Archive

Dragonpay Taps TripleA to Offer Crypto Payments to Filipino Merchants

Philippines’ payments firm Dragonpay announced that it has partnered with TripleA to roll out crypto payments to thousands of merchants in the country. With the low penetration of credit cards and banking services in the Philippines, Dragonpay aims to bridge

Read MoreBSP Deepens Industry Partnership to Roll Out Payments Digitalisation Initiatives

The Bangko Sentral ng Pilipinas (BSP) and the payment systems industry are set to rollout an array of initiatives that are expected to further advance payments digitalization and financial inclusion in the country. “The BSP will continue to work with

Read MoreGlobal Report Reveals Filipino Banks Face Extinction Unless They Embrace Digitisation

Three in five banks believe they will cease to exist within five to ten years unless they change their business models, according to a new global research report “Evolve or be extinct” from the Financial Times Focus (FT Focus) and

Read MoreFintech Alliance.PH Condemns Irresponsible Data Harvesting by Online Lenders

The Fintech Alliance.PH, the National Privacy Commission (NPC) and various industry players have joined forces in condemning the insidious practice of illegal and irresponsible data harvesting of some online lending applications. Several online lending platforms have been found to be

Read MoreHow Will Branch Banking Evolve in the Digital Age?

With digital adoption spiking up in recent years coupled with Bangko Sentral Ng Pilipinas’ recent introduction of the digital banking framework, industry pundits have been examining the relevance of branch banking and whether it will survive the digital age. A

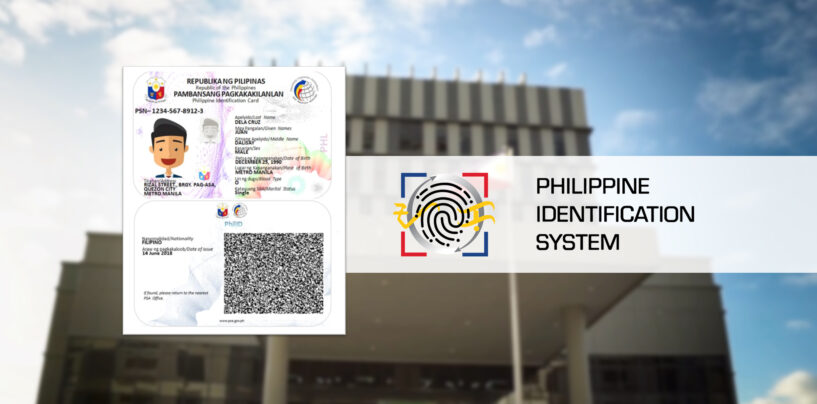

Read MorePhilSys: Key Building Block for Greater Financial Inclusivity in the Philippines

In August 2018, President Rodrigo Duterte signed the Philippine Identification System Act into law to create a national identification system where a single official identification card will be issued to every citizen that combines various government-issued identification. Through the act,

Read MoreMachine Learning: The Future of E-Commerce Fraud Prevention

Machine learning plays a pivotal role in effective fraud prevention systems. In this article, learn how machine learning can significantly improve your business’ ability to stop fraud attacks. With the recent surge in e-commerce usage globally, the possibility of an

Read MoreFintech Alliance.PH Partners 10×1000 Tech to Roll Out Fintech Programme for Filipinos

Fintech training platform 10×1000 Tech for Inclusion launched its latest global Fintech Foundation Programme Flex, an online certificate programme with the goal to bridge digital skills gap to drive inclusion. Fintech Alliance.ph will collaborate with 10×1000 to recruit 100 learners,

Read MoreRCBC’s DiskarTech App Rakes In PHP 11.8 Billion in Transactions a Year After Launch

Rizal Commercial Banking Corporation’s (RCBC) financial inclusion super app DiskarTech has booked a gross transaction value in excess of P11.8 billion a year after its launch in July last year. This total throughput value is an aggregate of both organic

Read MoreVoyager’s PayMaya Bags Sixth Digital Bank License From BSP

Bangko Sentral ng Pilipinas (BSP) has awarded the sixth digital banking license to Voyager Innovations (Voyager), through its financial technology arm PayMaya Philippines. PayMaya had previously raised US$167 million from the likes of Philippines telecoms PLDT, global investment firm KKR,

Read More