Big Data

Bank of Makati is Leveraging Qlik for Data-Driven Customer Insight

Qlik revealed its collaboration with Bank of Makati Inc (BMI), the Philippines’ fifth-largest stand-alone thrift bank by assets, marking a step forward in utilising data to enhance financial services. The partnership focuses on employing Qlik Sense to streamline the process

Read MoreFrom Manual to Mindful: AI-Powered mindox Analyses Financial Documents Seamlessly

In the current business landscape, where efficiency is increasingly important, many companies, especially in the financial sector, struggle with the demands of manual data entry, often leading to time and resource constraints. AND Global, a fintech company based in Singapore,

Read MoreLeapgen and FinScore Join Forces to Enhance Microloan Access for Filipinos

Local fintech firm Leapgen Lending has announced a partnership with FinScore, a Philippines-based alternative credit scoring provider. This collaboration aims to offer more accessible microloan options for individuals facing challenges in accessing traditional banking services. FinScore specialises in alternative credit

Read MoreFinScore’s CrediView Elevates Credit Scoring with Extensive Loan Inquiry Data

FinScore, a Philippines-based alternative credit scoring provider, has developed a new tool named CrediView, which aims to enhance the credit assessment process beyond traditional methods. CrediView grants banks and lenders access to a borrower’s recent loan inquiries across more than

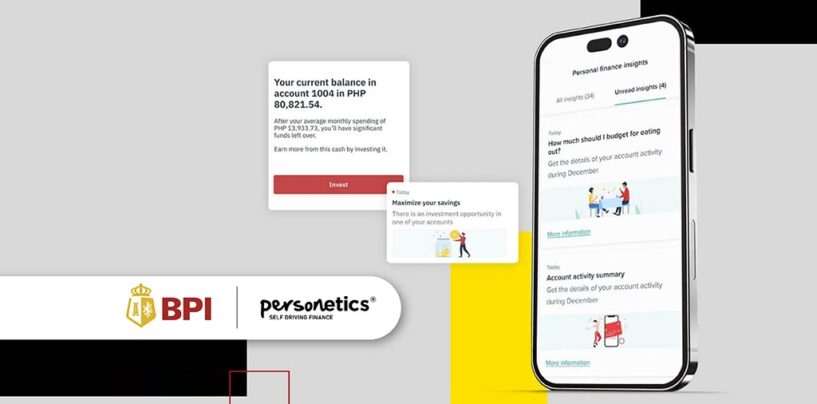

Read MoreBPI Taps Personetics to Provide AI-Powered Financial Insights for 6 Million Users

The Bank of the Philippine Islands (BPI) has joined forces with Personetics, a global provider of financial data-driven personalisation solutions, to push ahead with its advanced personal financial management (PFM) strategy. The Personetics Engagement Builder powers BPI’s newly launched Track and

Read MoreOne Alliance Lending Taps FinScore to Speed up Loan Approvals for Filipino SMEs

Philippines fintech firm One Alliance Lending joins the growing number of local financial institutions to leverage FinScore’s alternative credit scoring to make loans more accessible to more Filipino SMEs. Powered by FinScore’s telco data and advanced analytics, One Alliance Lending

Read MoreBanks, Lenders Get More Insights on Loan Applicants with CrediView by FinScore

FinScore, a Philippines-based alternative credit scoring provider, has introduced its latest offering CrediView – an add-on to its telco credit score. Simulating a credit report, CrediView shows banks and lenders a borrower’s recent loan inquiries from over 40 financial institutions

Read MoreFinScore Empowered Over 15 Million Underbanked Filipinos with Credit Scores

FinScore, a Philippines’ alternative credit scoring provider, has achieved a significant milestone by delivering 15 million total credit scores. This highlights the growing adoption of FinScore‘s services among banks and lending companies, as they strive to expand credit access for

Read MoreFintech Salmon Gets a Boost From Finscore’s Telco Data-Based Credit Scoring

Fintech startup Salmon has selected Philippines-based alternative credit scoring provider FinScore to offer flexible financing terms and generous loan amounts to merchants as well as the ability to defer shopping bills over several monthly installments to buyers. Powered by FinScore’s

Read MoreInterSystems Survey Highlights Data and Tech Obstacles for Financial Services in Asia Pacific

Financial services firms across the Asia Pacific are facing an ever-increasing array of data and technology challenges stemming from both the growth in the volume of customer and business data being generated and the proliferation of data siloes across different

Read More