Posts From Fintech News Philippines

Atome, Mastercard Unveil Card Feature with Gaming Credits and Rewards Exchange

Atome has collaborated with Mastercard to enhance the gaming experience for its users in the Philippines. This collaboration enables Atome Card holders to convert their Atome rewards points into gaming credits through the Mastercard Gamer Xchange (MGX). The initiative is

Read MoreBSP Reports Record Highs From Overseas Remittances in the Philippines

In December 2023, personal remittances from overseas Filipinos achieved a record high in the Philippines, reaching US$3.6 billion, an increase of 3.9% from the US$3.5 billion reported in December 2022. This growth, as detailed by the Bangko Sentral ng Pilipinas

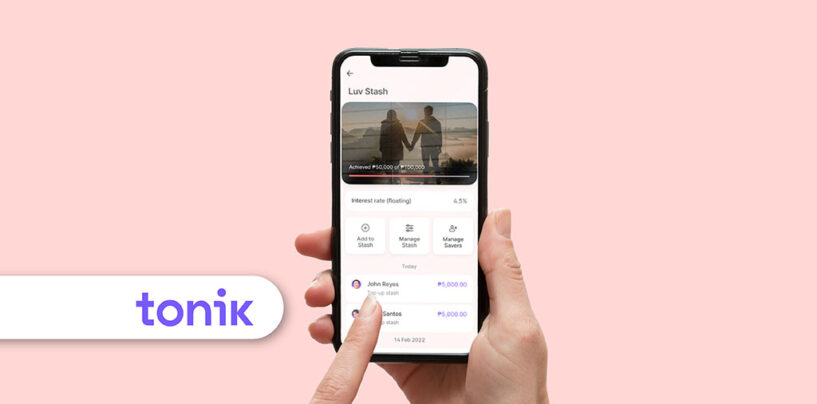

Read MoreTonik Introduces ‘Luv Stash’, a Savings Product for Couples to Earn 4.5% Interest

Following Valentine’s Day last week, Tonik Digital Bank has recently unveiled ‘Luv Stash,’ a novel savings product. This facility stands out in the market by allowing two individuals to jointly save whilst earning an interest rate of 4.5%. The idea

Read MoreGCash Broadens Remittance Services Expansion To Another 10 Countries

GCash has announced its continuing global expansion by securing regulatory approval to extend its services to an additional ten countries, following approval from the Bangko Sentral ng Pilipinas (BSP). This expansion enables the service to facilitate smoother financial transactions for

Read MoreBSP Lauds Rise in Digital Payment Technology in the Philippines

The Bangko Sentral ng Pilipinas (BSP) has reported on the ongoing expansion of digital payment technologies, noting their significant role in enhancing the delivery of financial services to unbanked populations and micro, small, and medium enterprises (MSMEs). This development is

Read MoreGCash’s GStocks PH Spearheads Efforts to Diversify Filipino Investment Access

In light of forecasts predicting a rebound in the Philippine stock market in 2024, the financial application GCash has expanded its services to include GStocks PH, a stock investment feature developed in collaboration with AB Capital Securities Inc. (ABCSI) in

Read MoreCoins.ph Marks 10th Anniversary with 10% USDC Rewards Initiative in February

To mark its tenth anniversary, local market cryptocurrency exchange Coins.ph has initiated a program to offer 10% rewards on USDC holdings to its users during February under its HODL and Earn scheme. This initiative, running from the 1st to the

Read MoreBrankas Set to Expand QR and e-Wallet Payment Services for NetGlobal Pay

Brankas and NetGlobal Solutions Inc. have recently formalised a Memorandum of Agreement that facilitates a collaborative effort to expand the capabilities of NetGlobal Pay. This initiative focuses on enhancing the platform’s offerings to include QR Ph, pay-by-bank, and pay-by-wallet functionalities

Read MoreTonik and Xendit Collaboration to Grow Digital Banking Payment Options

Tonik Digital Bank and the Southeast Asian payment gateway Xendit have announced a new strategic partnership, set to enhance the range of financial services available to Tonik consumers by introducing secure and convenient options for managing financial transactions. Starting from

Read MoreGCash Disbursed Record US$2.1 Billion in Loans Last Year, Doubling 2022’s Figures

Globe Fintech Innovations, Inc. (Mynt) operated GCash has disclosed its performance metrics for the year 2023, revealing a notable increase in disbursement of loans. The online banking platform reported disbursing loans totalling P118 billion (approximately US$2.11 billion), more than doubling

Read More