Lending

Fintech Plentina Partner With Ecommerce Platform Shopee in Time for 12.12 Big Christmas Sale

Coming off from completing its fresh venture funding, Plentina, a fintech app that allows Filipinos to purchase their goods and services through their favorite merchants and pay later on installments, launches its latest partnership with the leading e-commerce platform in

Read MoreCIMB Philippines Offers Easy Credit Through BNPL Offering for Lalamove Drivers

CIMB Bank Philippines and Lalamove partnered up to provide easy credit access to hundreds of thousands of partner drivers through the bank’s new Buy Now, Pay Later (BNPL) offering, REVI Credit. This collaboration will enable Lalamove partner drivers to get

Read MoreFintech Alliance.PH Condemns Irresponsible Data Harvesting by Online Lenders

The Fintech Alliance.PH, the National Privacy Commission (NPC) and various industry players have joined forces in condemning the insidious practice of illegal and irresponsible data harvesting of some online lending applications. Several online lending platforms have been found to be

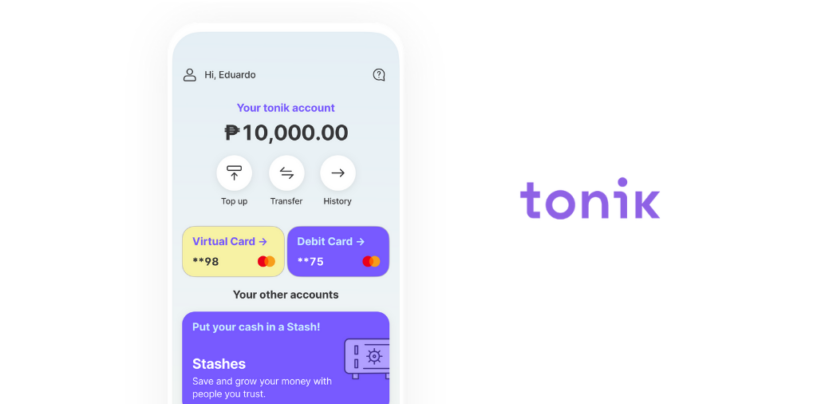

Read MoreTonik Ventures Into the Consumer Lending Market With ‘Quick Loan’ Offering

Philippines’ neobank Tonik announced that it has launched a Quick Loan product on its platform marking its venture into the consumer lending market in the country. Tonik said that its all-digital Quick Loan is designed to serve the unbanked and

Read MoreWelcome Bank Links up With FinScore for Alternative Credit Scoring

Philippines-based alternative credit scoring provider FinScore has partnered with Welcome Bank (Rural Bank), one of the subsidiaries of Korea’s Welcome Financial Group. The partnership will enable Welcome Bank to integrate FinScore’s predictive credit scores into it credit risk models. FinScore’s

Read MoreSB Finance Taps Finscore’s Telco Data-Powered Credit Scoring Solution

Consumer lending company SB Finance has partnered with FinScore to enhance its credit scoring efforts using alternative data. Security Bank Corporation and Bank of Ayudhya (Krungsri) in Thailand had previously entered a strategic partnership to form SB Finance which provides

Read MorePhilippines Must Not Overlook Fraud Prevention in It’s Financial Inclusion Journey

Digital technologies and online platforms can help emerging markets advance financial inclusion by providing banking services to Gen Z’s, low-income households, and small businesses with typically little to no access to traditional financial institutions. But while unbanked populations can benefit

Read MoreNetbank Partners Three Alternative Lenders to Expand Its Lending Operations

Philippines neobank Netbank has formed partnerships with 3 alternative lenders; Global Mobility Services (GMS), New Cross Credit Gate PH Inc. (Uploan) and Inclusive Financial Technologies, Inc. (Blend PH). This move will allow these lenders to expand their lending without needing

Read MoreNetbank Ties up With Indonesia’s Investree of Offer SME Loans to Filipinos

Banking as a service platform Netbank has partnered with Indonesian SME lender Investree to expand loan offerings to SMEs in the Philippines. Investree Philippines aims to address the largely underserved US$200+ billion MSME credit gap in the Philippines by connecting

Read MoreAustralian BNPL Firm Zip Drives Expansion in South East Asia With Investment in TendoPay

Australian Buy Now, Pay Later (BNPL) company Zip Co has furthered its global expansion, announcing a strategic investment in TendoPay, a BNPL provider based in the Philippines. The investment represents Zip’s first step into South East Asia, which will also

Read More