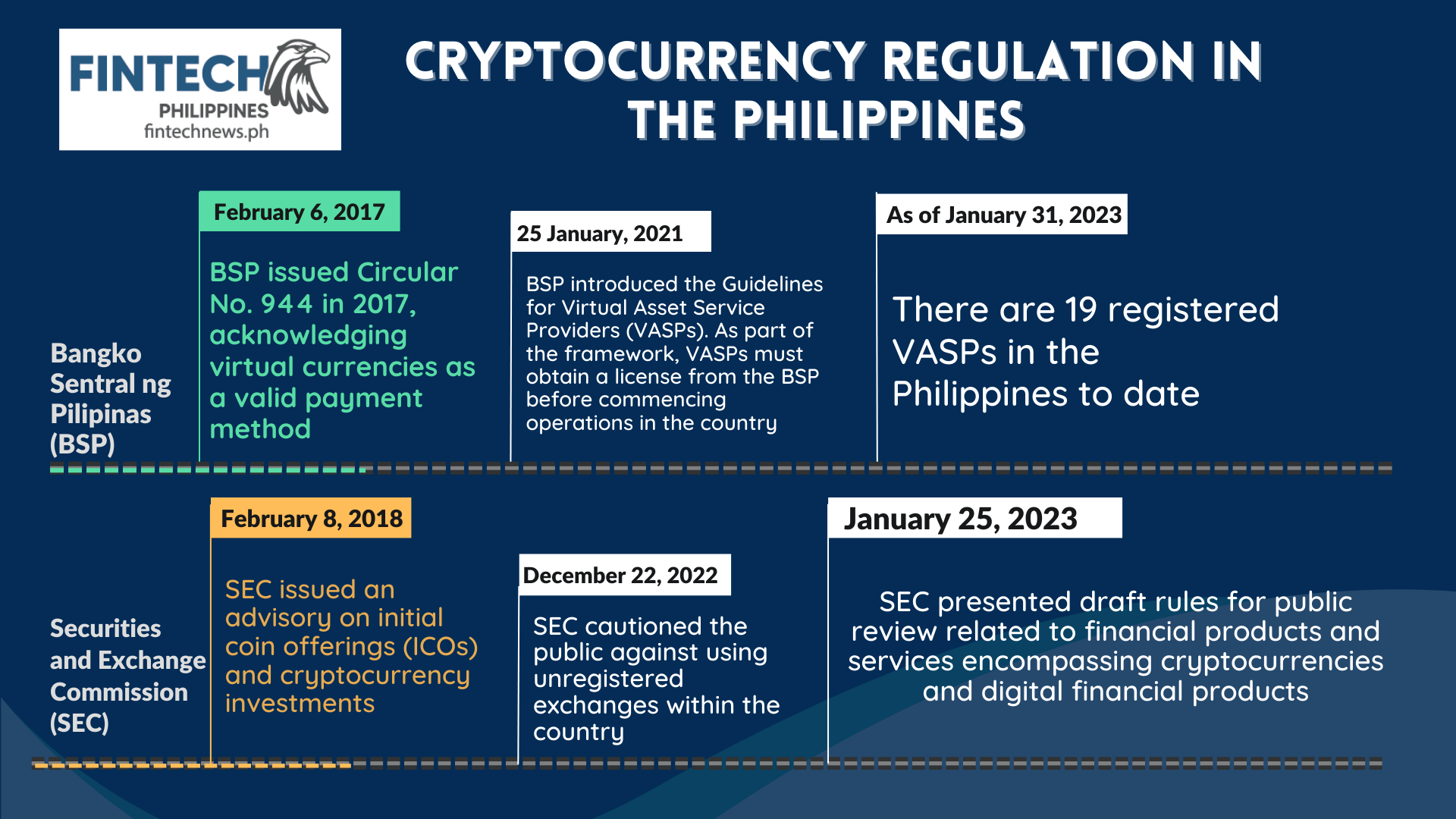

These advancements not only signify regulatory evolution overseen by the country’s forward-looking central bank the Bangko Sentral ng Pilipinas (BSP) and the Securities and Exchange Commission (SEC), but also indicate a shift towards more inclusive and sustainable financial practices.

Here are some of the landmark developments in and around the fintech space of the Philippines in 2023:

SEC Drafts Rules to Govern Crypto, Blockchain Assets

In January 2023, the SEC of the Philippines proposed new regulations targeting cryptocurrencies, tokenised securities products, and other blockchain-based financial assets. The SEC aims to implement these rules with utmost consideration for market stability and investor protection, thus delaying their introduction to thoroughly assess potential risks.

Responding to the burgeoning digital asset market, the Philippine government implemented a capital gains tax of up to 15% on cryptocurrency transactions. This decisive action aims to bring regulatory clarity and fiscal discipline to the fast-evolving crypto sector, ensuring that the growth of this market aligns with national economic goals.

The government is considering additional tax regulations on cryptocurrencies by 2024, stirring discussions in the financial sector. There is a prevailing concern that the Philippines might adopt a taxation model similar to India’s, which imposes a flat 30% tax on all cryptocurrency earnings. This potential policy shift indicates the government’s commitment to creating a robust and fair tax framework for digital assets.

The Bangko Sentral ng Pilipinas (BSP) announced another notable decision regarding the application process for new Virtual Asset Service Provider (VASP) licenses. The window for these applications will be closed for a three-year period, subject to future reassessment based on prevailing market conditions.

This move came as a proactive measure to safeguard investors, particularly in the wake of the FTX exchange collapse and more recent incidents such as the dubious operations of Binance exchange in the Philippines. This decision reflects the BSP’s cautious yet flexible approach to managing the fintech ecosystem.

