Posts From Johanan Devanesan

Oradian Champions Financial Inclusion at Scale in the Philippines

Oradian, a fintech company headquartered in Croatia, has made significant strides in enhancing accessibility in the financial sector, particularly in the Philippines. Recently, they played a prominent role in a panel discussion at the Singapore Fintech Festival, focusing on scalability

Read MoreInside the Digital Transformation Strategy of Historic PBCOM

The Philippine Bank of Communications (PBCOM) started operations as an overseas branch of the Chinese Bank of Communications, one of the largest banks in China that was headquartered in Taiwan – making it one of the first non-American foreign commercial

Read More3 Ways the Philippines is Navigating the Future of Its Digital Economy

Held at the Shangri-La The Fort in Taguig City, Philippines from 7th to 8th August 2023, the INDX 3 Summit brought together some of the most progressive minds in the country’s fintech sector to discuss developments of its burgeoning digital

Read MoreIMF Cautions Against CBDC Risk Posed to Banks in the Philippines

Felipe M Medalla, former Governor of Bangko Sentral ng Pilipinas (BSP), earlier this year stated that the central bank of the Philippines had started a pilot wholesale central bank digital currency (CBDC) project, a major capacity-building exercise for both the

Read MoreThe Fintech Philippines Report 2023: Financial Inclusion Drive Starts to Bear Fruit

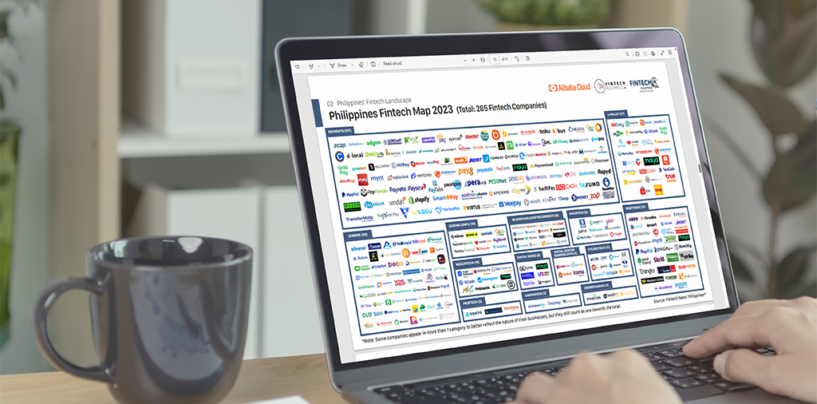

In the Philippines, the fintech sector has been expanding at an unparalleled rate, transforming how individuals and companies handle financial dealings, as evidenced in the 2023 edition of the Fintech Philippines Report, produced by Fintech News Philippines in collaboration with

Read MoreBSP to Incentivise Sustainable Green Financing in the Philippines

The Bangko Sentral ng Pilipinas (BSP) intends to introduce further incentives to promote sustainable and green financing in the Philippines. These incentives, including an increased single borrower’s limit (SBL) and a zero reserve requirement rate, are part of the BSP’s

Read MoreBanks in the Philippines Face Fintech Threat, Warns McKinsey

Management consulting firm McKinsey & Co. has cautioned banks in the Philippines that they must adapt to the emerging and rapidly evolving landscape of digital finance or risk losing market share to emerging fintech providers. In a study entitled On

Read MoreSEC Delays Releasing Philippines Digital Assets Framework in Wake of FTX

The Philippine Securities and Exchange Commission (SEC) has deferred the rollout of a new framework for digital assets, influenced by lessons learned from the fall of Bahamas-based cryptocurrency exchange, FTX, in late 2022. The SEC Chairperson, Emilio B. Aquino, expressed

Read MoreIs Philippines Falling Short of Its PhilSys Digital Identity Ambitions?

This month, the Bangko Sentral ng Pilipinas (BSP) issued the latest rules outlining the minimum digital identification and verification requirements for financial institutions, otherwise known as electronic ‘know-your-customer’ procedures, or e-KYC. Seeking to promote seamless identity verification and customer due

Read MoreHow Far Along is the Philippines’ Digital Payments Transformation Roadmap?

Of the many branches of fintech that can benefit society, the Philippines recognised the need to embrace digital payments as a means of fostering financial inclusion and economic growth. In response, the Bangko Sentral ng Pilipinas (BSP) launched the Digital

Read More