Top 5 Fintech Trends in the Philippines That Will Shape the Space in 2024

by Johanan Devanesan January 4, 2024The financial technology landscape in the Philippines has undergone transformative changes in 2024, driven by dynamic innovations and an increasingly digital-savvy population. Today we delve into five of the top fintech trends in the Philippines shaping the nation’s financial sector, each backed by compelling insights.

Data indicates a significant shift in consumer behaviour, favouring digital platforms over traditional banking methods. This trend is amplified by the rise of neobanks, which are rapidly gaining market share due to their user-friendly interfaces and personalised services.

There is an increased focus on financial inclusion, with fintech solutions targeting the unbanked and underbanked segments of the population. Innovative platforms are bridging the gap, providing accessible financial services to those previously excluded from the traditional banking system.

Together, these trends not only reflect the evolving fintech landscape in the Philippines but also signal the country’s growing prominence as a fintech hub in Southeast Asia. So what are five top fintech trends that will propel the Philippines forward in 2024?

Payments to drive the digital economy of the Philippines

The rise of digital payments in the Philippines, Source: Philippine Startup Ecosystem Report: Founders Edition 2023, Gobi-Core Philippine Fund, Nov 2023

Digital payments and the digital economy are expected to soar in the Philippines in 2024, as the country benefits from the increasing adoption of e-commerce, mobile payments, and contactless payments, as well as the supportive regulatory environment and initiatives by the Bangko Sentral ng Pilipinas (BSP).

In an effort to galvanise the Philippine financial sector and to promote financial inclusion for the massively underserved banking population, the BSP’s Digital Payments Transformation Roadmap set two primary goals for the country: first, to increase the share of digital transactions in total payment volume to 50% by 2023; and second, to ensure that 70% of Filipino adults have access to a transaction account.

As of 2023, the BSP now reports that over 41 million adult Filipinos now have access to bank and e-money accounts. At this rate, the central bank claims that financially including 70% of Filipino adults is on track for the very near future, likely by 2024, and that half of retail payments in the country were already of a digital nature.

Virtual asset regulation looming as crypto adoption increases

It is expected that in 2024, more Filipinos will use cryptocurrency for remittances, payments and investments despite a year of uncertainty for blockchain-based financials and a lack of clarity in regulations governing the space so far.