Piloting Open Finance Collaboration

A notable development in 2023 was the initiation of the Open Finance PH pilot. This initiative involves ten leading financial institutions participating in an experimental phase. They are exploring advanced functionalities, such as account consolidation and credit analysis, over an 18-month period. The insights garnered from this pilot will be instrumental in crafting a comprehensive and inclusive open finance framework for the Philippines.

In order to obtain well-rounded feedback, the BSP has sought inputs from various financial institutions and third-party providers regarding the Open Finance pilot. This initiative is aimed at bolstering the development of technical and operational standards in open finance, demonstrating the BSP’s commitment to fostering innovation and collaboration in the financial sector.

The Fintech Philippines Report 2023 details how Open Finance PH is a testament to the collaborative spirit within the fintech and wider financial industry of the Philippines. It is a voluntary initiative that brings together financial institutions and third-party providers to leverage Application Programming Interface (API) technologies to develop the ‘open’ ecosystem. This collaboration between stakeholders aims to enhance the delivery of financial products and services that were tailored to meet end-user needs.

In a statement, the BSP acknowledged the significance of the Open Finance PH pilot as an essential step towards a digital financial ecosystem that is responsive, inclusive, and responsible. The initiative aligned with the BSP’s vision of promoting innovation-driven consumer data usage.

Breakthroughs in Cross-Border Payment Partnerships

International initiative Project Nexus, led by the Bank for International Settlements (BIS), marked a milestone on March 23 by successfully integrating instant payment systems across Europe, Malaysia, and Singapore. The project is now set to expand, incorporating central banks from the Philippines, Indonesia, Malaysia, Singapore, and Thailand.

This expansion aims to connect their domestic instant payment systems, facilitating seamless cross-border transactions across these regions using just mobile phone numbers. Entering its subsequent phase, Project Nexus will focus on linking the instant payment systems of the Philippines, Indonesia, Malaysia, Singapore, and Thailand. This effort, as per BIS’s announcement, is aimed at enhancing regional financial connectivity.

Project Nexus is an offshoot of the Regional Payment Connectivity (RPC) initiative, endorsed by the BSP, Bank Indonesia (BI), the Monetary Authority of Singapore (MAS), Bank Negara Malaysia (BNM), and the Bank of Thailand (BOT) on November 14, 2022. The RPC aims to broaden the scope of current bilateral agreements and is designed to boost cross-border trade, thereby contributing to the economic revival and growth in the ASEAN region.

BSP May Dole out Additional Digital Bank Licenses

The Philippines central bank is contemplating to potentially end the three-year moratorium on digital bank licenses that was initiated in August 2021.

The initial purpose of the moratorium was to encourage healthy competition among digital banks without saturating the digital banking landscape.

However, BSP Governor Eli Remolona Jr. indicated a growing interest, both locally and from abroad, in obtaining licenses for digital banking operations within the Philippines which has prompted the regulator to reconsider its stance.

Currently, there are six existing digital banks, including LANDBANK’s Overseas Filipino Bank, Tonik Digital Bank, UNObank, Union Digital Bank, GOtyme Bank, and Maya Bank.

BSP is currently examining these banks’ business models to ensure sustainable growth. Once the study has been completed, the regulator may consider reopening the licensing process for more digital banks soon.

Sustainable Financing Initiatives by BSP

The BSP is actively promoting sustainable and eco-friendly financing. This is part of its comprehensive Strategy for Sustainable Central Banking, originally launched in December 2022.

To further this commitment, the BSP plans to roll out additional incentives for sustainable and eco-friendly finance nationwide. These include an increased cap for single borrowers and a zero reserve requirement rate, essential elements of the BSP’s sustainable banking strategy that was kicked off a year ago.

This 11-point strategy focuses on embedding sustainability in the BSP’s operations and across the broader financial landscape of the Philippines. Of note is that by August 2022, a majority of universal and commercial banks had invested in green initiatives, with total green loans reaching P829.7 billion (US$14.35 million) by the end of June 2022.

Approximately 7% of the total loan portfolio of these banks was dedicated to sustainable projects as of mid-2022, with the largest share of funding allocated to renewable energy (89%), followed by sustainable water and wastewater management (56%), and initiatives in energy efficiency and green buildings (each at 50%).

BSP had recently announced that it will be extending the ban on granting licenses to new e-money issuers (EMIs) until end of next year. Originally, the BSP imposed the moratorium in December 2021, initially planned to last for two years.

This extension is aimed at providing the BSP with more time to assess the digital money market and prevent potential misuse.

As a result, non-bank financial institutions (NBFIs) seeking authorisation to operate as an EMI will only be allowed to enter the market after 15 December 2024.

Exceptions to the moratorium will be considered for applications meeting specific criteria, including new business models, targeting underserved niches, and incorporating new technologies, subject to a regulatory sandbox approach.

These exceptions are intended to reshape the e-money industry by focusing on underserved markets and promoting innovation.

Earlier this year in February, BSP had issued a new EMI circular which laid out higher liquidity and capital requirements for for EMIs.

E-money firms with large-scale operations are required to maintain minimum capital of PHP 200 million while the minimum capital requirement for small-scale EMIs is now PHP 100 million. These entities were granted one year to comply with the revised rules.

Currently, the BSP oversees 71 registered and licensed EMI-Banks and EMI-NBFIs. Of these, 28 are EMI-Banks owned by banks, and 43 are EMI-NBFIs owned by non-bank entities such as GCash, PayMaya, and GrabPay.

These developments underscore the Philippines’ dynamic approach in navigating the fintech landscape, prioritising regulatory robustness, innovation, inclusivity, and sustainability. As the country continues to adapt to global financial trends, its fintech sector is poised for significant growth and transformation.