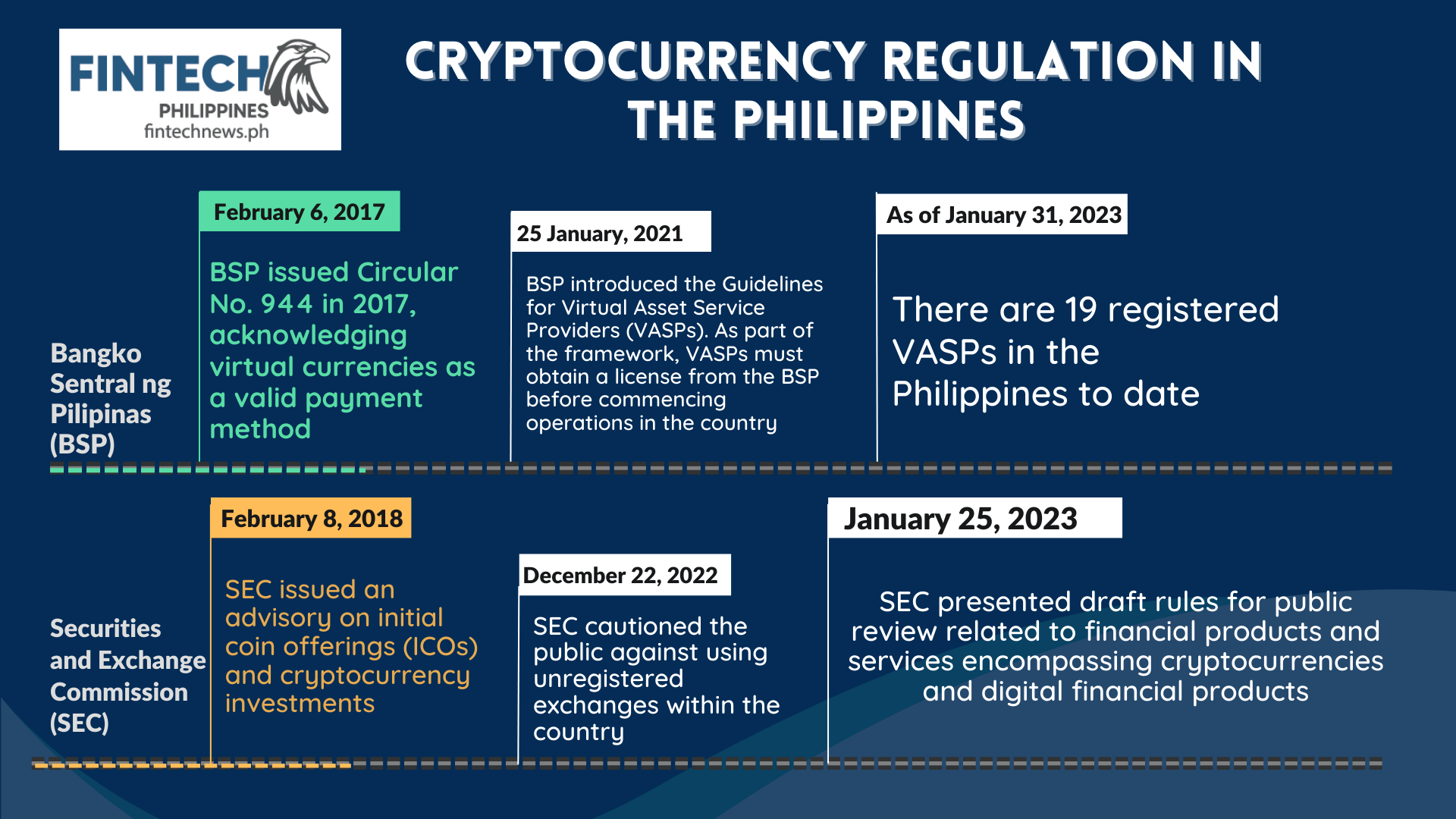

In an effort to embrace the evolving financial landscape, the BSP issued Circular No. 944 in 2017, acknowledging virtual currencies as a valid payment method, before introducing the Guidelines for Virtual Asset Service Providers (VASPs) in 2021.

Earlier in 2023, the Philippine Securities and Exchange Commission (SEC) joined forces with the University of the Philippines Law Center (UPLC) to devise effective policies to be tailored for cryptocurrencies, blockchain technology, and the regulation of digital asset exchanges, which are currently governed by traditional securities laws in the Philippines.

However, the SEC deferred the rollout of a new framework for digital assets in 2023, spurred by reservations that arose from the fall of Bahamas-based cryptocurrency exchange, FTX, in late 2022. Despite those reservations, the SEC has not ruled out the prospect of releasing the targeted digital asset guidelines for the Philippines in the near future, so that could mean the introduction of the new framework this year amidst renewed interest in crypto trading and digital assets.

Further fintech sector consolidation incoming

In spite of the shortfall in deal activity and investment during 2023 — one of the pervasive top trends impacting fintech not just in the Philippines but globally — the market continued to be active with larger entities merging or acquiring other players and creating a more focused landscape.

Filipino fintech companies raised a total of eight deals in the first three quarters of 2023, half as many as from the same period the previous year according to data from FinTech Global Research. Yet a flurry of M&A deals still took place amongst both fintech and traditional financial institutions, such as the full acquisition of Electronic Commerce Payments Inc (ECPay) by Mynt, which owns leading e-wallet GCash, or the merger between Bank of the Philippine Islands (BPI) and Robinsons Bank Corporation (RBC).

Other 2023 acquisitions had an international flavour, including the 100% acquisition of Philippine-based Finscore Inc by Malaysia’s CTOS Digital Bhd and the 90% stake of digital lender Y Finance purchased by UAE-based Astra Tech.

Amid a slowly recovering economic outlook, expect more deals and more market consolidation to take place in 2024 as some fintech segments become more streamlined, but the industry overall continues to grow. In fact, the Philippines Fintech Map 2023 shows the country’s fintech sector grew by more than 38% in less than two years, to 299 companies as of August 2023.

Insurtech preferred by Filipinos at home and overseas

Only 3% of the Philippines’ 113 million population had insurance in 2022, but with the strong presence of digital platforms such as e-commerce, travel sites and comparison sites providing embedded methods for purchasing digital insurance, the insured population has risen markedly in the country.

In fact, a Statista survey found that nearly half (49%) of respondents in the Philippines said they purchased online insurance directly from insurance provider sites or apps, with post-pandemic users attracted by the convenience of seamless online processes and an array of customised coverage options for micro requirements that traditional insurers might not cover.

With micro-insurance alternatives at extremely cost-effective premiums from the likes of bolttech, igloo, Oona Insurance and Singlife, a GlobalData study forecasts that the Philippines insurance market will grow at a compound annual growth rate of 6.2% between 2021 and 2024, indicating its resilience and potential amidst other headwinds.

As a growth sector benefiting from increasing digitalisation and financial inclusion initiatives, insurtech is poised to maintain sturdy growth in 2024.

Embedded finance takes centre stage in Philippines digitalisation drive

Embedded finance forecast Source: Lightyear Capital

As seen with insurtech, the strong support for digitalisation across both public and private sectors of the Philippines has provided strategic opportunities for embedded financial services to proliferate and empower users in the region.

Driven again by expansive internet and smartphone penetration, plus the prevalence of super apps and robust e-commerce growth in the region, the largely unbanked and underbanked populations of the Philippines have been more easily onboarded to digital financial services thanks to embedded financial options that are more accessible via non-financial platforms.

A 2022 Statista survey highlighted how over two-thirds (70%) of Filipinos have used apps with built-in finance, with the vast majority reporting that embedded payments are made more convenient that way. The survey revealed that besides instant payments, rewards, discounts, a preference for not using cash, and buy now, pay later (BNPL) options were driving use of these embedded features.

With a large segment of the population already onboarded and government platforms like eGov mandating for a fully digital transactions process, embedded finance has the strong foundation to boom majorly in 2024.

Popular super apps like Grab and WeChat have long integrated financial options within their platforms, not to mention the built-in features for digital saving and microlending in the apps of the nation’s blossoming digital banks. Embedded finance is likely one of the top fintech trends to have a long shelf life in the Philippines.

Featured image credit: edited from Freepik